FOMC ahead: Will Powell surrender the dollar to Trump?

FOMC ahead: Will Powell surrender the dollar to Trump?

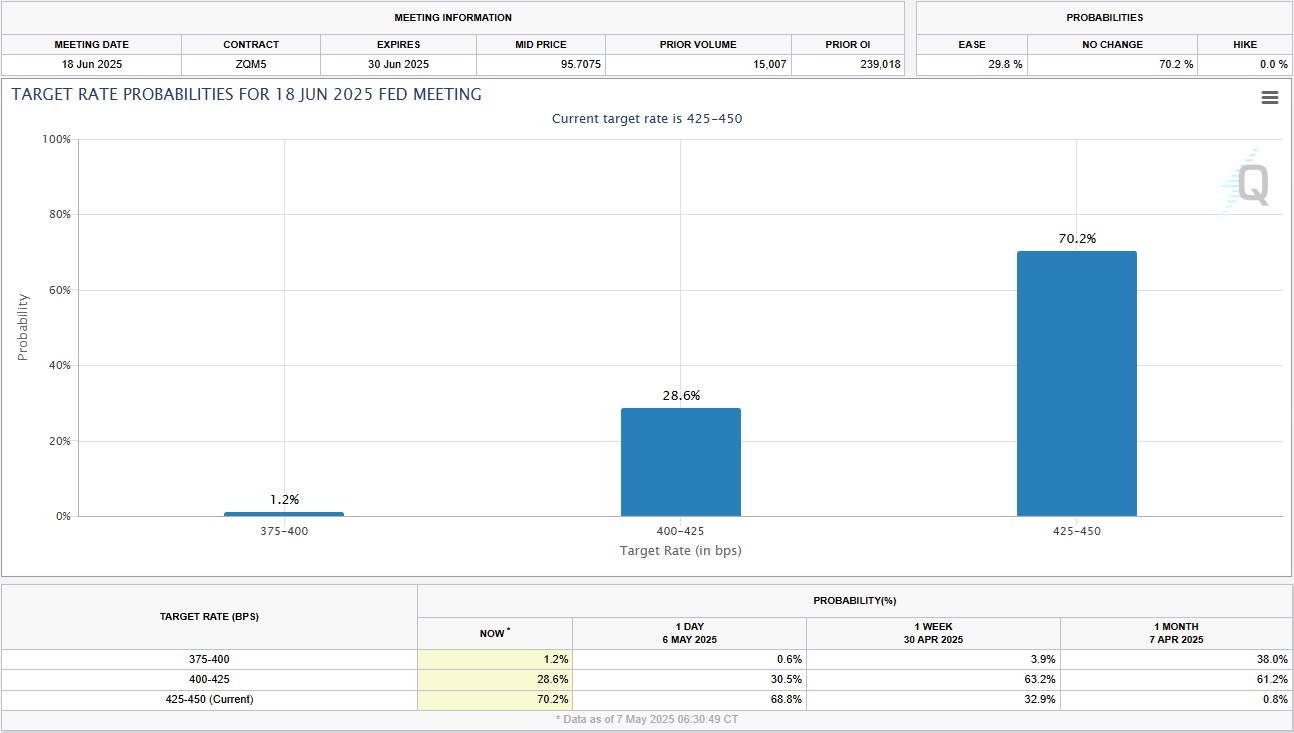

Markets are eagerly awaiting the outcome of the Fed meeting. Economists and analysts are unanimous that no rate changes are expected, and the rate will remain in the current range of 4.25%-4.50%. Despite developments in India and Pakistan and news of upcoming talks between the US and China, the market is poised for strong moves, remaining in a state of uncertainty about the central bank's next steps.

Since Trump took office, the Fed has tightened its interest rate policy in response to the pro-inflationary risks expected from tariffs. Rising inflation expectations in the US confirm this trend.

Recent GDP and trade balance data showed an increase in imports before tariffs were imposed, which has a negative effect on the economy. However, this effect can be seen because of strong demand supported by positive employment data.

Rate expectations for the June meeting shifted in favour of ‘no change’, with a 70% probability of such an outcome versus 0.8% a month earlier. This supported the US currency. The DXY index remains at the same level as on April 11th after declining due to trade conflicts. The Fed may maintain a cautious tone on inflation, which will support the USD, but tariff disputes are the main influence on the USD exchange rate.

Since the beginning of the year, USD declines have clearly correlated with escalating tariff threats. If Powell complies with Trump's demands and outlines the need to cut rates soon, this could lead to a USD sell-off. Historically, this behaviour has been accompanied by consolidation and continued rate cuts rather than an immediate rebound. This would also support the stock market.

However, such a reversal of events would contradict Powell's previous statements and is not supported by significant economic data.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)