Surprisingly soft US PPI has boosted optimism on interest rates

Surprisingly soft US PPI has boosted optimism on interest rates

The US producer price index has pleased bulls in equities, providing the Nasdaq100 with momentum to rise above 24,000 and update its historical highs.

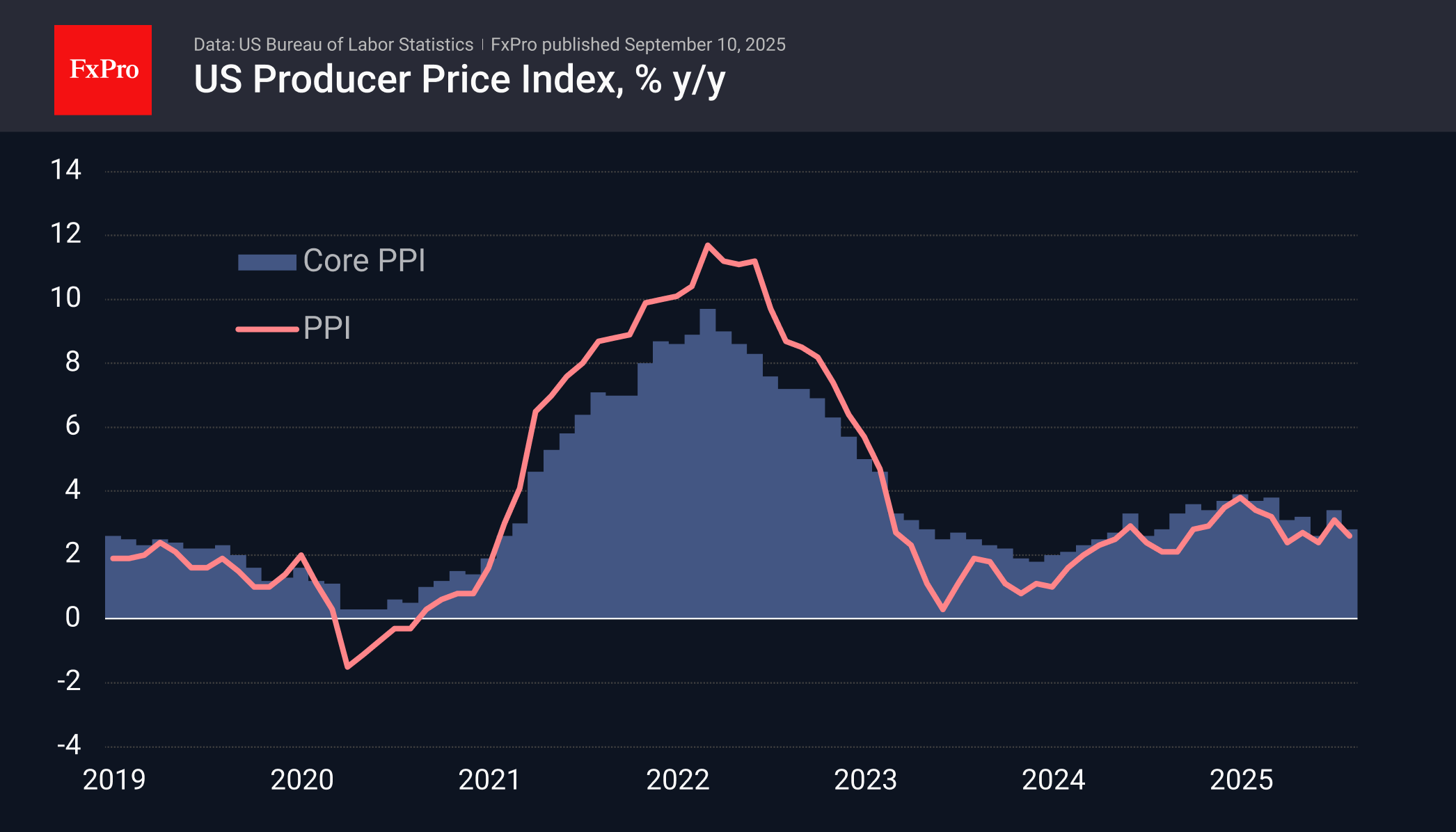

The producer price index fell 0.1% in August, slowing its annual growth rate to 2.6% from 3.1% previously (revised from 3.3%). This is a striking contrast to the average expectations of an acceleration to 3.3%.

Producer prices excluding food and energy also fell by 0.1% for the month, slowing to 2.8% year-on-year from 3.4% a month earlier.

This publication had an impact on the markets for two reasons. First, analysts tend to make the same mistake when forecasting PPI and CPI. Producer prices that are 0.4 percentage points below expectations set traders up for a similar mistake for consumer prices, which are released on Thursday.

Second, PPI is a leading indicator for headline inflation and triggers a reassessment of the inflation outlook for the coming months.

This data fits in with the narrative of recent days, pushing the Fed towards more aggressive interest rate cuts. These sentiments are lifting stock prices and putting pressure on the US dollar. The probability of three or more rate cuts before the end of the year is now estimated at 74%, up from 43% a week earlier.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)