The deterioration of the British labour market has weakened the pound.

The deterioration of the British labour market has weakened the pound.

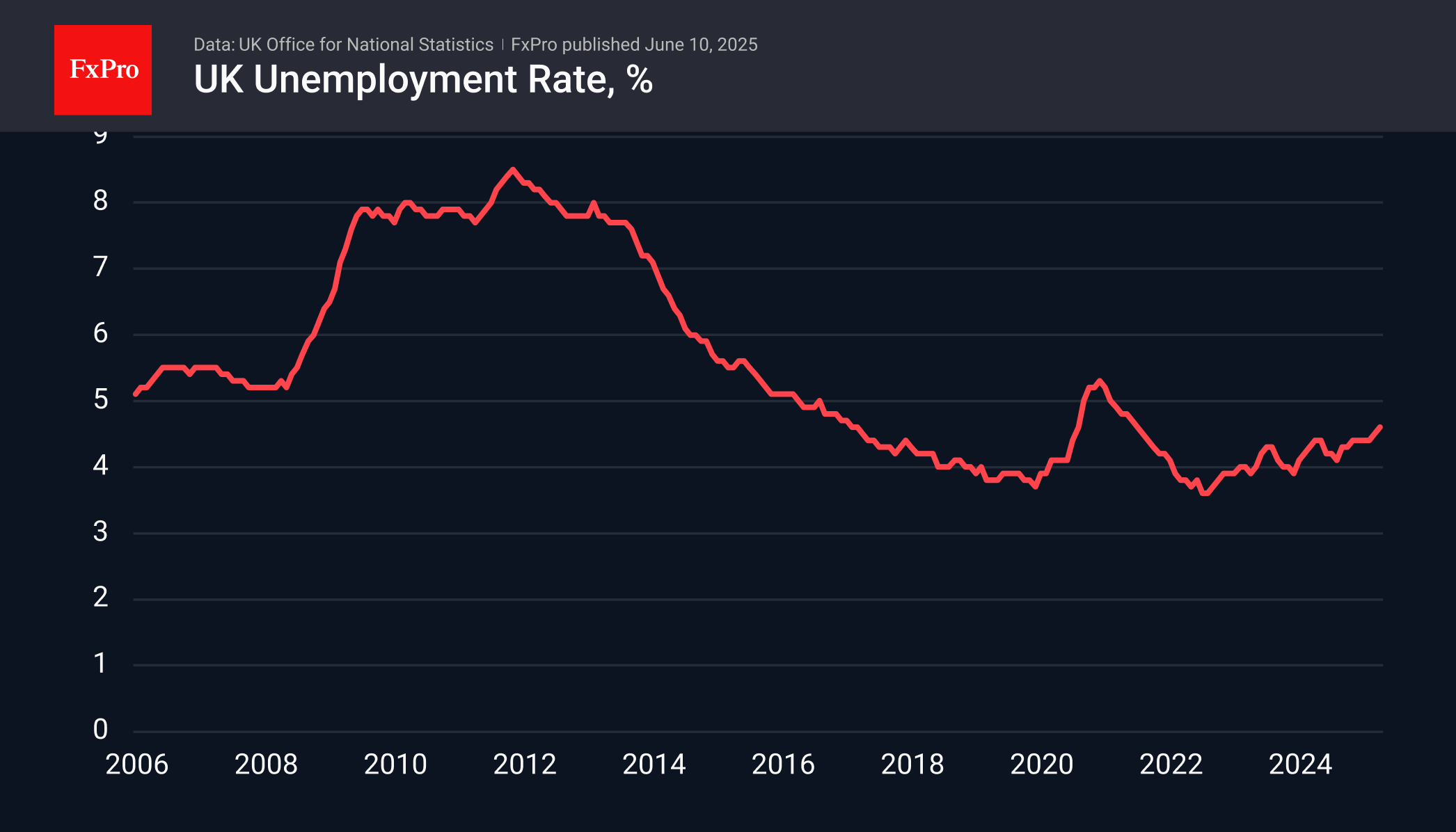

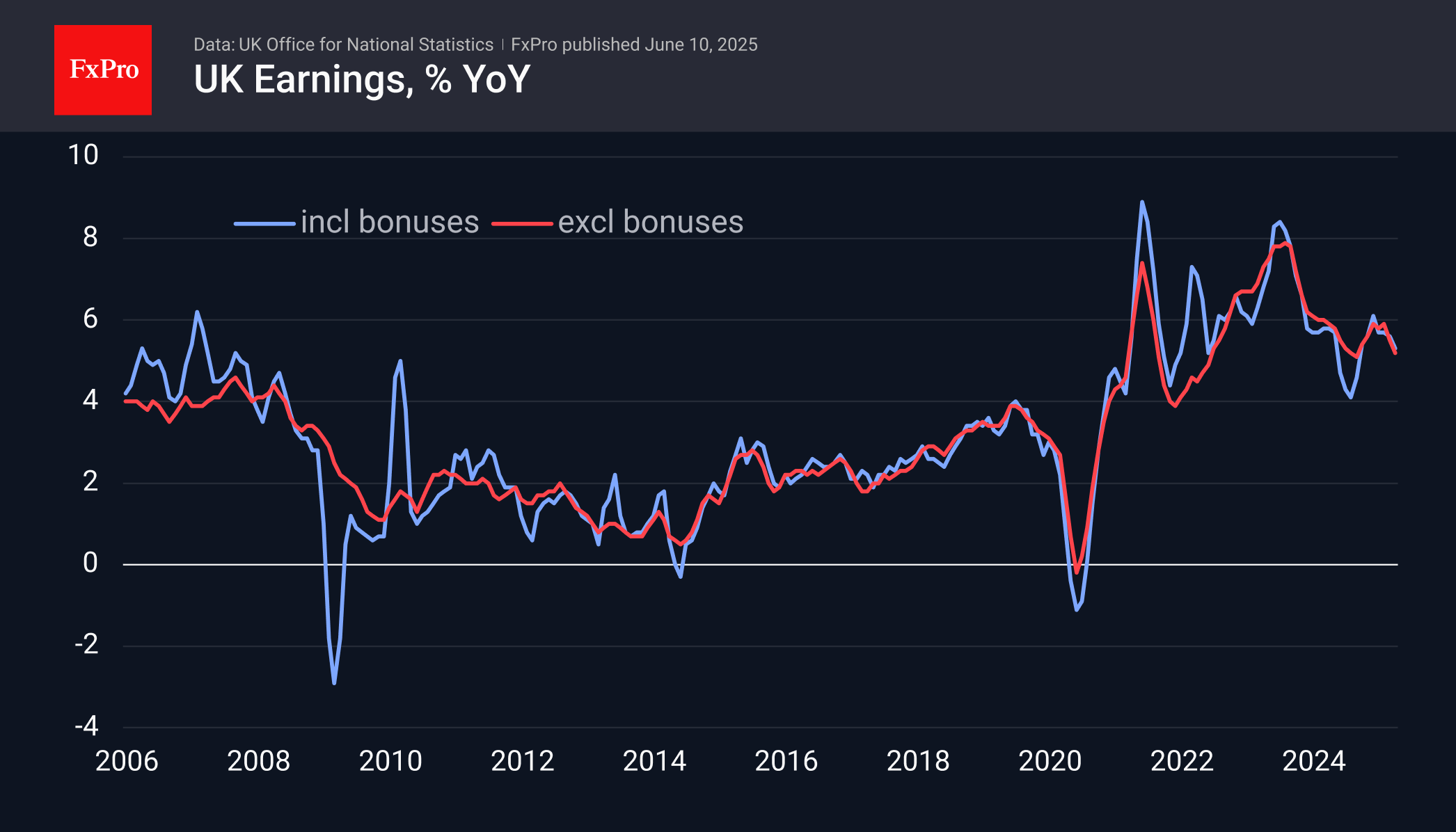

According to data published on Tuesday, the unemployment rate in the United Kingdom rose to 4.6% in April, reaching its highest level in three years and continuing an upward trend that began in December 2023. Income growth also slowed slightly to 5.3% in the three months to April compared with the same period a year earlier. This marks the fourth consecutive month of slowdown.

More recent May data on jobless claims showed an increase of 33,100, indicating a further rise in unemployment in the following month.

These data show that the Bank of England's monetary easing, while stimulating lending, has not yet reversed the trend in the labour market, strengthening the position of the doves on the Committee. As a result, the chances of further easing have increased. Expectations of two more rate cuts before the end of the year have strengthened in the futures market.

An hour after the publication, GBPUSD lost 0.65% to 1.3455, but then recovered almost completely to 1.3530 on the weakness of the dollar. The EURGBP pair soared to a four-week high of 0.8465 on the weakness of the pound.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)