Will the Fed boom or bust the dollar?

Struck right between a rock and hard place, today the Fed will deliver its difficult policy choice. The FOMC will have to choose between supporting the financial system and fighting inflation. They can do both, but both results will be mediocre.

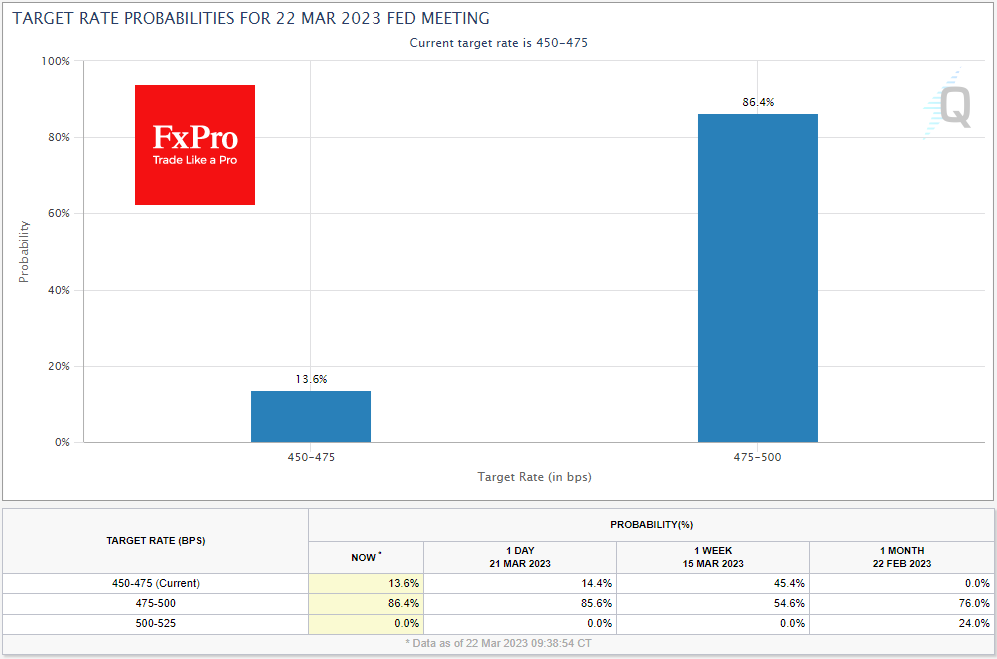

Economists' and markets' expectations are for a 25-point hike (with about 86% probability). But the big intrigue is whether this will be the last hike in this cycle and when we can expect a rate cut.

On the one hand, there is high inflation, which is already linked to soaring labour costs and sustained demand rather than higher commodity and energy prices, as was the case a year ago when the hiking cycle began. Powell's speech to Congress at the beginning of March led markets to expect a 50-point move on the back of persistently high inflation.

If the Fed is indeed responding to the data, today's decision should include hints of further policy tightening in addition to the actual rate hike. This is necessary to prevent inflation from becoming entrenched. Put simply, the US needs a "clean-up" recession that cools the labour market.

Such a straightforward approach to fulfilling the Fed's mandate could give the dollar a boost.

On the other hand of the Fed, is the resilience of the financial system, which we have heard a lot of crunch about again in recent weeks. The suffering of the regional banks is one of the consequences of the rate hike. Further policy tightening will only make things worse. There is also the risk that a recession and a shrinking labour market will increase defaults, further eroding banks' balance sheets and resilience.

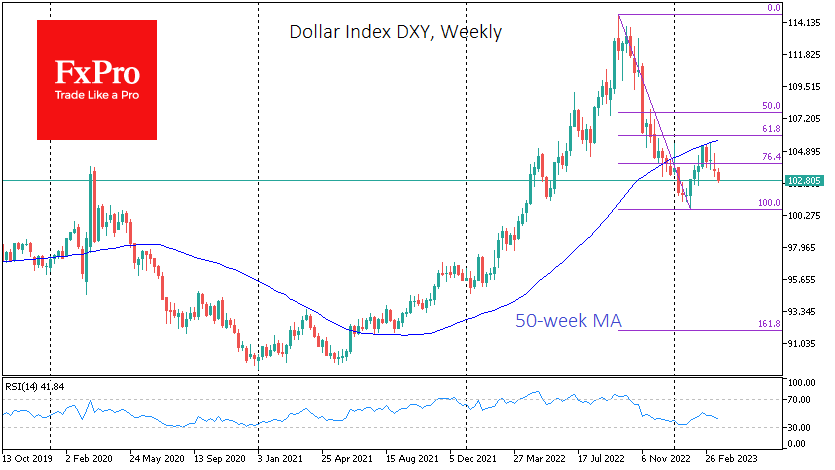

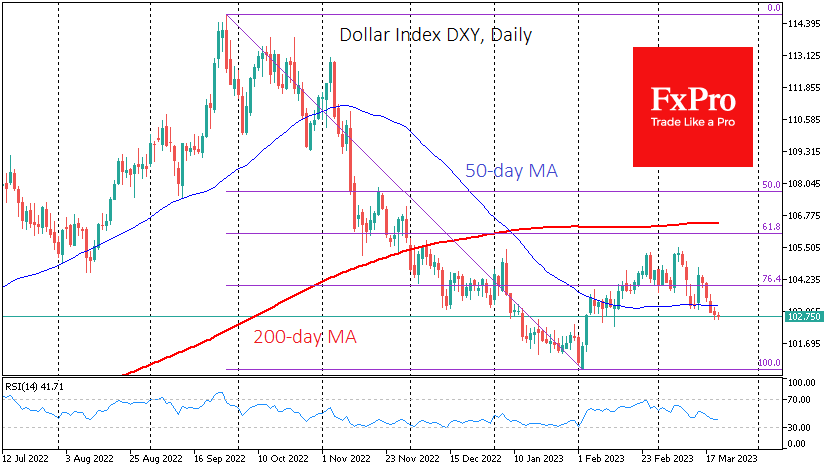

The Dollar Index has slipped below 103, the area of the lows of the last six weeks. Its steady decline over the past few days suggests that we have seen nothing more than a corrective bounce in February. The weekly chart clearly shows that the Dollar Index is perfectly contained near its 50-week moving average, confirming the long-term downtrend.

Furthermore, the DXY is not only in danger of falling below 100.6 (February lows). The long-term target for this decline is seen at 92.0, which would almost wipe out the dollar's gains over the course of the policy tightening cycle. Looking at the charts so far, this seems the most likely scenario, although there could be surprises.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)