Dollar enjoys a bid; stocks concerned about a hawkish Fed

May starts on a high note

The Fed meeting concludes today with the decision announced at 18:00 GMT and the press conference taking place 30 minutes later. The market does not expect a rate change but there is an increasing possibility of a tweak in the current balance sheet reduction programme. The focus will also be on the overall rhetoric and particularly Chairman Powell’s responses to questions about the Fed’s next rate move.

Going into the meeting, the Fed is facing mixed data. For the first time since October 2023, there are some signs of a slowdown in the economy, as seen at the recent GDP print for the first quarter of 2024 and the PMI surveys. Having said that, inflation remains elevated with Tuesday’s strong employment cost index complicating the outlook. Therefore, today's data releases ahead of the Fed gathering, which will include the ISM manufacturing PMI, will be quite important.

The Fed has a difficult task today. Powell will try to buy more time, but the market is getting anxious about the possibility of no rate cuts during 2024. US equities had a rough day yesterday, despite the positive earnings report from Amazon, with the three key indices ending the session with more than 1% losses for the time since April 12.

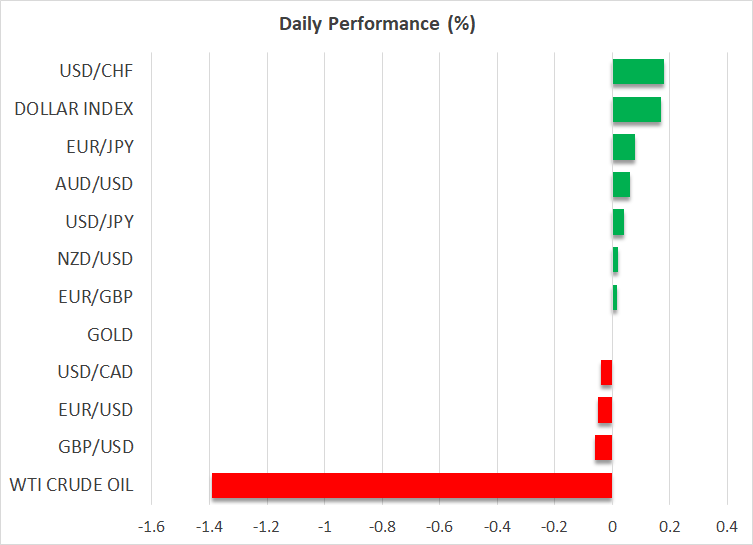

Dollar strength continues

The euro got an initial boost from the stronger euro area data yesterday, but as the US session progressed later in the day, it came under pressure, especially against the dollar. A relatively hawkish show from the Fed today might sustain the current dollar strength but its performance could gradually fade if US stocks come under severe pressure again.

More BoJ interventions on the way?

Dollar/yen is hovering around the 157 area as the market continues to digest Monday’s intervention. A look at the most recent interventions by Japan reveals that first, the BoJ tends to intervene multiple times, unless there is another plan in the works like quantitative easing, and second, market interventions as a stand-alone reaction have proven to be an insufficient measure.

This means that only a combination of domestic and foreign developments, such as a hawkish BoJ and a Fed rate cut soon, could allow the yen to sustainably appreciate against the dollar.

Interesting moves in both bitcoin and oil

Bitcoin remains under selling pressure as it tries to stay above the $60k level. The completion of the much-touted halving and a lack of positive news on the ETFs front appear to have cast a shadow on the king of cryptos.

In the meantime, WTI oil futures are preparing to test the April lows as the market appears more relaxed about geopolitics. However, developments in the Middle East could come to the foreground soon if the discussed ceasefire is not agreed and an Israeli ground operation in Rafah commences.

.jpg)