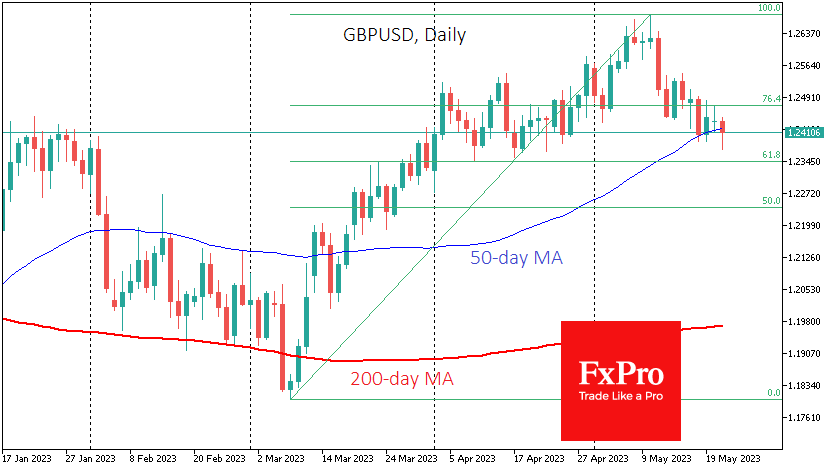

GBPUSD finds support on dips below 1.2400 despite weak data

Weaker-than-expected PMI reports were released today from the Eurozone and the UK, adding to the global Dollar pullback seen in recent weeks.

The manufacturing PMI fell to 46.9 in May from 47.8 in the previous month, in stark contrast to the expected rise to 47.9. The current level is the lowest since December last year and marks the tenth month of contraction.

The services sector also came in below expectations, with the corresponding index falling from 55.9 in April to 55.1 this month. On average, economists had expected a decline to 55.5. However, the index is still in solid growth territory by historical standards. A drop from last month's reading, or a comparison with the post-closure level, should not be misleading.

The GBPUSD intraday on Tuesday approached 1.2370, which has been an active support area since April. Below 1.2400, the pair is below its 50-day moving average. However, there are some attempts to buy the dips into this area, suggesting that the market wants to stay within the general uptrend in the pair, and this could be the first sign of the end of the Pound's corrective pullback that began on the 10th.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)