Navigating EUR/USD Stability, Speculation, and Technical Analysis

By RoboForex Analytical Department

EUR/USD remains steady near 1.0910 as it enters the new week of June, shrugging off some of the tension it previously faced.

In the recent past, the market was consumed with speculation and conjecture about the next moves of the US Federal Reserve System regarding interest rates. According to the CME FedWatch monitor, there is a high likelihood of a credit cost increase at the July meeting.

Monetary policymakers at the Fed have been hinting at similar possibilities. Fed Chair Jerome Powell, while addressing politicians last week, expressed that the idea of raising rates again seemed reasonable.

The primary objective for the Fed remains the same—to bring inflation back to 2%. Presently, inflation figures are considerably higher, necessitating an ongoing battle.

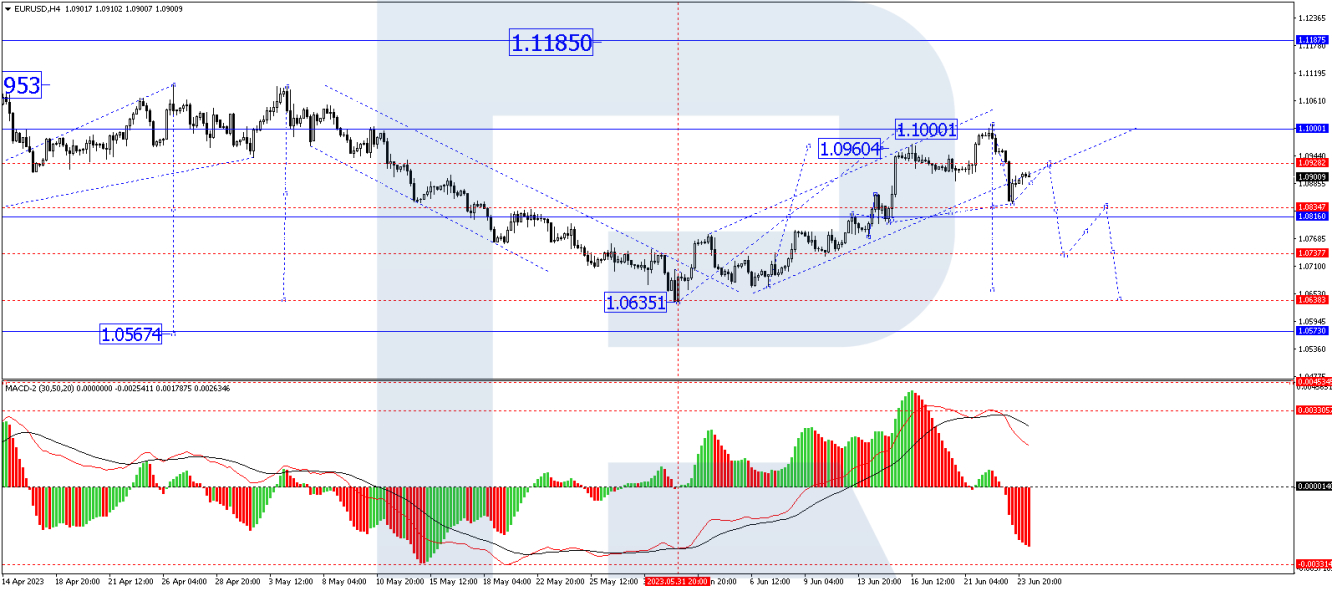

From a technical analysis perspective, EUR/USD has followed the projected upward wave to 1.1000 on the H4 timeframe. Subsequently, the market experienced a downward impulse, reaching 1.0844. A correction to 1.0930 could develop today, and after its completion, a new downward wave to 1.0740, possibly extending to 1.0660, may ensue. This scenario gains support from the MACD indicator, with its signal line currently at highs and descending sharply towards zero.

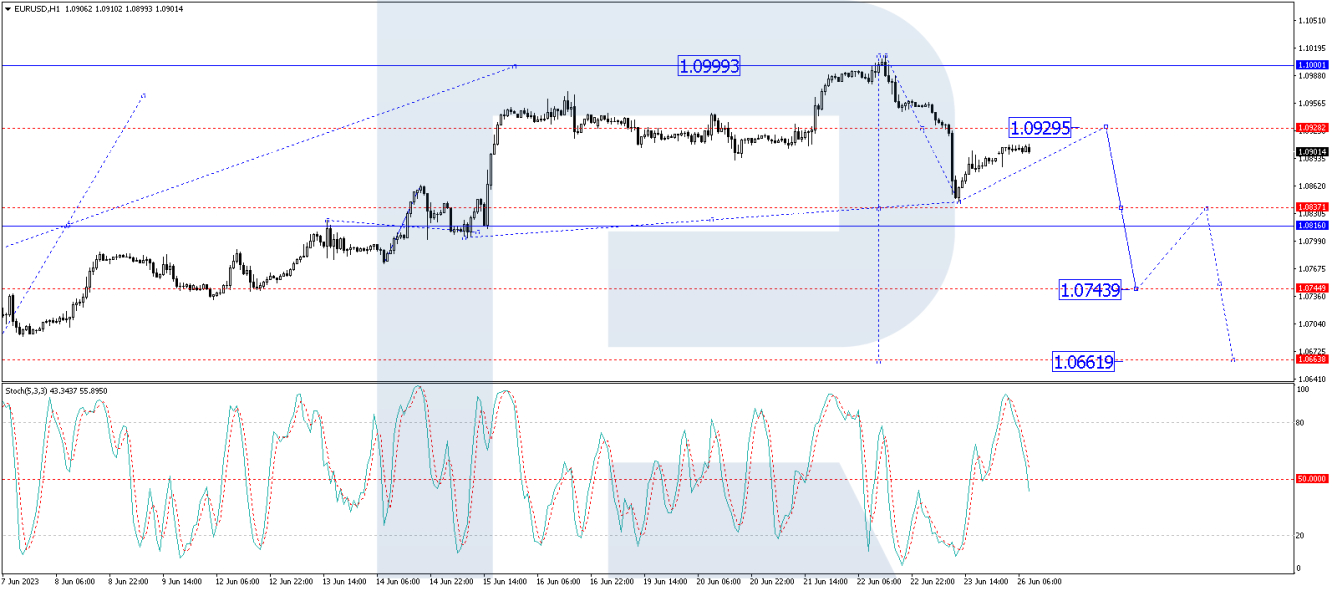

On the H1 timeframe, a consolidation range has formed around 1.0940. Upon breaking out upwards, the market exhibited an extended structure, reaching 1.1000. It then underwent a downward impulse to 1.0840. A correction to 1.0940 has already occurred today, testing from below. Following its completion, a fresh downward wave to 1.0840 could commence. This technical scenario finds confirmation from the Stochastic oscillator, as its signal line is above 50 and could potentially rise to 80 today.

Overall, EUR/USD has remained resilient near the 1.0910 level, exhibiting stability despite previous uncertainties. The upcoming actions of the US Federal Reserve System regarding interest rates continue to be a focal point for market participants, with analysts closely monitoring the potential impact on the currency pair. From a technical standpoint, various indicators and patterns suggest the possibility of both corrective rallies and downward movements, indicating the importance of monitoring key levels and trend developments.

Disclaimer Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.