Crypto dive

Market picture

Along with the rest of the cryptocurrency market, Bitcoin is pulling back further into the area of last month's lows. The sell-off intensified with the start of the new week, pushing total capitalisation back 3.6% in 24 hours to $2.26 trillion, which we last saw on May 13.

Particularly worrying is the rather organised nature of the retreat on all fronts, which reflects the global decline in traction in risk assets.

Bitcoin looks better than many major coins, losing 3.3% on the day to $62.2K. We still don't see technically important support levels up to the $60K area, but beyond that, it may not be so easy for the bears. In addition to the psychologically significant round level, the 61.8% Fibonacci retracement level is centred in this area. The next sensitive area is near $58K; the 200-day moving average is pulled up here, and there is the lower boundary of the downward range, which has been in force since March.

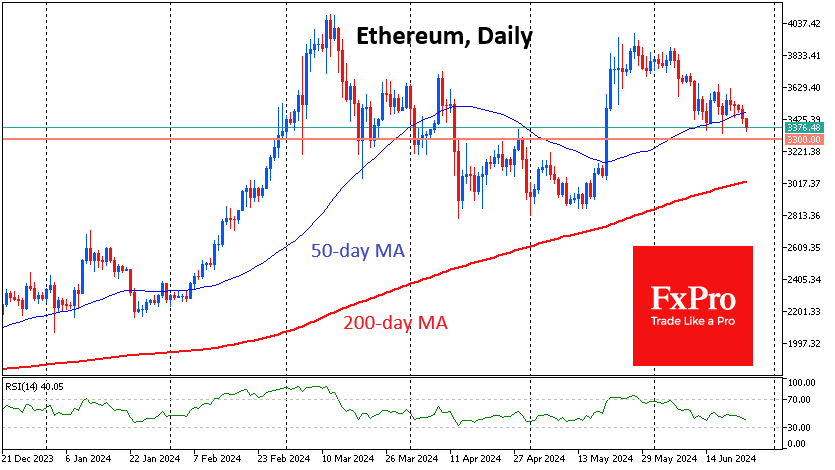

Ethereum is holding up better than many altcoins, and it is just starting to test the $3300 pivot area. That said, Solana and Litecoin have been at lows since late February, and Cardano has pulled back into the prolonged consolidation area of November. Surprisingly, the Cryptocurrency Fear and Greed Indexes rate the situation as "Neutral." This makes one think that the bottom is just yet to be reached.

News background

According to Google Trends, interest in bitcoin from retail investors has been steadily declining since March. Santiment records "extremely negative" investor sentiment towards BTC over the past four weeks, but this could signal a reversal for experienced traders who prefer to go against the tide.

BlackRock, VanEck, Franklin Templeton, Grayscale Investments, Invesco Galaxy, and 21Shares filed updated spot Ethereum-ETF filings with the SEC. The issuers also disclosed initial investments in the Ethereum-ETF.

Digital asset manager 3iQ has applied to register Canada's first Solana-ETF with a staking fee option (6-8 per cent p.a.). It is planned to be listed on the Toronto Stock Exchange (TSE).

US bitcoin miner Marathon Digital Holdings has launched a pilot project in Finland to use the heat generated by cryptocurrency mining for home heating.

The launch of the ZRO token of the LayerZero omnichain protocol triggered an increase in commissions in Arbitrum's L2 network, which led to a jump in the blockchain's daily revenue to a record $3.43 million (+16,680%).

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)