Altcoins upbeat, Bitcoin hesitant to breakout

Market picture

The crypto market added 0.5% in 24 hours to $2.46 trillion as a rebound in risk appetite in stocks helped altcoins attract buying interest. The Crypto Fear & Greed Index added 1 point to 72 (Greed).

Bitcoin is avoiding sharp swings and is trading at $66.75K on Wednesday morning, adding 0.3% in 24 hours but remaining inside the previous day's range. It looks like a very cautious testing of the 50-day moving average (now at $67.3K), but just shy of surpassing it for the third day in a row.

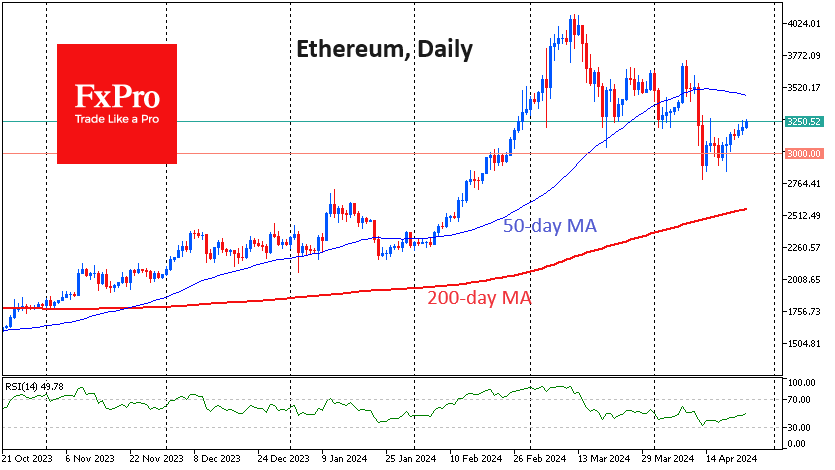

Ethereum appears more upbeat, adding 2.3% in 24 hours to $3250, once again near the highs since 13 April. However, Ethereum's decline has been deeper, pulling the price back below the support area of March and the first few days of April. Right now, the price is 6% below the 50-day MA that Bitcoin is nearing.

News background

Thanks to Bitcoin's halving, crypto assets are recovering from losses caused by geopolitical tensions, ETC Group noted. The positive effects of the halving are not expected to begin to manifest themselves until about 100 days after the event - in August.

The US SEC has extended the review period for Franklin Templeton's application to launch an Ethereum-based spot ETF. The next deadline is 11 June. After that date, the SEC will have to either give the green light or reject the application to launch the new product.

Bitcoin is entering a "DeFi summer" similar to Ethereum in 2020 thanks to record fees, Bernstein noted. Activity on the network is largely due to the launch of the Runes protocol.

According to The Block Data Dashboard, the combined market value of USD-linked stablecoins has risen to $165.2bn, the highest since June 2022, with 70% of this market share in USDT.

A class action lawsuit has been filed against Binance in Canada. A group of investors claim that the exchange violated local securities laws. Binance announced that it would cease operations in Canada back in May 2023.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)