- Domů

- Komunita

- Zkušení obchodníci

- What's the best way to trade Martingale Forex Trading

Advertisement

Edit Your Comment

What's the best way to trade Martingale Forex Trading

Členem od Jun 28, 2011

444 příspěvků

Feb 09, 2015 at 17:19

Členem od Jun 28, 2011

444 příspěvků

"Recent swiss events have shown us that it is extremely difficult to get something back when you got hit by nonexistent price."

If brokers were to get away with moving the price arbitrarily by that much, there would be no forex trading, everyone would just quit.

STP/ECN brokers came into existence because back in 2006 the advice traders all gave one another was “Don't trust your broker”. The word got out that the MT3 and Mt4 had the ability to hunt prices, hitting stop-losses that were close but the price on demos and other brokers didn't quit get that far. Also it was said that they could hold a price back by a couple of pips so a Take profit was missed. Forex trading began to slow but then came the ECNs and everyone began going to them and forex trading was saved. True story, I was there.

Bob

If brokers were to get away with moving the price arbitrarily by that much, there would be no forex trading, everyone would just quit.

STP/ECN brokers came into existence because back in 2006 the advice traders all gave one another was “Don't trust your broker”. The word got out that the MT3 and Mt4 had the ability to hunt prices, hitting stop-losses that were close but the price on demos and other brokers didn't quit get that far. Also it was said that they could hold a price back by a couple of pips so a Take profit was missed. Forex trading began to slow but then came the ECNs and everyone began going to them and forex trading was saved. True story, I was there.

Bob

where research touches lives.

Členem od Dec 12, 2014

109 příspěvků

Feb 09, 2015 at 17:40

Členem od Dec 12, 2014

109 příspěvků

There are still many people trading with unregulated or dealing desk brokers even today and operating in a way you describe.

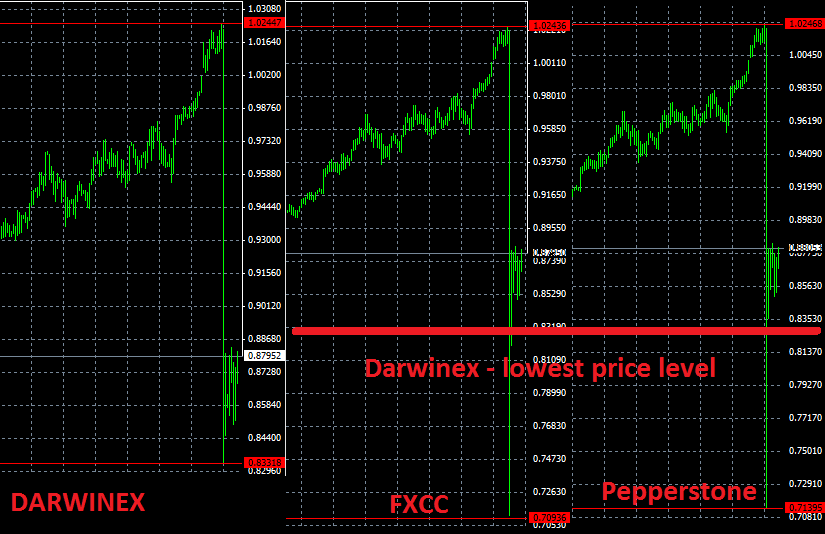

you were reffering to non existent price well, here are some screenshots from life price feed from ecn brokers Iam using.

It is clear that price was not accurate at least at two of them.

If you got caught, well bad luck for you, in my experience it is next to impossible to get money back at such occurance even thoug broker is regulated and respected.

unless you are ready to fight very long and very hard.

you were reffering to non existent price well, here are some screenshots from life price feed from ecn brokers Iam using.

It is clear that price was not accurate at least at two of them.

If you got caught, well bad luck for you, in my experience it is next to impossible to get money back at such occurance even thoug broker is regulated and respected.

unless you are ready to fight very long and very hard.

Get investors and get paid 15 percent of theyr profits. More on my website.

Členem od Jun 28, 2011

444 příspěvků

Feb 09, 2015 at 17:50

Členem od Jun 28, 2011

444 příspěvků

May I ask, what currency pair and time frame is that?

where research touches lives.

Členem od Dec 12, 2014

109 příspěvků

Feb 09, 2015 at 17:55

Členem od Dec 12, 2014

109 příspěvků

USDCHF, daily, but price is obvious on all timeframes

Get investors and get paid 15 percent of theyr profits. More on my website.

forex_trader_202879

Členem od Aug 07, 2014

378 příspěvků

Feb 10, 2015 at 07:37

Členem od Aug 07, 2014

378 příspěvků

CrazyTrader posted:Cholipop posted:

The funny thing is that many people are against martingale, as they are afraid to take risk. They are afraid of taking higher risk because their system is based on completely random entries, as most people trade support and resistance which of course has no science to it. Recall that crazytrader's current account was in red as much as 40% in drawdown % because he trades the higher tf which of course focuses more on extension of the over all trend instead of following price action.

If anyone has an accurate enough system in which he/she will not experience more then say 4 straight losses, then of course it would make sense to use martingale, as you are increasing your lot size not based on the theory in which you can not lose FOREVER, but because your systems focuses on accuracy thus making the newly opened order a high probability trade compared to the last one.

Most of the people who are against martingale are simple minded noobs who can't think past go. Thus simply comparing casino martingale to forex martingale which can be both the same or different. Instead of focusing on the different variations, they only focus on making it the same.

If we look at crazytraders account, and look at him using martingale (which he doesn't use) it would be clear to see he would of margin called the account many days ago. Yet, his account doesn't focus on accuracy as his floating EU loss currently has a PIP-DRAWDOWN of over 200 pips. He has been saved by the NFP news, which still has not been able to take him out of the red.

You are really jealous... they talk about Martingale and then you talk again about my account that you admit has nothing to do with martingale.

By the way, I currently hold my short position issued from Trading Against the Crowd. As long as I trade trend... why should I be worried when some noobs like you are posting "be prepared for the so freaking bullish move"... I had to requote myself on EURUSD thread for you to look at the chart. You talk about Price Action.... You consider a correction as a Price Action... well done noob.

You should only talk about Pip Drawdown... and guess what, even there, I have already shown you 6 months ago I was better than you at this game. To do this, my EA pick up the best entry you could ever reach.

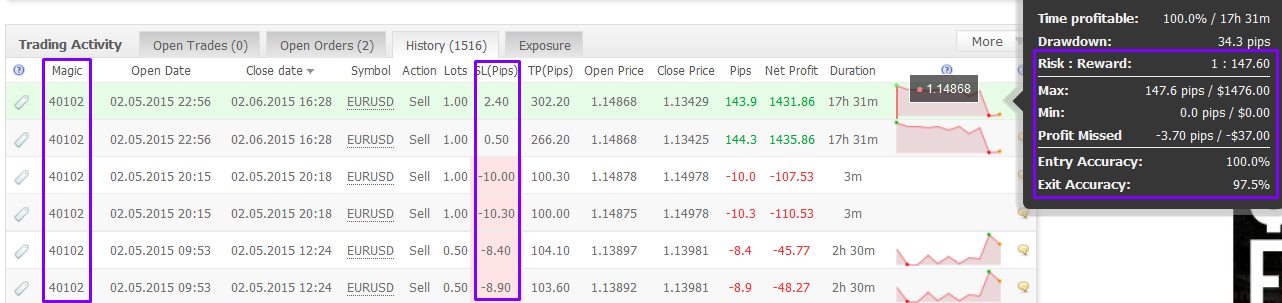

Exemple: My last 2 trades on EURUSD. (Short off course) !!!

This robot (Magic Num 40102) has SL = 10 pips.

The difference between you and me is that I don't close trade when i'm up 10 pips because I'm affraid that market reverses.... Obviously it couldn't work for you because you don't trade the trend.

Have you ever heard about "Look left, market leaves clues"... if yes, you better study again!

Well you wonderful EA sure has not picked a wonderful entry on EU, as you were in red as much as 200+ pips in which you have been holding for more then a week (yes trading with the trend) but you have given way more pips to the market then you have gainned from that very trade. You may have a few trades in which you end up with a good REAL r:r BUT OVER 80% of your trades are HORRIBLE not only in entry, but in exit which is why your down is well over 35% and your currently in red almost 20%.

Price action what you fail to realize isn't JUST CORRECTION, but the entire move which creates what you see on every single TF. Since you have no idea on how to read price action,you simple GO WITH THE TREND, thus getting your socks rocked. Talk about your open EU trade which went in red AS MUCH AS 41%.... What is your excuse to risk 41% of your entire account on one trade alone? Not to mention the trades which you have placed after that have been almost as bad as your floating EU trade.

Členem od Aug 30, 2012

64 příspěvků

Feb 10, 2015 at 07:38

Členem od Aug 30, 2012

64 příspěvků

those rules, will not work we tried them about 8 years. ago. there is a few missing parts to the logic you have presented. that are needed to make it even remotely work. they are not addressed in your current explanation. fibs have Interlocking wave echo functions.

LIKE MY TRADE ALERT POST! TRY IT FREE! NO SIGN UP! 100% FREE - w.w.w.ForexAlertSystem.c.o.m "CLICK ON BIG GREEN TRIAL BUTTON"

forex_trader_202879

Členem od Aug 07, 2014

378 příspěvků

Feb 10, 2015 at 07:47

Členem od Aug 07, 2014

378 příspěvků

mavericks posted:

There are still many people trading with unregulated or dealing desk brokers even today and operating in a way you describe.

you were reffering to non existent price well, here are some screenshots from life price feed from ecn brokers Iam using.

It is clear that price was not accurate at least at two of them.

If you got caught, well bad luck for you, in my experience it is next to impossible to get money back at such occurance even thoug broker is regulated and respected.

unless you are ready to fight very long and very hard.

Nice snapshot my friend. All in all the broker can blame it on "lack of liquidity" when in the reality their is no way to actually prove if their was or wasn't any liquidity at all. Broker can make the spreads what ever it is they please, thus controlling both the bid and ask, as your snapshot reveals. If only people would realize how dangerous it is to have any type of exposuer to this currency market, only then will realize that scalping is the best way to go. Black Thursday or the next 9/11 can come at any moment thus draining your account even if you have a .01 order open with a 50,000usd account.

Členem od Dec 12, 2014

109 příspěvků

Feb 10, 2015 at 08:06

Členem od Dec 12, 2014

109 příspěvků

Cholipop posted:mavericks posted:

There are still many people trading with unregulated or dealing desk brokers even today and operating in a way you describe.

you were reffering to non existent price well, here are some screenshots from life price feed from ecn brokers Iam using.

It is clear that price was not accurate at least at two of them.

If you got caught, well bad luck for you, in my experience it is next to impossible to get money back at such occurance even thoug broker is regulated and respected.

unless you are ready to fight very long and very hard.

Nice snapshot my friend. All in all the broker can blame it on "lack of liquidity" when in the reality their is no way to actually prove if their was or wasn't any liquidity at all. Broker can make the spreads what ever it is they please, thus controlling both the bid and ask, as your snapshot reveals. If only people would realize how dangerous it is to have any type of exposuer to this currency market, only then will realize that scalping is the best way to go. Black Thursday or the next 9/11 can come at any moment thus draining your account even if you have a .01 order open with a 50,000usd account.

Thank you Choli.

With any broker, you better be ready for anything.

even if you had small trade on CHF pairs on that moment: spreads would kill you, stop loss would not work.

If you survived the movement some of them would reduce leverage from 200:1 to 10:1. And if you do not have capital to cover it you are also done.

Scalping is a great way I agree. Unfortunatelly I was never able to do that effeciently. And trust me Iam working hard to come up with some EA. :)

And you are right. Forex can be an epitome of chaos, anything can happen any given moment.

Regards

M

Get investors and get paid 15 percent of theyr profits. More on my website.

Členem od Apr 05, 2014

33 příspěvků

Feb 10, 2015 at 12:23

Členem od Apr 05, 2014

33 příspěvků

ForexAssistant posted:

Remember that a recovery system is not a trading system, RISE doesn't use a recovery system because it never loses. A recovery system only zeros out losses. And the fast recovery can fail every once in a while, but the probabilities that it would fail twice before a total recovery could be achieved by the slow recovery process is so low that we can feel comfortable with using it.

The fast recovery, like a Martingale or Fibonacci requires a limit, say 10 iterations. If it fails, then we double our base trade size and start over. Half of those recovery trades are to make our normal profit, the other half compensates for the previous losses. So we are not concerned if the fast recovery system fails, only that it doesn't fail twice in close proximity to each other.

Bob

This is all true but I have demonstrated that any recovery system sacrifices profitability when compared to a non recovery system of equal RoR.

In return you get an increased chance of any 1 given trade in a series to land at a balance which is higher than or equal to the starting balance. Perhaps this has some psychological value? If you want highest profitability for a given RoR though, turn your recovery systems off.

Členem od Jun 28, 2011

444 příspěvků

Feb 10, 2015 at 15:15

Členem od Jun 28, 2011

444 příspěvků

@ Maverick

Well my friend, this is a first. Since you are using ECN brokers, those feed come directly from the liquidity providers, the big banks that run the forex. We have long known that there was small differences from one provider to another. In fact, there had been conversations in the past about watching one broker and trading on a second broker that tended to follow the first but the differences were so small that everyone seems to have given up on it. But we never anything this massive.

Of course it would have taken something like locking a currency to a bigger one as was done to the Swiss Frank. Of course everyone knew it was temporary as it makes no sense to have a currency that does the exact same thing as your neighbors currency. I figured that we would be losing the Swiss Frank fairly soon. The very fact that the Swiss bankers felt that they wanted to lock the frank to the euro for a bit, screams problems. I don't see where any solutions have been offered so the problems, whatever they are still exists.

Going back to a free floating currency was unexpected, quite frankly I don't know what it means but until someone figures this out, I for one would not be trading the Swiss Frank.

However, this diversion from the norm is troubling. It may signal a shift or change in the forex market. I need to be cautious here but I may want to consider shifting my focus back to real estate and stocks for a bit, it just depends on how this shakes out.

Bob

Well my friend, this is a first. Since you are using ECN brokers, those feed come directly from the liquidity providers, the big banks that run the forex. We have long known that there was small differences from one provider to another. In fact, there had been conversations in the past about watching one broker and trading on a second broker that tended to follow the first but the differences were so small that everyone seems to have given up on it. But we never anything this massive.

Of course it would have taken something like locking a currency to a bigger one as was done to the Swiss Frank. Of course everyone knew it was temporary as it makes no sense to have a currency that does the exact same thing as your neighbors currency. I figured that we would be losing the Swiss Frank fairly soon. The very fact that the Swiss bankers felt that they wanted to lock the frank to the euro for a bit, screams problems. I don't see where any solutions have been offered so the problems, whatever they are still exists.

Going back to a free floating currency was unexpected, quite frankly I don't know what it means but until someone figures this out, I for one would not be trading the Swiss Frank.

However, this diversion from the norm is troubling. It may signal a shift or change in the forex market. I need to be cautious here but I may want to consider shifting my focus back to real estate and stocks for a bit, it just depends on how this shakes out.

Bob

where research touches lives.

Členem od Dec 12, 2014

109 příspěvků

Feb 10, 2015 at 15:56

Členem od Dec 12, 2014

109 příspěvků

ForexAssistant posted:

@ Maverick

Well my friend, this is a first. Since you are using ECN brokers, those feed come directly from the liquidity providers, the big banks that run the forex. We have long known that there was small differences from one provider to another. In fact, there had been conversations in the past about watching one broker and trading on a second broker that tended to follow the first but the differences were so small that everyone seems to have given up on it. But we never anything this massive.

Of course it would have taken something like locking a currency to a bigger one as was done to the Swiss Frank. Of course everyone knew it was temporary as it makes no sense to have a currency that does the exact same thing as your neighbors currency. I figured that we would be losing the Swiss Frank fairly soon. The very fact that the Swiss bankers felt that they wanted to lock the frank to the euro for a bit, screams problems. I don't see where any solutions have been offered so the problems, whatever they are still exists.

Going back to a free floating currency was unexpected, quite frankly I don't know what it means but until someone figures this out, I for one would not be trading the Swiss Frank.

However, this diversion from the norm is troubling. It may signal a shift or change in the forex market. I need to be cautious here but I may want to consider shifting my focus back to real estate and stocks for a bit, it just depends on how this shakes out.

Bob

Bob, mate

Fortunatelly for me I wasnt trading chf since they first little trick.

News are that swiss could no longer sustain holding the floor.

I personally think, that they simply figured out that they no longer need to buy other currencies anymore if they pulled this little stunt.

CHF is no safe haven anymore for 99 percent of people.

Swiss are the best in massive speculations like that.

Other thing is that at forex you can never be certain of anything and you need to be ready for everything.

Its still chaotic market. Anything can happen globally anytime.

Also one thing that came to my mind regarding center point.

If you look at monthly timeframe, and you cosinder historical max min as boundaries of price - creating center point.

Based on fractal geometry it can be like looking at 5 min timeframe for last 8 hour and then think that price will never move oudside of this levels.

Truth is , you can never be sure what will happen in the future.

Still not sure if I understand your concept correctly, but Iam thinking about it.

Regards

Get investors and get paid 15 percent of theyr profits. More on my website.

Členem od Jun 28, 2011

444 příspěvků

Feb 10, 2015 at 17:50

Členem od Jun 28, 2011

444 příspěvků

Fractals are prevalent in nature but not in everything. I have a little truck that I am found of. There are other little tucks like it but there are none that is ten times bigger as would be expected if fractals were ubiquitous in all. I for one do not believe that fractals hold any sway in forex trading. However, the numbers associated with the wave form are just measurements from an arbitrary starting point. Where each wave or form in fractal geometry would actually begin from its own start point, say the bottom of the local form of the open but would not be required to all start and stop at the same price. In other words, the form would still be the same form if you moved it up or down by some amount.

Bob

Bob

where research touches lives.

Členem od Dec 12, 2014

109 příspěvků

Feb 10, 2015 at 17:53

Členem od Dec 12, 2014

109 příspěvků

ForexAssistant posted:

Fractals are prevalent in nature but not in everything. I have a little truck that I am found of. There are other little tucks like it but there are none that is ten times bigger as would be expected if fractals were ubiquitous in all. I for one do not believe that fractals hold any sway in forex trading. However, the numbers associated with the wave form are just measurements from an arbitrary starting point. Where each wave or form in fractal geometry would actually begin from its own start point, say the bottom of the local form of the open but would not be required to all start and stop at the same price. In other words, the form would still be the same form if you moved it up or down by some amount.

Bob

:)

Get investors and get paid 15 percent of theyr profits. More on my website.

Členem od Apr 05, 2014

33 příspěvků

Feb 10, 2015 at 22:04

Členem od Apr 05, 2014

33 příspěvků

ForexAssistant posted:

I am not disagreeing with you but we are talking about different things. Let's take 2 dice, as you are showing it, there are 23 possible outcomes. 2 through 24. However there is only one chance to get boxcars (24), two to get a 3 or 11, while there are 6 chances to get a seven. This means there are 36 possible outcomes but some are the same value as others. What a recover system does is to make up for the rare times when the outcome is snake eyes or boxcars. The rest of the time we make our money the normal way.

Bob

Nope, even if we add "more sides to the coin" the math will always show any increase of bet size after each loss always reduces the profit to RoR ratio. Here's an example with more sides to the coin and probability of each outcome is now included:

Win=66.666%

R:R=1:1

ruin=1.23%

RoR=1.23

Fibbanacci Recovery System (startlot 8, RoR 1.23%)

EV “L” “L” “L” “L” Chance 1 trade sum

-0.79 -8.00 -16.00 -16.00 -24.00 1.23% -64

“W” “L” “L” “L”

-0.79 8.00 -8.00 -16.00 -16.00 2.47% -32

“L” “W” “L” “L”

-0.40 -8.00 16.00 -8.00 -16.00 2.47% -16

“W” “W” “L” “L”

-0.40 8.00 8.00 -8.00 -16.00 4.94% -8

“L” “L” “W” “L”

-0.40 -8.00 -16.00 16.00 -8.00 2.47% -16

“W” “L” “W” “L”

0.40 8.00 -8.00 16.00 -8.00 4.94% 8

“L” “W” “W” “L”

0.40 -8.00 16.00 8.00 -8.00 4.94% 8

“W” “W” “W” “L”

1.58 8.00 8.00 8.00 -8.00 9.88% 16

sum “L” “L” “L” “W”

-0.40 -8.00 -16.00 -16.00 24.00 2.47% -16

“W” “L” “L” “W”

0.00 8.00 -8.00 -16.00 16.00 4.94% 0

“L” “W” “L” “W”

0.79 -8.00 16.00 -8.00 16.00 4.94% 16

“W” “W” “L” “W”

2.37 8.00 8.00 -8.00 16.00 9.88% 24

“L” “L” “W” “W”

0.00 -8.00 -16.00 16.00 8.00 4.94% 0

“W” “L” “W” “W”

2.37 8.00 -8.00 16.00 8.00 9.88% 24

“L” “W” “W” “W”

2.37 -8.00 16.00 8.00 8.00 9.88% 24

“W” “W” “W” “W”

6.32 8.00 8.00 8.00 8.00 19.75% 32

EV of 1 run 13.43

Flat Risk (Lot 8,RoR 1.23)

EV “L” “L” “L” “L” Chance 1 trade sum

-0.79 -16.00 -16.00 -16.00 -16.00 1.23% -64

“W” “L” “L” “L”

-0.79 16.00 -16.00 -16.00 -16.00 2.47% -32

“L” “W” “L” “L”

-0.79 -16.00 16.00 -16.00 -16.00 2.47% -32

“W” “W” “L” “L”

0.00 16.00 16.00 -16.00 -16.00 4.94% 0

“L” “L” “W” “L”

-0.79 -16.00 -16.00 16.00 -16.00 2.47% -32

“W” “L” “W” “L”

0.00 16.00 -16.00 16.00 -16.00 4.94% 0

“L” “W” “W” “L”

0.00 -16.00 16.00 16.00 -16.00 4.94% 0

“W” “W” “W” “L”

3.16 16.00 16.00 16.00 -16.00 9.88% 32

sum “L” “L” “L” “W”

-0.79 -16.00 -16.00 -16.00 16.00 2.47% -32

“W” “L” “L” “W”

0.00 16.00 -16.00 -16.00 16.00 4.94% 0

“L” “W” “L” “W”

0.00 -16.00 16.00 -16.00 16.00 4.94% 0

“W” “W” “L” “W”

3.16 16.00 16.00 -16.00 16.00 9.88% 32

“L” “L” “W” “W”

0.00 -16.00 -16.00 16.00 16.00 4.94% 0

“W” “L” “W” “W”

3.16 16.00 -16.00 16.00 16.00 9.88% 32

“L” “W” “W” “W”

3.16 -16.00 16.00 16.00 16.00 9.88% 32

“W” “W” “W” “W”

12.64 16.00 16.00 16.00 16.00 19.75% 64

21.33

Členem od Apr 05, 2014

33 příspěvků

Feb 10, 2015 at 22:08

Členem od Apr 05, 2014

33 příspěvků

Oops, that title of the last set should read *Flat Risk (Lot 16,RoR 1.23)

Členem od Apr 05, 2014

33 příspěvků

Feb 12, 2015 at 12:18

Členem od Apr 05, 2014

33 příspěvků

So, that's why the correct mathematical answer to OP's question is:

Set your Martingale Multiplier as close to 1 as possible (turning martingale off is best.) assuming you're going for maximum profitability for a given risk of ruin.

Set your Martingale Multiplier as close to 1 as possible (turning martingale off is best.) assuming you're going for maximum profitability for a given risk of ruin.

Členem od Apr 05, 2014

33 příspěvků

Feb 12, 2015 at 12:34

Členem od Apr 05, 2014

33 příspěvků

bendex77 posted:

Oops, that title of the last set should read *Flat Risk (Lot 16,RoR 1.23)

And ruin is -64 NOT 1.23.

(Risk of Ruin 1.23%)

Členem od Feb 22, 2011

4573 příspěvků

Feb 12, 2015 at 13:07

Členem od Feb 22, 2011

4573 příspěvků

I got it:)

The best way to use martingale as money management technique (it is not trading system)

is to set coeficient to less than 1. So decreasing equity your trade size decrease as well.

That's actually named anti-martingale

The best way to use martingale as money management technique (it is not trading system)

is to set coeficient to less than 1. So decreasing equity your trade size decrease as well.

That's actually named anti-martingale

Členem od Oct 11, 2013

769 příspěvků

Feb 16, 2015 at 16:33

Členem od Oct 11, 2013

769 příspěvků

The trick with martingale is knowing when to add or to average down your position. If you do it too soon, you may run out of capital, if you do it too late, you may miss the pullback.

Členem od Jun 28, 2011

444 příspěvků

Feb 16, 2015 at 23:31

Členem od Jun 28, 2011

444 příspěvků

Maverick, I am speechless. fractal trucks... and they all look like mine....

But that doesn't change the economics, currencies can't get too far out of line with all the other currencies or it would become useless and we would not be trading it. Currencies can collapse, of course but they generally don't do it in secrete, in fact, everyone knows about it weeks before it happens. There is risk but manageable.

Bob

But that doesn't change the economics, currencies can't get too far out of line with all the other currencies or it would become useless and we would not be trading it. Currencies can collapse, of course but they generally don't do it in secrete, in fact, everyone knows about it weeks before it happens. There is risk but manageable.

Bob

where research touches lives.

*Komerční použití a spam nebudou tolerovány a mohou vést ke zrušení účtu.

Tip: Zveřejněním adresy URL obrázku /služby YouTube se automaticky vloží do vašeho příspěvku!

Tip: Zadejte znak @, abyste automaticky vyplnili jméno uživatele, který se účastní této diskuse.