- Domů

- Komunita

- Zkušení obchodníci

- What's the best way to trade Martingale Forex Trading

Advertisement

Edit Your Comment

What's the best way to trade Martingale Forex Trading

Členem od Dec 12, 2014

109 příspěvků

Feb 08, 2015 at 15:13

(Upravené Feb 08, 2015 at 15:14)

Členem od Dec 12, 2014

109 příspěvků

ForexAssistant posted:"It is not written in the stone that price would not move outside of current boundaries, and forget that there was ever some center point"

Mav, you just told on yourself my friend. Anyone who does not understand the significance of the center point, doesn't understand the forex market. Not trading the market, but the forex market itself. Why does it exist, what is its purpose? How to use that knowledge to make a safe trading system..

That is the problem that I have with technical trading. It allows people to trade, make and lose money, but never really understand the market in which they trade. Now to me, that's scary.

Bob

Actually, I truly do not know about your concept of center point - never heard of it.

From your post i understand it as middle of historical range.

Can you elaborate ?

Get investors and get paid 15 percent of theyr profits. More on my website.

Členem od Jun 28, 2011

444 příspěvků

Feb 08, 2015 at 15:50

Členem od Jun 28, 2011

444 příspěvků

"Can you elaborate ?"

Not here, I thought my previous post was too long but I will make that much available in the very near future.

Just like I automated my trading, I am in the process of automating my course on systemic trading. (A type of fundamental trading). My intent is to make the first 3 chapters of the text book and the first lecture free as a way to determine if my investment programs are right for the reader before purchasing. It covers the basic fundamentals of the market. The textbook is currently being edited. When I get it back from the editor, I will let you know how to get that free part.

Bob

Not here, I thought my previous post was too long but I will make that much available in the very near future.

Just like I automated my trading, I am in the process of automating my course on systemic trading. (A type of fundamental trading). My intent is to make the first 3 chapters of the text book and the first lecture free as a way to determine if my investment programs are right for the reader before purchasing. It covers the basic fundamentals of the market. The textbook is currently being edited. When I get it back from the editor, I will let you know how to get that free part.

Bob

where research touches lives.

forex_trader_202879

Členem od Aug 07, 2014

378 příspěvků

Feb 08, 2015 at 15:54

Členem od Aug 07, 2014

378 příspěvků

mavericks posted:ForexAssistant posted:CrazyTrader posted:

Second best way is to do antimartingale.

Do you guys know what is the opposite of Martingale?

Yes, you double the winning trades. But that isn't a recovery system, its just another bizarre technical trading system. You know, the kind of system that is responsible for 80 to 85% losses?

So lets look at a recovery system to see if it is as scary as technical trading. We start with .01 lots and set our take-profit and stop losses at 20 pips. Now to decide if we should do buys or sells, we look at the current price. The center point is half way between the historical high and the historical low.

If the current price is above the center point then we do sells as we expect the price to spend most of its time somewhere around the middle. If you don't know why, you will have to read my book. If the current price is below center, we do buys. Lets say we do a buy trade for our first trade and the price drops 20 pips and we close for a loss. The next trade we open the trade of .01 lots and make the take profit and stop losses 40 pips, twice what the loss was. And of course, a win would pay for the loss and give us a profit. But a second loss would make our next trade 80 pips.

The 4th trade would be 160 pips, the 5th 320 pips, the sixth, 640 pips. The trade size is still .01 lots. After 7 straight losses we would have moved 1260 pips away from center. The aud/cad only has 1600 pips from center to the historical limits. The 8th trade would be for a win or loss of 1280 pips, 940 pips beyond the historical limits.

Now that is not the way I trade a recovery system but this exerciser was not intended to teach anyone how to trade or use a recovery system, just how to think outside the box. What are traders afraid of when discussing any recovery system? That the trade size gets to large and blows out the account. right?

The trade size in our demonstration is still only .01 lots but at the opening of the 8th iteration we would have lost a total of 1260 pips. A change of one pip for a .01 lot size trade, changes the equity by .10 of the first listed currency of the pair. In the case of the aud/cad, it would change by .10 Aussi dollars. So at 1260 pips, we would have a draw of 126.00 Ausie dollars. If we had say $500 in our trading account, it would be near impossible to ever have a margin call.

There are better ways to trade using a recovery system but it is not my purpose to teach investors/traders how to trade. For that, I get paid. Nothing wrong with that, because I also paid to learn what I know. Boy did I pay...

Bob

Interesting. Actually I took a time to read it :)

My observations:

1) It is not written in the stone that price would not move outside of current boundaries, and forget that there was ever some center point.

2)It takes exponentialy longer time, considering daily range to get back the losses, after longer lasting streaks.

3) Your systems sounds more like an averaging system to me with some characteristics, of martingale. But basically you are waiting for some correction buoing / selling at better price - I have no problem with that. :)

But anyway. something to think about.

Regarding martingale and antimartingale, I have not used any of those, if someone manages to succed with any of them good for him.

Regards

M

The funny thing is that many people are against martingale, as they are afraid to take risk. They are afraid of taking higher risk because their system is based on completely random entries, as most people trade support and resistance which of course has no science to it. Recall that crazytrader's current account was in red as much as 40% in drawdown % because he trades the higher tf which of course focuses more on extension of the over all trend instead of following price action.

If anyone has an accurate enough system in which he/she will not experience more then say 4 straight losses, then of course it would make sense to use martingale, as you are increasing your lot size not based on the theory in which you can not lose FOREVER, but because your systems focuses on accuracy thus making the newly opened order a high probability trade compared to the last one.

Most of the people who are against martingale are simple minded noobs who can't think past go. Thus simply comparing casino martingale to forex martingale which can be both the same or different. Instead of focusing on the different variations, they only focus on making it the same.

If we look at crazytraders account, and look at him using martingale (which he doesn't use) it would be clear to see he would of margin called the account many days ago. Yet, his account doesn't focus on accuracy as his floating EU loss currently has a PIP-DRAWDOWN of over 200 pips. He has been saved by the NFP news, which still has not been able to take him out of the red.

Členem od Apr 05, 2014

33 příspěvků

Feb 08, 2015 at 15:55

Členem od Apr 05, 2014

33 příspěvků

rajivzz posted:

What's the best way to grate my face with a cheese grater , any idea??

bendex77 posted:

grating your face with a cheese grater is a terrible idea!!!!

ForexAssistant posted:

Ben, can we assume from your post that you have grated your face with a cheese grater so your post is accurate within the limits of your knowledge? For you see, I have grated my face with a cheese grater and a horse once got me good and to tell you the truth, I don't see the comparison.

No sir you can not.

What I don't understand is how so many people can make negative comments on what they don't understand and have never actually grated. Grating my face with a cheese grater are not perfect but once you learn the concept of facial cheese, they are tools that will improve your output. As I said prior, no face grating system can make a bad face good but it can and does improve the face of decent faces. A computer (robots) are particularly good at using face grating systems.

I see.

Its all math.

It sure is!!! Lets do some!!! Good idea!!!!

Here's a quick comparison of 3-trade runs of equal Risk of Ruin:

-------------------------------------------------

Percentage Risk 2.1% (NON Martingale)

sum “L” first trade bal “L” 2nd bal “L” fin bal

-0.25 -0.08 3.92 -0.08 3.83 -0.08 3.75

“W”

“L”

“L”

-0.05 0.13 4.13 -0.09 4.04 -0.08 3.95

“L”

“W”

“L”

-0.05 -0.08 3.92 0.12 4.04 -0.08 3.95

“W”

“W”

“L”

0.17 0.13 4.13 0.13 4.26 -0.09 4.17

sum “L” first trade bal “L” 2nd bal “W” fin bal

-0.05 -0.08 3.92 -0.08 3.83 0.12 3.95

“W”

“L”

“W”

0.17 0.13 4.13 -0.09 4.04 0.13 4.17

“L”

“W”

“W”

0.17 -0.08 3.92 0.12 4.04 0.13 4.17

“W”

“W”

“W”

0.39 0.13 4.13 0.13 4.26 0.13 4.39

EV of 8 runs 0.51

--------------------------------------------------------

Martingale (1.5x) start risk 0.052

sum “L” “L” “L”

-0.25 -0.05 -0.08 -0.12

“W” “L” “L”

-0.05 0.08 -0.05 -0.08

“L” “W” “L”

0.01 -0.05 0.12 -0.05

“W” “W” “L”

0.10 0.08 0.08 -0.05

“L” “L” “W”

0.05 -0.05 -0.08 0.18

“W” “L” “W”

0.14 0.08 -0.05 0.12

“L” “W” “W”

0.14 -0.05 0.12 0.08

“W” “W” “W”

0.23 0.08 0.08 0.08

EV of 8 runs 0.38

The EV to RoR ratio of Martingale is always lower sir.

I do not suggest that you or anyone use a face grating system because if you don't know what you are doing, it will eat your lunch. But then I wouldn't give a chainsaw to a 12 year old either. However, as long as you are willing to make negative statements about any face grating system, that statement is at least true for you, so it shouldn't be used at least by you.

Bob

So true!

Členem od Dec 12, 2014

109 příspěvků

Feb 08, 2015 at 16:06

Členem od Dec 12, 2014

109 příspěvků

ForexAssistant posted:"Can you elaborate ?"

Not here, I thought my previous post was too long but I will make that much available in the very near future.

Just like I automated my trading, I am in the process of automating my course on systemic trading. (A type of fundamental trading). My intent is to make the first 3 chapters of the text book and the first lecture free as a way to determine if my investment programs are right for the reader before purchasing. It covers the basic fundamentals of the market. The textbook is currently being edited. When I get it back from the editor, I will let you know how to get that free part.

Bob

Wish you good luck, but I would be glad If you could at leat rougly explain your concept of ,, center point,,.

Get investors and get paid 15 percent of theyr profits. More on my website.

Členem od Dec 12, 2014

109 příspěvků

Feb 08, 2015 at 16:19

(Upravené Feb 08, 2015 at 16:20)

Členem od Dec 12, 2014

109 příspěvků

Cholipop posted:mavericks posted:ForexAssistant posted:CrazyTrader posted:

Second best way is to do antimartingale.

Do you guys know what is the opposite of Martingale?

Yes, you double the winning trades. But that isn't a recovery system, its just another bizarre technical trading system. You know, the kind of system that is responsible for 80 to 85% losses?

So lets look at a recovery system to see if it is as scary as technical trading. We start with .01 lots and set our take-profit and stop losses at 20 pips. Now to decide if we should do buys or sells, we look at the current price. The center point is half way between the historical high and the historical low.

If the current price is above the center point then we do sells as we expect the price to spend most of its time somewhere around the middle. If you don't know why, you will have to read my book. If the current price is below center, we do buys. Lets say we do a buy trade for our first trade and the price drops 20 pips and we close for a loss. The next trade we open the trade of .01 lots and make the take profit and stop losses 40 pips, twice what the loss was. And of course, a win would pay for the loss and give us a profit. But a second loss would make our next trade 80 pips.

The 4th trade would be 160 pips, the 5th 320 pips, the sixth, 640 pips. The trade size is still .01 lots. After 7 straight losses we would have moved 1260 pips away from center. The aud/cad only has 1600 pips from center to the historical limits. The 8th trade would be for a win or loss of 1280 pips, 940 pips beyond the historical limits.

Now that is not the way I trade a recovery system but this exerciser was not intended to teach anyone how to trade or use a recovery system, just how to think outside the box. What are traders afraid of when discussing any recovery system? That the trade size gets to large and blows out the account. right?

The trade size in our demonstration is still only .01 lots but at the opening of the 8th iteration we would have lost a total of 1260 pips. A change of one pip for a .01 lot size trade, changes the equity by .10 of the first listed currency of the pair. In the case of the aud/cad, it would change by .10 Aussi dollars. So at 1260 pips, we would have a draw of 126.00 Ausie dollars. If we had say $500 in our trading account, it would be near impossible to ever have a margin call.

There are better ways to trade using a recovery system but it is not my purpose to teach investors/traders how to trade. For that, I get paid. Nothing wrong with that, because I also paid to learn what I know. Boy did I pay...

Bob

Interesting. Actually I took a time to read it :)

My observations:

1) It is not written in the stone that price would not move outside of current boundaries, and forget that there was ever some center point.

2)It takes exponentialy longer time, considering daily range to get back the losses, after longer lasting streaks.

3) Your systems sounds more like an averaging system to me with some characteristics, of martingale. But basically you are waiting for some correction buoing / selling at better price - I have no problem with that. :)

But anyway. something to think about.

Regarding martingale and antimartingale, I have not used any of those, if someone manages to succed with any of them good for him.

Regards

M

The funny thing is that many people are against martingale, as they are afraid to take risk. They are afraid of taking higher risk because their system is based on completely random entries, as most people trade support and resistance which of course has no science to it. Recall that crazytrader's current account was in red as much as 40% in drawdown % because he trades the higher tf which of course focuses more on extension of the over all trend instead of following price action.

If anyone has an accurate enough system in which he/she will not experience more then say 4 straight losses, then of course it would make sense to use martingale, as you are increasing your lot size not based on the theory in which you can not lose FOREVER, but because your systems focuses on accuracy thus making the newly opened order a high probability trade compared to the last one.

Most of the people who are against martingale are simple minded noobs who can't think past go. Thus simply comparing casino martingale to forex martingale which can be both the same or different. Instead of focusing on the different variations, they only focus on making it the same.

If we look at crazytraders account, and look at him using martingale (which he doesn't use) it would be clear to see he would of margin called the account many days ago. Yet, his account doesn't focus on accuracy as his floating EU loss currently has a PIP-DRAWDOWN of over 200 pips. He has been saved by the NFP news, which still has not been able to take him out of the red.

:)

Yes there are many people following same old tired agape over and over again, applying useless knowledge hoping for better results.

At some point they realise that coward trading will not save them, so they make dumbest gamble, betting rest of account on one position.

If you already have a great entry and exit , no matter what you do you will be ok anyway.

Martingale will propably not make or brake your strategy. At that point you can also use antimartingale with sucess.

I personally do not care how the person arrives to the results, he can use most outrageous approach in the universe, but as far as he is consistent and profitable , he is ok in my eyes :))

Regards

M

Get investors and get paid 15 percent of theyr profits. More on my website.

Členem od Nov 21, 2011

1601 příspěvků

Feb 08, 2015 at 16:25

Členem od Nov 21, 2011

1601 příspěvků

Cholipop posted:

The funny thing is that many people are against martingale, as they are afraid to take risk. They are afraid of taking higher risk because their system is based on completely random entries, as most people trade support and resistance which of course has no science to it. Recall that crazytrader's current account was in red as much as 40% in drawdown % because he trades the higher tf which of course focuses more on extension of the over all trend instead of following price action.

If anyone has an accurate enough system in which he/she will not experience more then say 4 straight losses, then of course it would make sense to use martingale, as you are increasing your lot size not based on the theory in which you can not lose FOREVER, but because your systems focuses on accuracy thus making the newly opened order a high probability trade compared to the last one.

Most of the people who are against martingale are simple minded noobs who can't think past go. Thus simply comparing casino martingale to forex martingale which can be both the same or different. Instead of focusing on the different variations, they only focus on making it the same.

If we look at crazytraders account, and look at him using martingale (which he doesn't use) it would be clear to see he would of margin called the account many days ago. Yet, his account doesn't focus on accuracy as his floating EU loss currently has a PIP-DRAWDOWN of over 200 pips. He has been saved by the NFP news, which still has not been able to take him out of the red.

You are really jealous... they talk about Martingale and then you talk again about my account that you admit has nothing to do with martingale.

By the way, I currently hold my short position issued from Trading Against the Crowd. As long as I trade trend... why should I be worried when some noobs like you are posting "be prepared for the so freaking bullish move"... I had to requote myself on EURUSD thread for you to look at the chart. You talk about Price Action.... You consider a correction as a Price Action... well done noob.

You should only talk about Pip Drawdown... and guess what, even there, I have already shown you 6 months ago I was better than you at this game. To do this, my EA pick up the best entry you could ever reach.

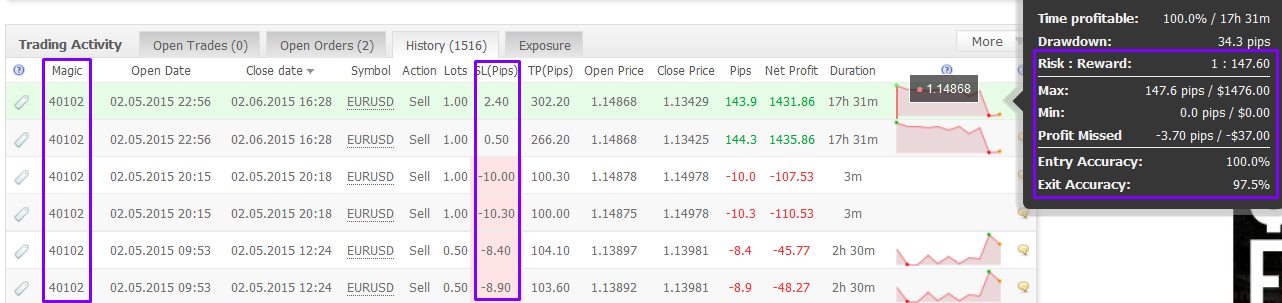

Exemple: My last 2 trades on EURUSD. (Short off course) !!!

This robot (Magic Num 40102) has SL = 10 pips.

The difference between you and me is that I don't close trade when i'm up 10 pips because I'm affraid that market reverses.... Obviously it couldn't work for you because you don't trade the trend.

Have you ever heard about "Look left, market leaves clues"... if yes, you better study again!

Členem od Nov 21, 2011

1601 příspěvků

Feb 08, 2015 at 16:33

Členem od Nov 21, 2011

1601 příspěvků

mavericks posted:

Wish you good luck, but I would be glad If you could at leat rougly explain your concept of ,, center point,,.

He probably refers to belkhayate gravity center

Členem od Jun 28, 2011

444 příspěvků

Feb 08, 2015 at 16:59

Členem od Jun 28, 2011

444 příspěvků

I'm sorry Ben, but I can't really follow what you are trying to say. Humor doesn't carry over very well in text and that whole “face grating” thing distracted from whatever point you were trying to make.

One error that I was able to pick up on is the belief that all possibilities are of equal weight. In the flip of the coin scenario, what you are saying makes some sense as it requires a fair coin. But there is nothing fair about the forex market. My preferred recovery system uses the older Fibonacci sequence instead of the Martingale one. You will never get this line of logic from a technical trading point of view, these are fundamental concepts.

I have made this recommendation many time prior to this but will repeat it once more, “it is ill advised to use any system, including recovery ones, for which you have not been trained”.

There is no offense intended Ben, it is just the fact that we think very differently. No one can be an expert in everything. I for one do not understand technical trading and what everyone sees in it. To me a failure rate of 80 to 85% is just lunacy, But I can't make 10% a month, now can I? So I acknowledge that there are other ways to trade and won't throw stones at what I do not understand.

But when you are talking about recovery systems, grids and the like, well that is the math department, your playing in my ballpark, I certainly could not acquiesce to someone who has never even used a recovery system before. So lets just agree that we are from different worlds and disagree on which is best.

Bob

One error that I was able to pick up on is the belief that all possibilities are of equal weight. In the flip of the coin scenario, what you are saying makes some sense as it requires a fair coin. But there is nothing fair about the forex market. My preferred recovery system uses the older Fibonacci sequence instead of the Martingale one. You will never get this line of logic from a technical trading point of view, these are fundamental concepts.

I have made this recommendation many time prior to this but will repeat it once more, “it is ill advised to use any system, including recovery ones, for which you have not been trained”.

There is no offense intended Ben, it is just the fact that we think very differently. No one can be an expert in everything. I for one do not understand technical trading and what everyone sees in it. To me a failure rate of 80 to 85% is just lunacy, But I can't make 10% a month, now can I? So I acknowledge that there are other ways to trade and won't throw stones at what I do not understand.

But when you are talking about recovery systems, grids and the like, well that is the math department, your playing in my ballpark, I certainly could not acquiesce to someone who has never even used a recovery system before. So lets just agree that we are from different worlds and disagree on which is best.

Bob

where research touches lives.

Členem od Jun 28, 2011

444 příspěvků

Feb 08, 2015 at 17:13

Členem od Jun 28, 2011

444 příspěvků

Mav, "Wish you good luck, but I would be glad If you could at least roughly explain your concept of ,, center point,,. "

In sound-bite fashion, “it's because the banks want it that way”, but that's not an answer to why, and why can't be explained in sound-bite. But, I will answer your question, I'm just not sure of how soon. A little patience, I'll get it to you, promise.

Bob

In sound-bite fashion, “it's because the banks want it that way”, but that's not an answer to why, and why can't be explained in sound-bite. But, I will answer your question, I'm just not sure of how soon. A little patience, I'll get it to you, promise.

Bob

where research touches lives.

Členem od Oct 11, 2013

769 příspěvků

Feb 09, 2015 at 06:08

Členem od Oct 11, 2013

769 příspěvků

lets see how everything works out.

Členem od Feb 22, 2011

4573 příspěvků

Feb 09, 2015 at 07:36

(Upravené Feb 09, 2015 at 07:51)

Členem od Feb 22, 2011

4573 příspěvků

ForexAssistant posted:"It is not written in the stone that price would not move outside of current boundaries, and forget that there was ever some center point"

Mav, you just told on yourself my friend. Anyone who does not understand the significance of the center point, doesn't understand the forex market. Not trading the market, but the forex market itself. Why does it exist, what is its purpose? How to use that knowledge to make a safe trading system..

That is the problem that I have with technical trading. It allows people to trade, make and lose money, but never really understand the market in which they trade. Now to me, that's scary.

Bob

@ForexAssistant

Bob,

Regarding your statement ...Anyone who does not understand the significance of the center point, doesn't understand the forex market....

You are completely wrong, there are some approaches to understand forex market.

Why on earth should be only yours the choosen one?

Členem od Apr 05, 2014

33 příspěvků

Feb 09, 2015 at 07:41

Členem od Apr 05, 2014

33 příspěvků

ForexAssistant posted:

One error that I was able to pick up on is the belief that all possibilities are of equal weight. In the flip of the coin scenario, what you are saying makes some sense as it requires a fair coin. But there is nothing fair about the forex market. My preferred recovery system uses the older Fibonacci sequence instead of the Martingale one. You will never get this line of logic from a technical trading point of view, these are fundamental concepts.

Bob

No it just requires understanding of RoR or RoDD and some math. You said that it's all math and you're right. I have presented some to clearly show that risking percent of equity is always better than increasing risk after a loss when it comes to profitability versus RoR. I only showed a coin flip that pays out 1:1.5 because it's easier to wrap you're head around, you can choose any type of trading, betting or gambling with any edge, R:R, risk sizing etc and run the math with same results: Risking percent of equity is always better than ANY TYPE of ever increasing risk after each loss when it comes to profitability versus RoR. The original poster asked about Martingale so I have proven Martingale is the worst choice for MM with math. It's your turn to post some math if you think you've found some magic Fibonacci type of increasing risk after each loss.

Btw it will be obvious to the readers who is making sense so, no need to accuse others of not understanding. Waste of words, just go ahead and prove it with math.

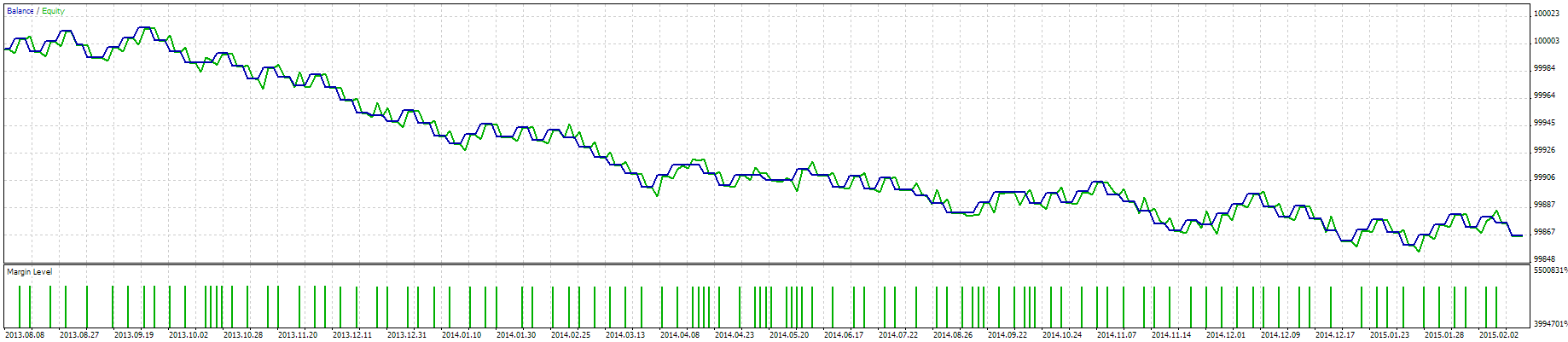

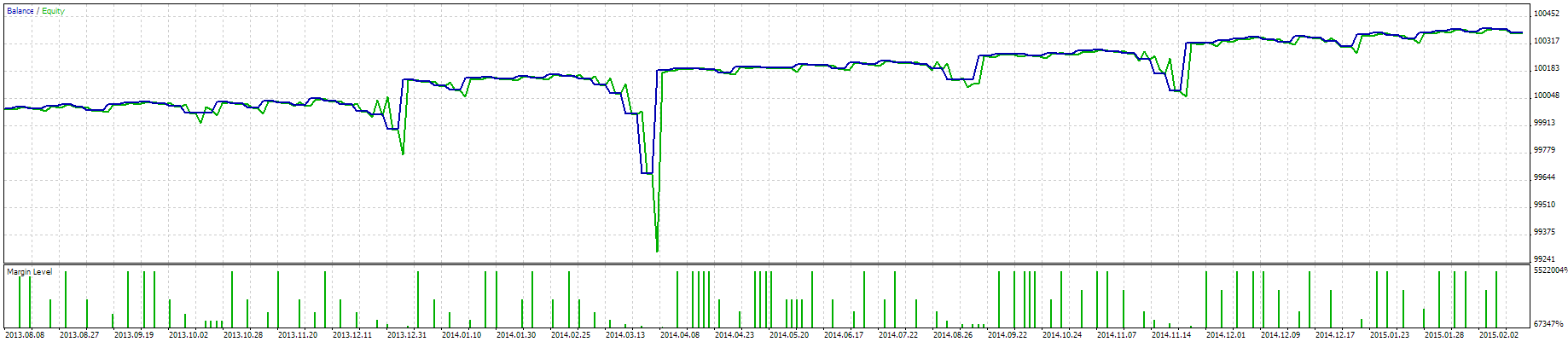

What's more, with enough starting capitol and a small enough start lot size, increasing risk size after each loss can make a losing system look like a winning one for quite a while (although making the eventual downswings much bigger) Check out this losing strategy for instance...

Now if we add a simple martingale we can make it look profitable for the whole sample while delaying the ever increasing downswing coming....

We have delayed the big DD for the entire sample and made it look profitable. We can now see that increasing lot size after each loss merely delays DD (while actually increasing it) in any system (even a losing one) and can give the illusion of profitability while hiding true risk/profitablity/performance of a system. This is the premise behind the scam roulette bot going around right now.

Členem od Apr 05, 2014

33 příspěvků

Feb 09, 2015 at 07:45

Členem od Apr 05, 2014

33 příspěvků

ForexAssistant posted:

My preferred recovery system uses the older Fibonacci sequence instead of the Martingale one. You will never get this line of logic from a technical trading point of view, these are fundamental concepts.

Bob

Yes because 1,1,2,3,5,8 is so much harder to understand than 1,2,4,8,16? Post what 5 losses in a row looks like (is it -1x,-1x,-2x,-3x,-5x or -1x,-2x,-2x,-3x,-4x,-6x?) and I'll show you how you can either have the same RoR with higher profitability or same profitability with lower RoR by choosing to risk a percentage of your account on each trade instead.

Členem od Apr 05, 2014

33 příspěvků

Feb 09, 2015 at 07:49

Členem od Apr 05, 2014

33 příspěvků

ForexAssistant posted:

My preferred recovery system uses the older Fibonacci sequence instead of the Martingale one.

Bob

StartAccount=1000

Ruin=-64

RoR=6.25%

Win Rate= 50%

R:R= 1:1.5

Fibonacci Recovery System (start lot=8 RoR=6.25%)

sum “L” “L” “L” “L”

-64.00 -8.00 -16.00 -16.00 -24.00

“W” “L” “L” “L”

-28.00 12.00 -8.00 -16.00 -16.00

“L” “W” “L” “L”

-8.00 -8.00 24.00 -8.00 -16.00

“W” “W” “L” “L”

0.00 12.00 12.00 -8.00 -16.00

“L” “L” “W” “L”

-8.00 -8.00 -16.00 24.00 -8.00

“W” “L” “W” “L”

20.00 12.00 -8.00 24.00 -8.00

“L” “W” “W” “L”

20.00 -8.00 24.00 12.00 -8.00

“W” “W” “W” “L”

28.00 12.00 12.00 12.00 -8.00

sum “L” “L” “L” “W”

-4.00 -8.00 -16.00 -16.00 36.00

“W” “L” “L” “W”

12.00 12.00 -8.00 -16.00 24.00

“L” “W” “L” “W”

32.00 -8.00 24.00 -8.00 24.00

“W” “W” “L” “W”

40.00 12.00 12.00 -8.00 24.00

“L” “L” “W” “W”

12.00 -8.00 -16.00 24.00 12.00

“W” “L” “W” “W”

40.00 12.00 -8.00 24.00 12.00

“L” “W” “W” “W”

40.00 -8.00 24.00 12.00 12.00

“W” “W” “W” “W”

48.06 12.00 12.00 12.00 12.00

EV of 16 runs: 180.06

Percent of Equity System(1.64% risked, RoR=6.25%)

sum “L” first trade bal “L” 2nd bal “L” 3rd bal “L” fin bal

-64.00 -16.40 983.60 -16.13 967.47 -15.87 951.60 -15.61 936.00

“W” “L” “L” “L”

-24.99 24.60 1024.60 -16.80 1007.80 -16.53 991.27 -16.26 975.01

“L” “W” “L” “L”

-24.99 -16.40 983.60 24.20 1007.80 -16.53 991.27 -16.26 975.01

“W” “W” “L” “L”

15.65 24.60 1024.60 25.21 1049.81 -17.22 1032.59 -16.93 1015.65

sum “L” first trade bal “L” 2nd bal “W” 3rd bal “L'

-24.99 -16.40 983.60 -16.13 967.47 23.80 991.27 -16.26 975.01

“W” “L” “W” “L”

15.65 24.60 1024.60 -16.80 1007.80 24.79 1032.59 -16.93 1015.65

“L” “W” “W” “L”

15.65 -16.40 983.60 24.20 1007.80 24.79 1032.59 -16.93 1015.65

“W” “W” “W” “L”

75.63 24.60 1024.60 25.21 1049.81 25.83 1075.63 -17.64 1057.99

sum “L” first trade bal “L” 2nd bal “L” 3rd bal “W” fin bal

-24.99 -16.40 983.60 -16.13 967.47 -15.87 951.60 23.41 975.01

“W” “L” “L” “W”

15.65 24.60 1024.60 -16.80 1007.80 -16.53 991.27 24.39 1015.65

“L” “W” “L” “W”

15.65 -16.40 983.60 24.20 1007.80 -16.53 991.27 24.39 1015.65

“W” “W” “L” “W”

57.99 24.60 1024.60 25.21 1049.81 -17.22 1032.59 25.40 1057.99

sum “L” first trade bal “L” 2nd bal “W” 3rd bal “W”

15.65 -16.40 983.60 -16.13 967.47 23.80 991.27 24.39 1015.65

“W” “L” “W” “W”

57.99 24.60 1024.60 -16.80 1007.80 24.79 1032.59 25.40 1057.99

“L” “W” “W” “W”

57.99 -16.40 983.60 24.20 1007.80 24.79 1032.59 25.40 1057.99

“W” “W” “W” “W”

75.63 24.60 1024.60 25.21 1049.81 25.83 1075.63 26.46 1102.09

EV of 16 runs 255.20

It is always best to use a percent of your equity to calculate lot size if you want to achieve the either the highest profitability from a given RoR or the lowest RoR from a given profitability.

Členem od Feb 22, 2011

4573 příspěvků

Feb 09, 2015 at 07:58

Členem od Feb 22, 2011

4573 příspěvků

@bendex77 @ForexAssistant

guys, these are nice theories.

Do you have some live account that is following these rules?

guys, these are nice theories.

Do you have some live account that is following these rules?

Členem od Jun 28, 2011

444 příspěvků

Feb 09, 2015 at 13:00

Členem od Jun 28, 2011

444 příspěvků

togr posted:"...the significance of the center point, doesn't understand the forex market. Not trading the market, but the forex market itself. Why does it exist, what is its purpose? "

Bob

Regarding your statement ...Anyone who does not understand the significance of the center point, doesn't understand the forex market.... "

You are completely wrong, there are some approaches to understand forex market.

Why on earth should be only yours the choosen one?

" Not trading the market, but the forex market itself"

I was concerned that someone would miss the part about the market itself but for you Vontogr I will explain because I don't want you or any of my other friends to think I am egotistical or anything.

A mechanic looks at the functionality of a car very differently than the driver. The driver can operate the car and get where he/she is going without understanding what makes the car go.

The forex market was not created to make a bunch of traders happy. It is designed to make commerce around the world possible. If the price of some currency pair goes beyond the historical limits, a couple of things happen. 1) for the country that has the weaker currency, they find the price of goods imported from over seas too expensive and their citizens must do without. (High inflation)

2) The country that has the stronger currency can't sell their products over seas because no one can afford them. This makes for higher unemployment and unhappy citizens. The central banks job is to keep the market in balance. Certainly the price can go beyond the historical limits but not too far or the world stops functioning.

Some place in the middle is a happy median. The place were the price will mostly hang our. It is not a price but a range. When the price of the currency gets out of that comfort zone, the banks and governments go to work to get it back into perspective. Without paying attention to the economic factors a trader thinks that the price can go do anything it wants to do, they think that it is driven by the traders. In small doses that is sort of true, but over all, traders don't have as much say as you may think.

Countries always devalue their currency (inflation) but though the prices of goods continually go up, the value of foreign currencies always stay close to the center point, why?

OK that's all I am going to say about this, the rest will have to read the book.

Bob

where research touches lives.

Členem od Dec 12, 2014

109 příspěvků

Feb 09, 2015 at 13:24

(Upravené Feb 09, 2015 at 13:30)

Členem od Dec 12, 2014

109 příspěvků

ForexAssistant posted:togr posted:"...the significance of the center point, doesn't understand the forex market. Not trading the market, but the forex market itself. Why does it exist, what is its purpose? "

Bob

Regarding your statement ...Anyone who does not understand the significance of the center point, doesn't understand the forex market.... "

You are completely wrong, there are some approaches to understand forex market.

Why on earth should be only yours the choosen one?

" Not trading the market, but the forex market itself"

I was concerned that someone would miss the part about the market itself but for you Vontogr I will explain because I don't want you or any of my other friends to think I am egotistical or anything.

A mechanic looks at the functionality of a car very differently than the driver. The driver can operate the car and get where he/she is going without understanding what makes the car go.

The forex market was not created to make a bunch of traders happy. It is designed to make commerce around the world possible. If the price of some currency pair goes beyond the historical limits, a couple of things happen. 1) for the country that has the weaker currency, they find the price of goods imported from over seas too expensive and their citizens must do without. (High inflation)

2) The country that has the stronger currency can't sell their products over seas because no one can afford them. This makes for higher unemployment and unhappy citizens. The central banks job is to keep the market in balance. Certainly the price can go beyond the historical limits but not too far or the world stops functioning.

Some place in the middle is a happy median. The place were the price will mostly hang our. It is not a price but a range. When the price of the currency gets out of that comfort zone, the banks and governments go to work to get it back into perspective. Without paying attention to the economic factors a trader thinks that the price can go do anything it wants to do, they think that it is driven by the traders. In small doses that is sort of true, but over all, traders don't have as much say as you may think.

Countries always devalue their currency (inflation) but though the prices of goods continually go up, the value of foreign currencies always stay close to the center point, why?

OK that's all I am going to say about this, the rest will have to read the book.

Bob

Bob

What came to my mind:

“Beware of those who weep with realization, for they have realized nothing.”

― Carlos Castaneda, Fire from Within

Your statement is based on sound logic (as far as Iam concern) and Iam actually looking forward for more info (as you promised me earlier).

When I said its not written in the stone that price will oblige to any historical boundaries. Here is some example.

As you can see spike went more than 100 percent of range below. It obviously returned, but thats the proof that you cant rely on anything too much.

Range is tight and fairly predictable, but question is if it gives you any advantage long term , considering that those situations are always possible.

Also if you already using whole range of the price, you need to have substantial capital to last it. At which point you could just place any trade anywhere and simly wait for price to return to your level - than laugh all the way to the bank.

Get investors and get paid 15 percent of theyr profits. More on my website.

Členem od Jun 28, 2011

444 příspěvků

Feb 09, 2015 at 15:09

Členem od Jun 28, 2011

444 příspěvků

Mav, I checked my brokers and that spike doesn't exist on them. Sometimes when a broker unplugs from the system, their computer is looking for a price that isn't there so it bottoms out. Electronic spikes can be challenged because it never really existed in the market. If they don't make it right, that is theft by your broker. It is the same as if they kept the price from hitting a take profit. It is theft. But every broker since "One world" which went out of business refunds losses due to electronic spikes.

But on Jan 11, this year the audnzd did brake below the previous historical limit and has been weak ever since you can check that out to see a normal reset of the limits.

@ Ben;

I am not disagreeing with you but we are talking about different things. Let's take 2 dice, as you are showing it, there are 23 possible outcomes. 2 through 24. However there is only one chance to get boxcars (24), two to get a 3 or 11, while there are 6 chances to get a seven. This means there are 36 possible outcomes but some are the same value as others. What a recover system does is to make up for the rare times when the outcome is snake eyes or boxcars. The rest of the time we make our money the normal way.

Remember that a recovery system is not a trading system, RISE doesn't use a recovery system because it never loses. A recovery system only zeros out losses. And the fast recovery can fail every once in a while, but the probabilities that it would fail twice before a total recovery could be achieved by the slow recovery process is so low that we can feel comfortable with using it.

The fast recovery, like a Martingale or Fibonacci requires a limit, say 10 iterations. If it fails, then we double our base trade size and start over. Half of those recovery trades are to make our normal profit, the other half compensates for the previous losses. So we are not concerned if the fast recovery system fails, only that it doesn't fail twice in close proximity to each other.

Now since that is all in the book, I will quit discussing it now or there won't be any reason for anyone to actually read the book. And after all the work it took to write the damn thing, No one left to read it would really bum me out.

Bob

But on Jan 11, this year the audnzd did brake below the previous historical limit and has been weak ever since you can check that out to see a normal reset of the limits.

@ Ben;

I am not disagreeing with you but we are talking about different things. Let's take 2 dice, as you are showing it, there are 23 possible outcomes. 2 through 24. However there is only one chance to get boxcars (24), two to get a 3 or 11, while there are 6 chances to get a seven. This means there are 36 possible outcomes but some are the same value as others. What a recover system does is to make up for the rare times when the outcome is snake eyes or boxcars. The rest of the time we make our money the normal way.

Remember that a recovery system is not a trading system, RISE doesn't use a recovery system because it never loses. A recovery system only zeros out losses. And the fast recovery can fail every once in a while, but the probabilities that it would fail twice before a total recovery could be achieved by the slow recovery process is so low that we can feel comfortable with using it.

The fast recovery, like a Martingale or Fibonacci requires a limit, say 10 iterations. If it fails, then we double our base trade size and start over. Half of those recovery trades are to make our normal profit, the other half compensates for the previous losses. So we are not concerned if the fast recovery system fails, only that it doesn't fail twice in close proximity to each other.

Now since that is all in the book, I will quit discussing it now or there won't be any reason for anyone to actually read the book. And after all the work it took to write the damn thing, No one left to read it would really bum me out.

Bob

where research touches lives.

Členem od Dec 12, 2014

109 příspěvků

Feb 09, 2015 at 15:40

(Upravené Feb 09, 2015 at 15:41)

Členem od Dec 12, 2014

109 příspěvků

ForexAssistant posted:

Mav, I checked my brokers and that spike doesn't exist on them. Sometimes when a broker unplugs from the system, their computer is looking for a price that isn't there so it bottoms out. Electronic spikes can be challenged because it never really existed in the market. If they don't make it right, that is theft by your broker. It is the same as if they kept the price from hitting a take profit. It is theft. But every broker since "One world" which went out of business refunds losses due to electronic spikes.

But on Jan 11, this year the audnzd did brake below the previous historical limit and has been weak ever since you can check that out to see a normal reset of the limits.

@ Ben;

I am not disagreeing with you but we are talking about different things. Let's take 2 dice, as you are showing it, there are 23 possible outcomes. 2 through 24. However there is only one chance to get boxcars (24), two to get a 3 or 11, while there are 6 chances to get a seven. This means there are 36 possible outcomes but some are the same value as others. What a recover system does is to make up for the rare times when the outcome is snake eyes or boxcars. The rest of the time we make our money the normal way.

Remember that a recovery system is not a trading system, RISE doesn't use a recovery system because it never loses. A recovery system only zeros out losses. And the fast recovery can fail every once in a while, but the probabilities that it would fail twice before a total recovery could be achieved by the slow recovery process is so low that we can feel comfortable with using it.

The fast recovery, like a Martingale or Fibonacci requires a limit, say 10 iterations. If it fails, then we double our base trade size and start over. Half of those recovery trades are to make our normal profit, the other half compensates for the previous losses. So we are not concerned if the fast recovery system fails, only that it doesn't fail twice in close proximity to each other.

Now since that is all in the book, I will quit discussing it now or there won't be any reason for anyone to actually read the book. And after all the work it took to write the damn thing, No one left to read it would really bum me out.

Bob

Well I chcecked with all 4 of STP/ECN brokers I have accounts with. same spike could be found at 2 of them.

Recent swiss events have shown us that it is extremely difficult to get something back when you got hit by nonexistent price.

Unless you are ready to fight for years.

Get investors and get paid 15 percent of theyr profits. More on my website.

*Komerční použití a spam nebudou tolerovány a mohou vést ke zrušení účtu.

Tip: Zveřejněním adresy URL obrázku /služby YouTube se automaticky vloží do vašeho příspěvku!

Tip: Zadejte znak @, abyste automaticky vyplnili jméno uživatele, který se účastní této diskuse.