Crypto market looks to return to growth

Market Picture

According to the sentiment index, the cryptocurrency market remains in a state of fear at 28. Still, market capitalisation rose for the second day in a row as lower prices attracted buyers. Capitalisation rose 1.9% to $2.16 trillion, surpassing previous local highs, which is promising.

Bitcoin gained 3.2% in 24 hours as it attempted to consolidate above the $59.0K level and the 200-day moving average. These levels are above the local highs, and we have seen the sell-off intensify over the past four days. The next milestones on the way up are seen at $60,000 and then $63,000. However, even after rising to $65.5K this month, bitcoin will remain within the descending channel.

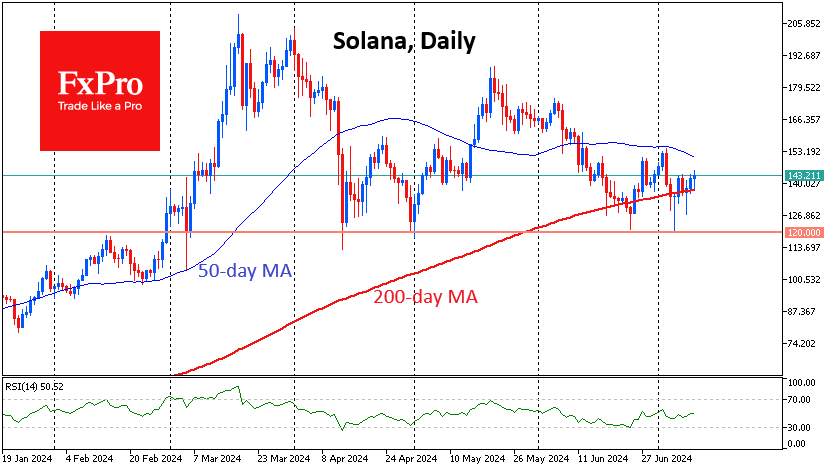

Solana received impressive buyer support at the beginning of the week when it touched the 200-day moving average. This was an important signal that the balance of power was still with the bulls. However, it is too early for them to celebrate, as the crossing of the important curve is still small, and the 50-day average is pointing down and above the price—a bearish signal.

News Background

Demand for crypto instruments was seen against the backdrop of the German government's maximum coin sales. On the 9th, the German government sent 6,306.9 BTC ($362.12 million) to trading platforms. Since mid-June, the country's authorities have transferred over 26,200 BTC (~$1.5 billion) to exchanges and market makers. According to Arkham Intelligence, 27,460 BTC (~$1.57 billion) remain in reserve.

Market participants also expect the remaining distribution of 94,771 BTC (~$5.4bn) to Mt Gox customers.

Meanwhile, social media trader sentiment is the most bearish it has been in a year, according to Santiment data. With such a FUD crowd, the chances of a bounce catching most by surprise are at an all-time high.

Nate Geraci, president of The ETF Store, suggested that the SEC will approve the listing of spot Ethereum ETFs on 15 July. BlackRock, Fidelity, Grayscale, 21Shares, Franklin Templeton, and VanEck submitted updated Forms S-1 to the SEC the day before. Bloomberg analyst Eric Balchunas expects the ETH ETF to launch on 18 July.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)