Edit Your Comment

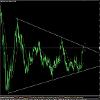

EUR/USD

Miembro desde Nov 11, 2012

posts 253

Miembro desde Oct 11, 2013

posts 769

May 08, 2020 at 05:30

Miembro desde Dec 18, 2019

posts 24

1% on first position locked + 1% on second position locked and just added 1% on 3 position http://prntscr.com/scz0mz

trade currently stands at 6.5r on all positions combined. thats +6.5% on a single trade as of now. looking for the reversal tocontiue and give me more than 20r total

trade currently stands at 6.5r on all positions combined. thats +6.5% on a single trade as of now. looking for the reversal tocontiue and give me more than 20r total

Miembro desde Jan 06, 2020

posts 69

May 09, 2020 at 12:19

(editado May 09, 2020 at 12:21)

Miembro desde Dec 18, 2019

posts 24

i am gonna dd a 4th 1% posiiton on monday open based on 15m chart. trade is already locked +6.5% in profit. so either make that profit % go throught the roof or down to +4%

this is how i make money at least. pick the 1st entry, lock it and build it up. i try to find 1 trade per week like this and i am good.

i try to do this on 3-4 trades every week, i only need one to work.

this week my pick was on eurusd

this is my view on it on the daily

http://prntscr.com/sdo650

and this on 15m

http://prntscr.com/sdo96a

realistic tp at 1.0975

this is how i make money at least. pick the 1st entry, lock it and build it up. i try to find 1 trade per week like this and i am good.

i try to do this on 3-4 trades every week, i only need one to work.

this week my pick was on eurusd

this is my view on it on the daily

http://prntscr.com/sdo650

and this on 15m

http://prntscr.com/sdo96a

realistic tp at 1.0975

Miembro desde Jan 06, 2020

posts 69

May 11, 2020 at 04:56

Miembro desde Apr 01, 2020

posts 5

Now the price is in the resistance area of 1.0850, I am waiting for a reaction and probably a sale for a 30 minute chart. If above 1.0850, then the trend will change to bullish and look for entry points for buying

https://www.myfxbook.com/forex-charts/EURUSD,H4/140817

https://www.myfxbook.com/forex-charts/EURUSD,H4/140817

Go hard ;)

Miembro desde Nov 11, 2012

posts 253

Miembro desde Nov 11, 2012

posts 253

May 19, 2020 at 18:27

(editado May 19, 2020 at 18:27)

Miembro desde Apr 01, 2020

posts 5

Go hard ;)

Miembro desde Jul 02, 2018

posts 5

May 29, 2020 at 10:54

Miembro desde May 21, 2020

posts 2

Hi, how are you? Im managing accounts with my OrbitEA. Have a look first: https://www.myfxbook.com/members/OrbitEA/orbitea/6002218

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.