Tech rebound starts to fade as US-China truce tested

Tech stocks surge in shutdown relief rally

US tech giants staged a strong rebound on Monday, boosted by news that Republicans and Democrats have reached a funding deal on ending the longest shutdown in US history, which is now in its 42nd day. The Senate passed the stop-gap bill late on Monday, with a 60-40 vote, securing the backing of eight Democrats who broke with their party.

The revised bill includes concessions by the Republicans on allowing a Senate vote on whether to extend the healthcare subsidies that are set to expire by the end of the year, and a provision to reinstate all federal workers that were laid off during the shutdown.

The bill is now expected to make its way to the House of Representatives, but whilst House Speaker Mike Johnson plans to put it to a vote on Wednesday, he has not committed to backing it.

Still, hopes are high that the legislation will land on the President’s desk by the end of tomorrow to be signed into law, offering relief to investors spooked by the AI jitters.

Concerns about excess valuations in the AI sector, amid massive investments by the Big Tech, sparked a sharp pullback last week. The selloff deepened towards the end of the week after soft data raised fears of an economic slowdown in the US, with the Fed more worried about inflation than a faltering labour market.

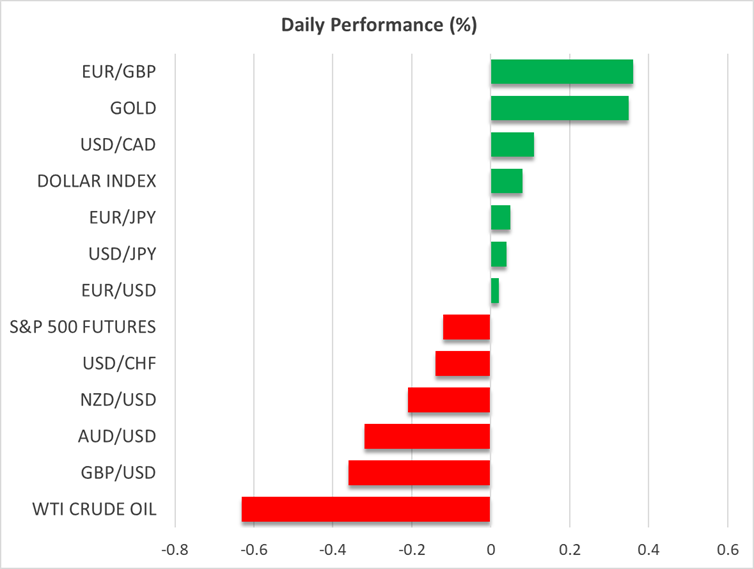

The Nasdaq 100 rallied by more than 2%, recording its biggest daily gain since May, while the S&P 500 closed 1.5% higher.

Some uncertainties persist but UK stocks jump

However, the relief rally already appears to be petering out, with US futures slightly lower today, as doubts about the US economy and the uncertainty surrounding the Fed’s policy outlook have not dissipated. In addition, there are fresh concerns about US-China trade relations following reports that Beijing is working on a new system of export controls for rare earths that could restrict access for companies that have links with the US military.

It hasn’t taken long for the sensitive issue of rare earths to put a strain on the fragile truce agreed by the US and Chinese leaders at the end of last month.

Shares in China ended today’s session in the red, but European stocks were in a buoyant mood. The UK’s FTSE 100 is leading the gains, hitting record territory on renewed bets that the Bank of England will cut rates at its next meeting.

Pound takes a knock from soft UK jobs data

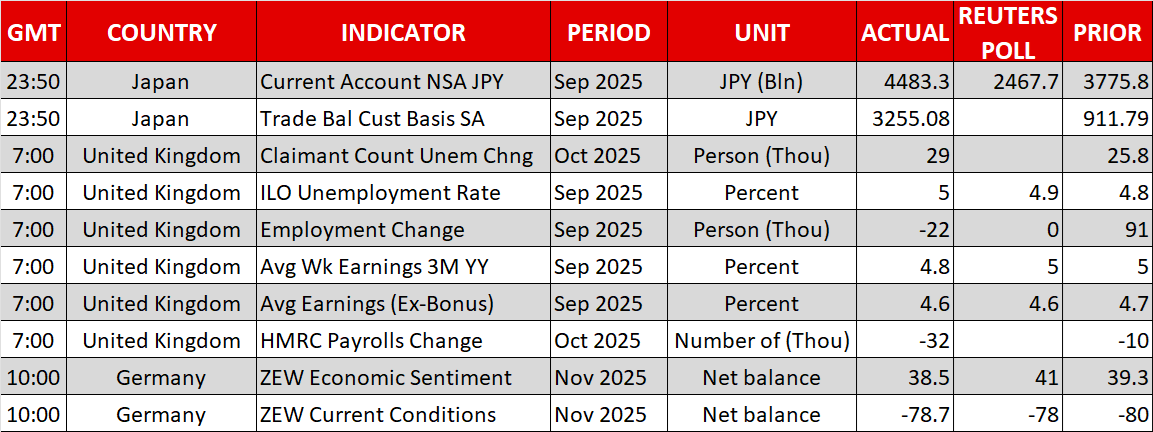

Expectations that the BoE will trim rates in December were lifted after the latest employment report out of the UK today pointed to a weakening labour market. The unemployment rate spiked to 5.0% in the three months to September, which is the highest since January 2021, while wage growth moderated to 4.8% y/y from 5.0% y/y.

Barring any surprises in next week’s CPI report and the Autumn Budget on November 26, investors are increasingly confident that the BoE will lower borrowing costs in its final policy decision of the year.

The pound is sliding today, underperforming all its peers, although it’s managing to hold above $1.31 for now.

Yen continues to face headwinds

The Japanese yen is not having a great day either, slipping to nine-month lows against the US dollar. Aside from the improvement in risk appetite, anxiety around Japanese fiscal spending is pressuring the yen after Prime Minister Sanae Takaichi signalled the government will no longer aim to achieve a primary budget balance each year and instead focus on multi-year budgets.

Moreover, an economic advisor to Takaichi has suggested the Bank of Japan should wait at least until the January meeting before hiking rates again.

Dollar steady but gold gains traction

As for the US dollar, it’s trading slightly higher on Tuesday against a basket of currencies in what is expected to be a muted day, as US bond markets are closed for Remembrance Day.

Gold, meanwhile, continued to recover from its recent pullback, advancing towards $4,150 today. With the US government shutdown potentially ending this week, the resumption of key US data releases next week will play a major role in gold’s recovery, as a Fed rate cut in December hangs in the balance.

.jpg)