Unimpressive crypto rebound

Unimpressive crypto rebound

Market Overview

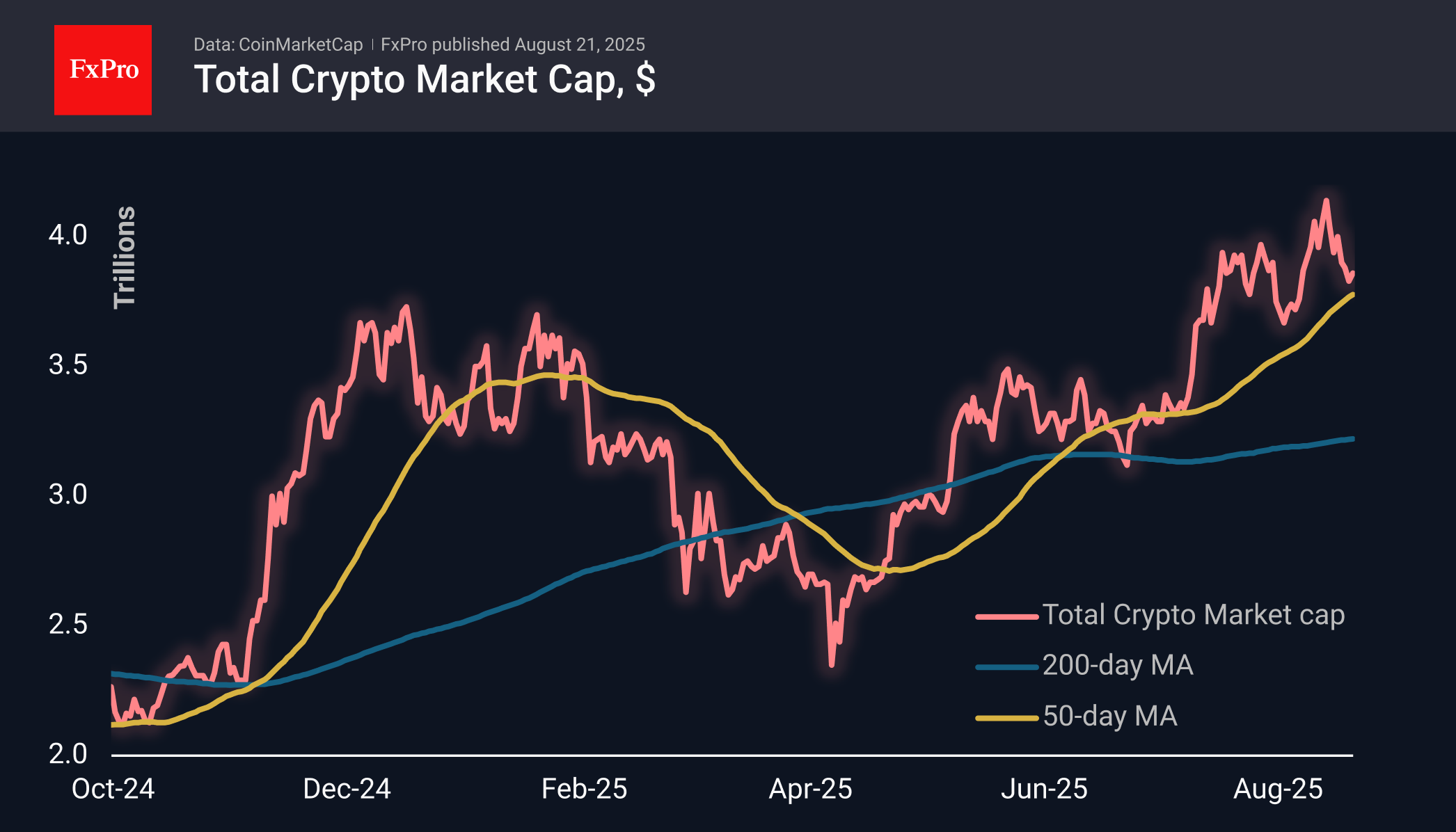

The crypto market capitalisation has added 1% over the past 24 hours, reaching $3.86 trillion, but this can hardly be called the beginning of a recovery. Yesterday looks more like a small bounce on the way down. The technology sector in traditional financial markets remains under pressure, dampening the mood of cryptocurrency buyers.

Bitcoin is trading at $113.7k, with an unsuccessful attempt to return above $115K only highlighting the market's weakness and reinforcing the role of the 50-day moving average as a key local resistance. Market participants remain hopeful that Powell will soften his tone on Friday but remain cautious beforehand.

News Background

According to SoSoValue, net outflows from BTC ETFs jumped to $523.3 million on August 19, while the net outflow from the ETH-ETF amounted to $429.7 million. The negative trend continues for the third trading session after a week of net inflows.

Kronos Research explains the decline in cryptocurrencies as being caused by profit-taking and the liquidation of leveraged positions after BTC's historic high in August.

News of a US SEC investigation into Alt5 Sigma intensified pressure on the crypto market. Alt5 Sigma entered a $1.5 billion deal with World Liberty Financial, which is linked to US President Donald Trump.

Ethereum's on-chain metrics are exacerbating the situation. The number of active addresses has fallen 28% from its peak on July 30.

Against this backdrop of uncertainty, market participants are more actively hedging their risks in the derivatives market. The delta skew of 30-day Bitcoin options reached 12%, a four-month high.

According to Bitwise, the inclusion of cryptocurrencies in US pension plans could push Bitcoin to $200,000 by the end of the year. This event could prove to be more significant than the approval of spot Bitcoin ETFs. The first inflows from pension funds could begin as early as this autumn.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)