US dollar fights to regain its safe-haven status

US dollar fights to regain its safe-haven status

The US dollar has managed to recover, backed by the Middle East conflict. Until now all the troubles for the global economy originated in America, from trade tariffs to the US fiscal problems that undermined confidence in the greenback and deprived its status as the main safe-haven currency.

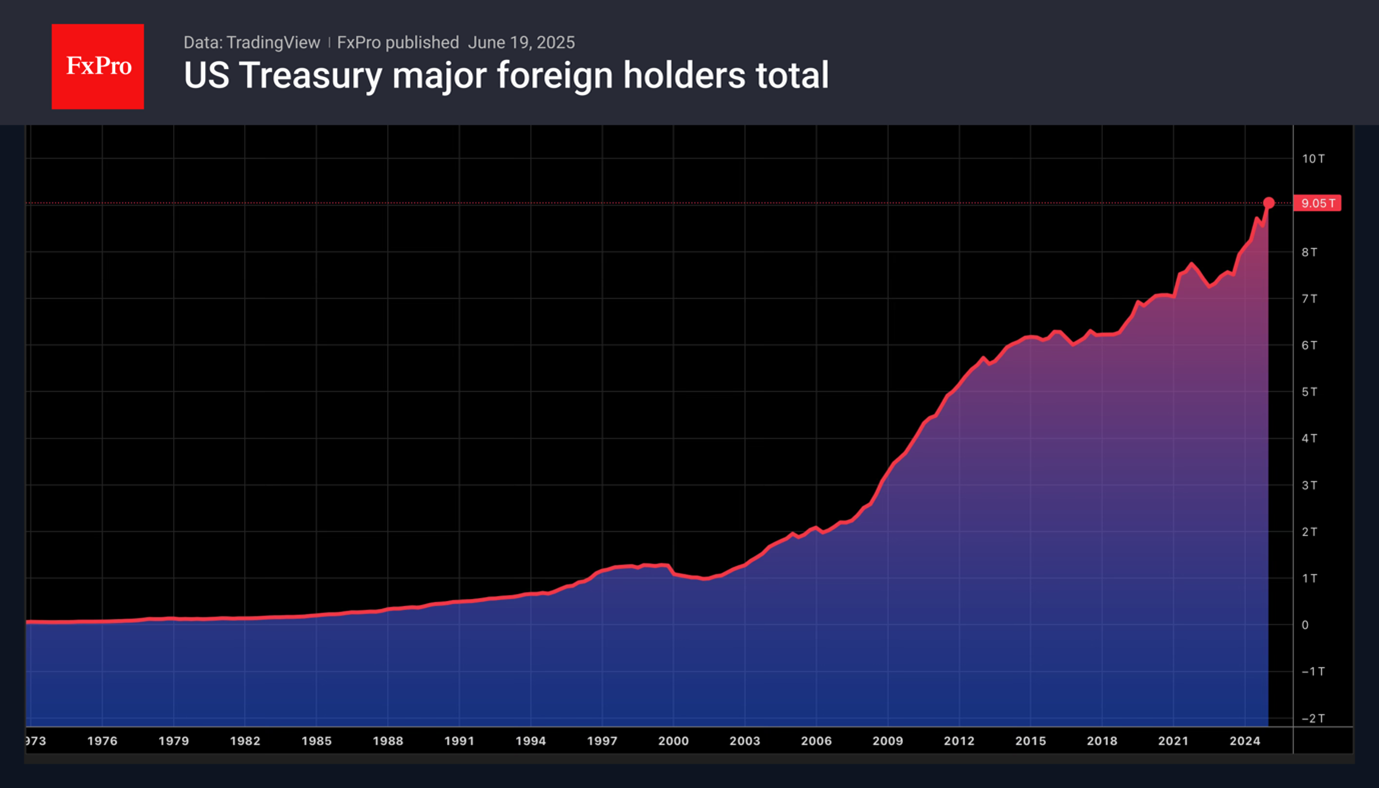

However, as soon as the epicentre of turmoil shifted, everything changed. The Middle East conflict is about to make the US dollar great again. The stability of foreign investors' holdings of Treasury bonds indicates continued interest in the American currency. While China was getting rid of Treasuries in April, Japan and Britain were buying them.

Rising oil prices are helping to shore up the USD index. As a result, the risks of inflation accelerating in the US and the chances of the Fed keeping interest rates high for a long time are increasing. Rumours are circulating on Forex that without de-escalation of the Israel-Iran conflict, the US dollar will not weaken significantly.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)