EBC Markets Briefing | UK stocks probe record peak

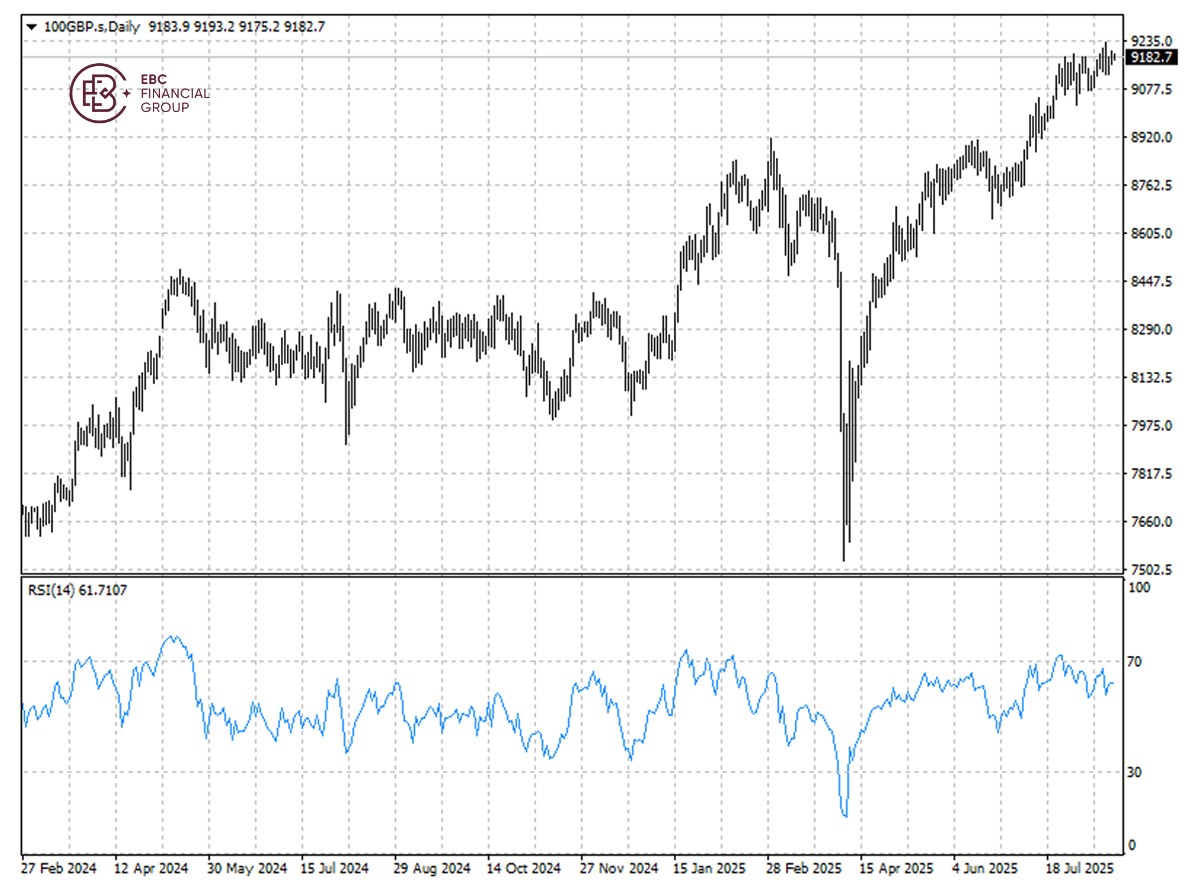

The FTSE 100 closed within a whisker of its record high on Tuesday, although both lagged European indexes. Financial stocks remained robust, benefiting from still-high interest rates.

Profit warnings from UK-listed companies rose 20% year-on-year in Q2, according to EY Parthenon. Unpredictable tariff policy, rising employment costs and shifting regulatory frameworks are reshaping corporate behaviour.

Market sentiment improved following Trump's meeting on Monday with Zelenskiy and European allies, where he pledged US state support for Ukraine's security in any war-ending agreement.

But European leaders doubt Moscow is sincere about a peace deal, so they will cooperate until Trump finally realizes he will need to impose tougher sanctions instead of fawning on his Russia counterpart.

Britain's post-pandemic recovery has lagged behind that of many other economies, something PM Starmer and finance minister Reeves have promised voters they will change following last year's national election.

At the end of June, the country's GDP was 4.5% higher than at the end of December 2019 compared with 6.0% growth in the euro zone and almost 13% in the US, according to data from the OECD.

Bearish MACD divergence portends a near-term retreat of the FTSE 100. A retest of the support around 9,140 is likely, which would pave the way for consolidation.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.