Alarming signal of credit activity in the eurozone

Alarming signal of credit activity in the eurozone

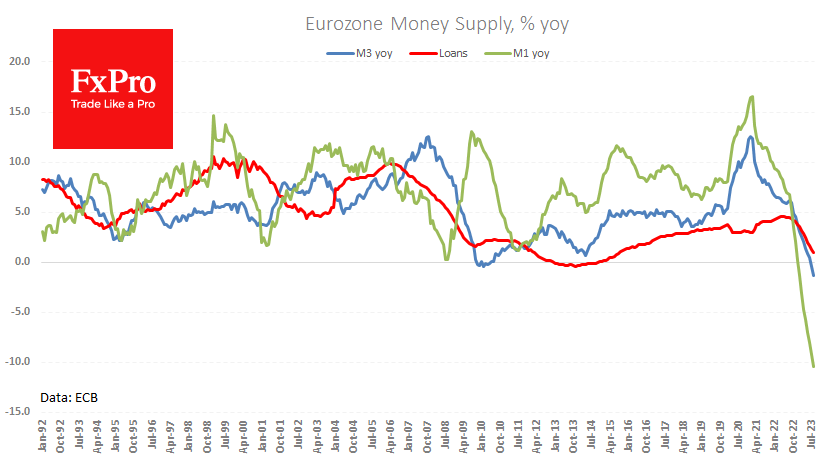

The ECB started raising interest rates in September last year, which was immediately reflected in the dynamics of money supply and lending. This process has continued to this day.

Credit growth in the eurozone has slowed to 1.0% y/y - the lowest in eight years. However, the monetary aggregates M1 and M3 lead one to expect a contraction in annual terms.

The M3 monetary aggregate showed a contraction of 1.3% y/y in August, renewing the historical lows of 2010 when the largest contraction was 0.4% y/y.

The narrower monetary aggregate M1 has been in uncharted territory since the beginning of the year, contracting already at a rate of 10.4%.

Such contraction in money supply and credit significantly dampens the region's economic outlook.

Unlike in the US, in Europe, most loans are made at floating rates, so an increase in the ECB's key rate simultaneously tightens the conditions for both new and existing loans. Thanks to this feature, the transmission mechanism of monetary policy works faster. As a result, fewer rate hikes are needed to cool the economy and, through it, inflation.

A continued decline in these indicators, also faster than forecast, could be a strong argument for ending the rate hike cycle and bringing the reversal to an easing. And that's bad news for the euro, which pulled back to an eight-month low at 1.0511 on Wednesday.

In addition, Europe seems to be reigniting the flames of debt problems as we saw 12 years ago - another consequence of high interest rates coupled with a weakening economy.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)