Yen intervention risk rises, US jobs concerns intensify

To intervene or not to intervene?

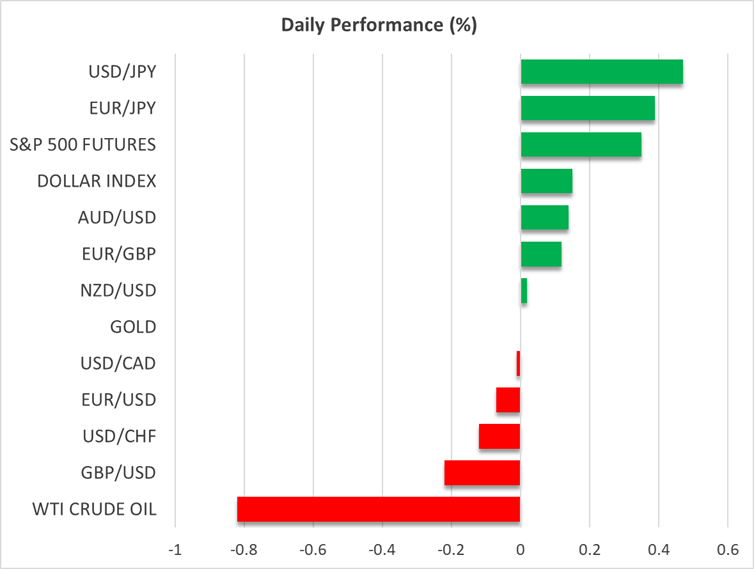

The US dollar traded mixed on Tuesday, gaining the most against the Japanese yen and the British pound, with their slides extending today, despite the dollar pulling back against the others.

The Japanese currency slid to levels last seen back in February, perhaps driven by the risk-on market sentiment on hopes that the US government will reopen soon, and by expectations that Japanese Prime Minister Takaichi will opt for looser fiscal policy during her term.

At the beginning of this week, Takaichi noted that she is planning to set a fiscal strategy that will be extended for several years to allow more flexible spending. Today, she said that she “strongly hopes” the BoJ will decide on the future of interest rates based on wage increases rather than rising raw material costs. This may have also hurt the yen, as 25bps is now fully penciled in for June 2026.

The tumble in the yen triggered more warnings from Japanese officials, with finance minister Katayama saying today that the negative aspects of a weak yen on the economy have become more pronounced than the positive ones. Yet, the yen remained on the back foot.

Although Japanese officials have repeatedly noted that they are not monitoring a specific level whose breach could prompt intervention, the latest warnings suggest that Katayama and her colleagues may be closely monitoring the 155.00 zone in dollar/yen. Even if a break above that resistance does not result in an immediate response, it could intensify verbal intervention by authorities and perhaps lead some traders to cover some of their short positions in the yen.

US House to vote on funding bill, ADP adds to labor market concerns

As for the US shutdown, the Senate passed a short-term funding bill that will keep the government running until January 30, and today, it is the turn of the House to vote on it. If approved, the bill will be sent to US President Trump to sign it into law.

That said, despite the optimism surrounding the potential end of the shutdown, the dollar seems numb today, perhaps as the newly introduced payroll processor by the ADP revealed that US companies shed more than 11k jobs per week through late October, adding to the concerns injected to the market by the Challenger, Gray and Christmas report, which said that firms cut more than 150k jobs in October.

According to Fed funds futures, the probability of a 25bps rate cut in December has now increased to 65%, with investors penciling in another 67bps worth of reductions by the end of 2026.

Pound slides as UK jobs data support a December BoE cut

The British pound came under pressure yesterday as the employment report disappointed once again. Following the soft numbers for August, the unemployment rate rose at an even faster pace in September, while wage growth slowed, corroborating the BoE’s dovish shift at its latest gathering.

With four members voting for a rate cut, and Governor Bailey acknowledging downside risks to inflation, the probability of a December rate cut has now risen to around 76%.

Wall Street cheers prospect of government reopening, gold rises

On Wall Street, the Dow Jones rose more than 1%, with the S&P 500 also recording some gains. Only the Nasdaq slid somewhat, perhaps due to concerns about US labor market weakness. That said, today, stock futures are in positive territory, perhaps as investors are confident that the House will approve the short-term spending bill for reopening the US government.

Despite the broader risk appetite, gold continued to gain, perhaps driven more by the increasing probability of a December Fed rate cut rather than the broader optimism about the reopening of the US government.

.jpg)