EBC Markets Briefing | Wall St on a roll; IBM cheers quantum breakthrough

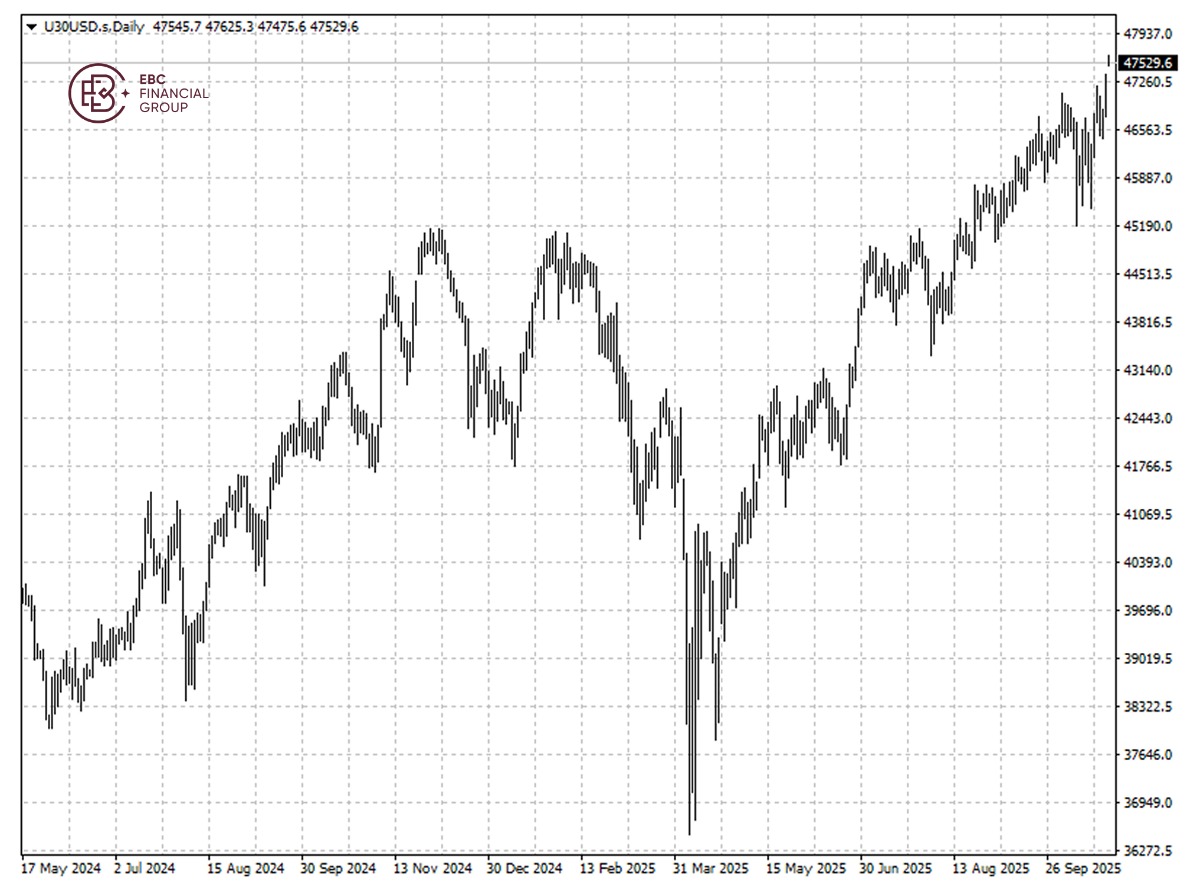

US stock index extended gains on Friday to keep its momentum heading into year-end, including a flood of corporate results headlined by megacap companies and a likely interest rate cut by the Fed.

Among companies that have reported, S&P 500 profits are estimated to have increased 10.4% from a year ago, according to LSEG IBES data. So far, 87% of companies have topped analysts' earnings estimates.

US consumer prices surged 3% year over year in September, just below the forecast. The report provides a glimpse into the state of the U.S. economy at a time when all other data releases have been suspended.

The concerns about AI exuberance lead to major investors shifting away from hyped-up stocks into potential next-in-line winners, a strategy from the dotcom era that prove to be effective against crash.

Nvidia's valuation has surged beyond $4 trillion despite US tariffs. Timing the phases of a bubble has historically been a way to play it without the risk of trying to call the peak too early.

Top Chinese and US economic officials hashed out on Sunday the framework of a trade deal for Trump and his Chinese counterpart Xi to decide on later this week in their eagerly anticipated meeting in South Korea.

The Dow has been trending higher unhampered, and the path of least resistance is to hit a fresh peak later this week. But 48,000 is seen as potential hurdle.

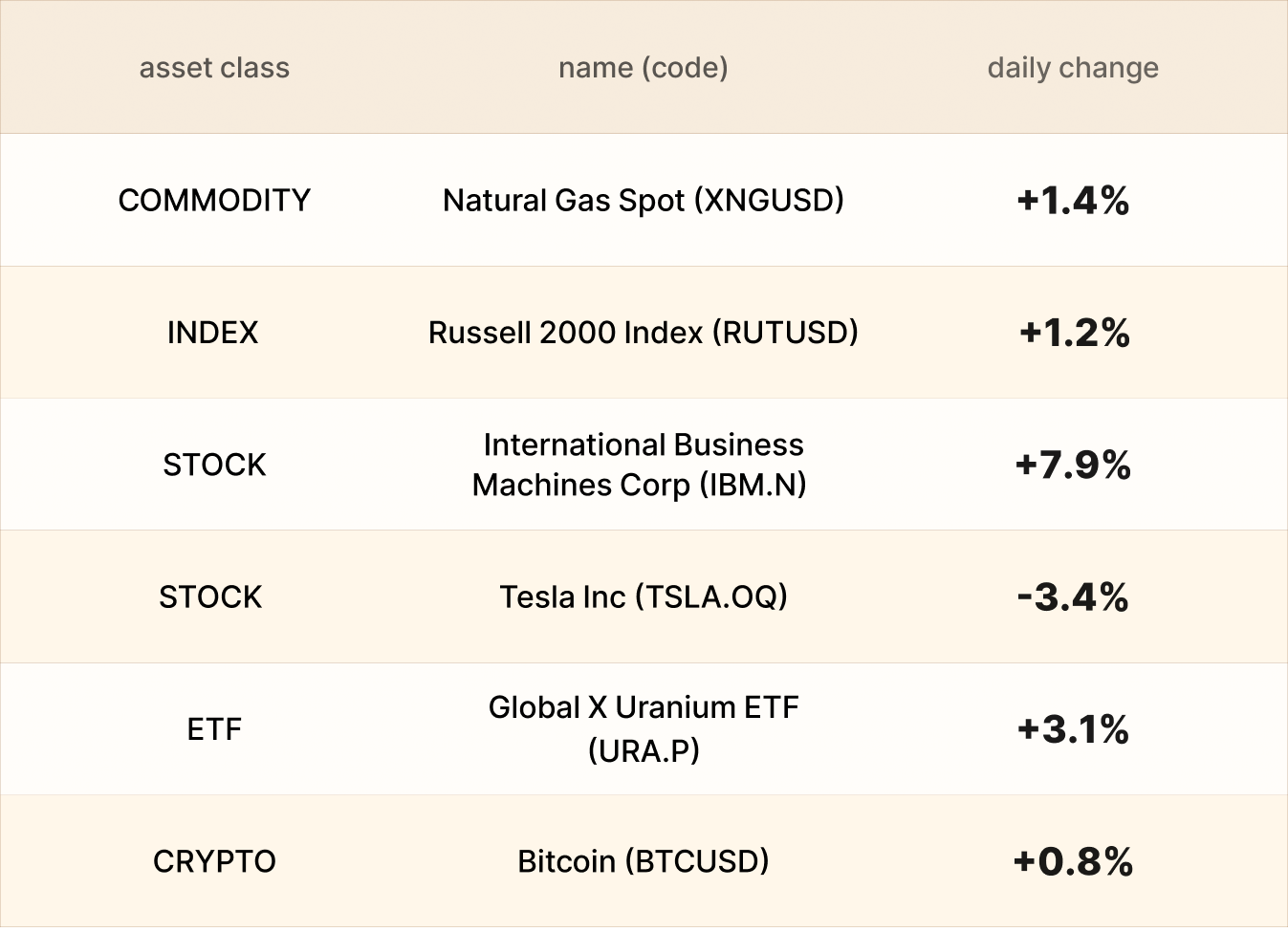

Asset recap

As of market close on 24 October, among EBC products, IBM shares led gains, while global X Uranium ETF also increased after Russia claimed test of nuclear-power missile.

The tech company said on Friday it can run a key cerror correction algorithm on commonly available chips from AMD, a step toward commercializing super-powerful computers.

Meanwhile, Tesla more than wiped out its gains of the previous session. Ex–Stellantis CEO says Tesla could exit the car industry and may not exist in 10 years.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.