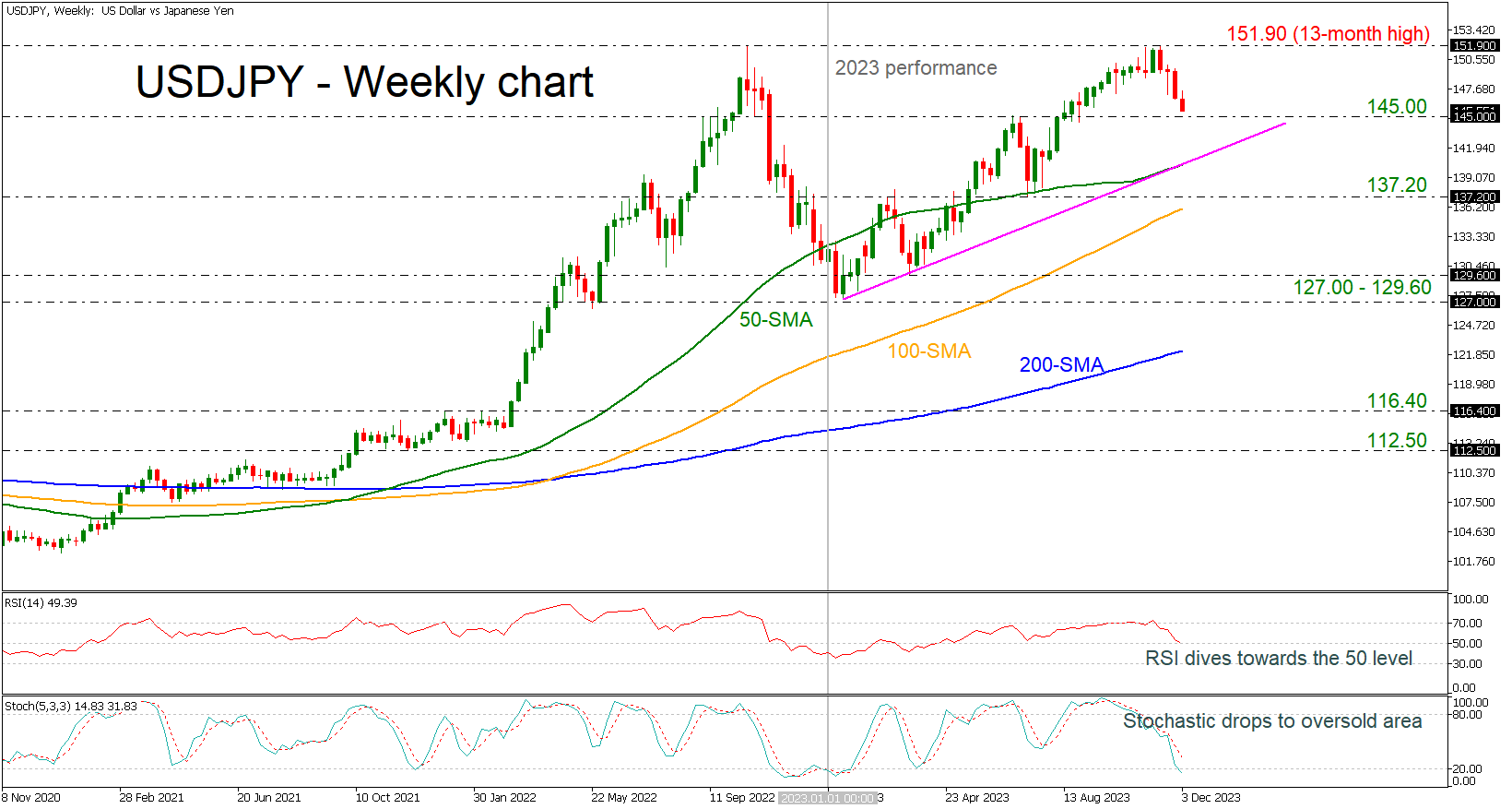

USDJPY’s 2023 performance is positive

· USDJPY remains above uptrend line

· Bearish correction may be on the cards

· RSI and stochastic indicate negative move

USDJPY has been in ascending movement since the beginning of 2023, but now is creating the fourth consecutive red week after the pullback off the 13-month high of 151.90.

Technically, the bulls might still be in the town as the market is developing above the long-term uptrend line. However, the technical indicators are suggesting a bearish correction, mirroring the latest downward move in price. The RSI is diving towards the neutral threshold of 50, while the stochastic is moving towards the oversold territory.

In the event the price stays resilient above the 145.00 handle, the bulls might push for a close above the 13-month peak of 151.90. Therefore, a successful move higher could immediately shift the attention to the April 1990 peak at 160.70, only if the market surpasses the next psychological levels such as 152.00 and 155.00.

On the other hand, if downside pressure continues, selling forces could intensify towards the 145.00 support. Then, additional losses from there could retest the uptrend line, which overlaps with the 50-day simple moving average (SMA) at 140.00. A move south below this hurdle could open the way for a negative structure until 137.20.

In a nutshell, USDJPY may remain supported in the coming sessions, though room for improvement could be limited before the next bearish round takes place above the uptrend line.

.jpg)