Dollar Gain on Hawkish Fed Prospect

- U.S. PMI readings beating market expectations fuels dollar upward momentum.

- Dow Jones plunged by nearly 600 points yesterday on heightening Hawkish Fed prospects.

- Gold is trading with strong bearish momentum and has recorded a decline of 5% since Monday's Peak.

Market Summary

Yesterday's US data release surprised markets, with upbeat PMI readings exceeding expectations. The S&P Composite PMI reached a two-year high, while Initial Jobless Claims fell short of forecasts. This robust economic performance dampened hopes for a Fed rate cut this year, leading to a sharp selloff across both equities and fixed income markets.

The Dow Jones led the decline, plunging nearly 600 points. The prospect of a rate hike, hinted at during the latest FOMC meeting, strengthened the dollar. This put pressure on commodity prices, with gold and oil trading lower.

Despite a minor pullback against the dollar yesterday, the Sterling remains buoyed by recent positive economic data. Today's UK Retail Sales figure will be closely watched by traders as they gauge the strength of the Sterling.

Current rate hike bets on 12nd June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.8%) VS -25 bps (1.2%)

Market Movements

DOLLAR_INDX, H4

The US dollar strengthened this week after initially facing headwinds. The sentiment shift followed the release of hawkish Federal Open Market Committee (FOMC) meeting minutes on Wednesday, which bolstered the dollar after its recent decline. Yesterday's US economic data surprised markets on the upside, exceeding expectations. This data reinforced the view that a Fed rate cut this year may be less likely, further fueling the dollar's upward momentum. Notably, the S&P PMI reading reached 54.4, the highest level in two years. This robust figure suggests the US economy is expanding solidly despite a rising interest rate environment.

The Dollar Index has surpassed the 105 mark, suggesting a potential trend reversal for the dollar. The RSI is approaching the overbought zone, while the MACD has broken above the zero line, suggesting bullish momentum is forming.

Resistance level: 105.70, 106.40

Support level: 104.65, 103.90

XAU/USD, H4

Gold prices relinquished their earlier gains in recent sessions, pressured by diminishing expectations for a Federal Reserve rate cut this year. Upbeat economic data, coupled with hints of a potentially more hawkish stance from the Fed, has dampened the appeal of the yellow metal. The recent string of positive economic indicators has convinced market participants that the Fed may prioritise inflation control over stimulus measures. Furthermore, the May FOMC meeting minutes revealed discussions regarding further rate hikes, solidifying the perception of a hawkish Fed policy shift.

Gold prices continue to plunge, and from its bullish trajectory, the trend has reversed. The RSI has gotten into the oversold zone, while the MACD has broken below the zero line, suggesting that bearish momentum is gaining.

Resistance level: 2364.00, 2332.00

Support level: 2288.00, 2240.00

GBP/USD,H4

Pound Sterling came under pressure as political uncertainties in the UK weighed on demand. Prime Minister Rishi Sunak's call for a national election has heightened market anxiety, with his Conservative Party expected to lose to the Labour Party after 14 years in power. The potential policy shifts following the election further cloud the economic outlook, keeping the Pound subdued. Investors should monitor these political developments for further trading signals.

GBP/USD is trading lower while currently testing the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.2740, 1.2795

Support level: 1.2685, 1.2645

EUR/USD,H4

The EUR/USD pair experienced bearish momentum as the strengthening US Dollar continued to weigh on demand. Despite this, the economic outlook for the Eurozone remains optimistic. The latest composite Purchasing Managers’ Index (PMI) exceeded expectations and remained above the 50 level, indicating growth and a recovery in manufacturing. This positive economic data supports a resilient outlook for the Euro region.

EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the pair might extend its losses after it successfully breakout below the support level, since the RSI stays below the midline.

Resistance level: 1.0865, 1.0920

Support level: 1.0805, 1.0730

USD/JPY,H4

The Japanese Yen extended its losses following downbeat inflation data, signalling potential prolonged quantitative easing by the Bank of Japan (BoJ). Japan’s core consumer price index (CPI), excluding fresh food, rose 2.2% year-on-year in April, down from 2.6% in March. This slower-than-expected inflation prompted a drop in Japanese treasury yields, further widening interest rate differentials. The data suggests the BoJ may continue its accommodative policies, impacting the Yen's performance.

USD/JPY is trading higher following the prior break above resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the pair might enter overbought territory.

Resistance level: 157.90, 159.45

Support level: 156.55, 155.05

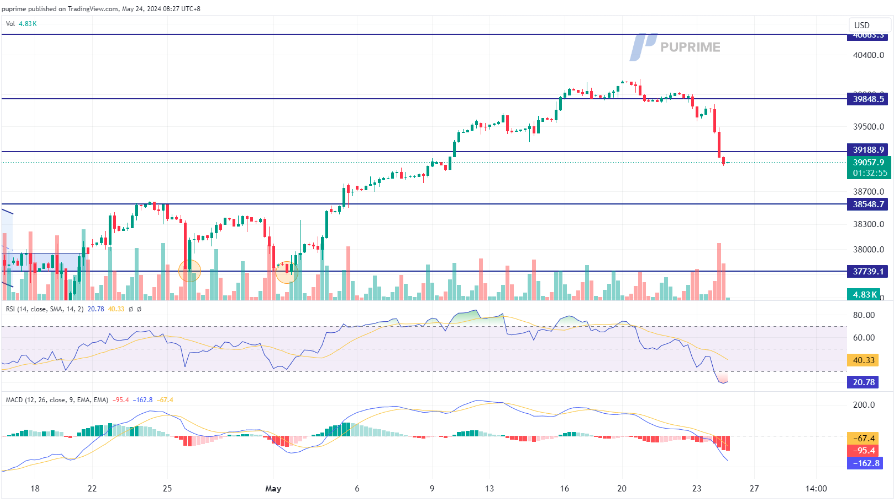

Dow Jones, H4

US equities experienced a sharp selloff this week, with the Dow Jones Industrial Average plummeting nearly 600 points, or 1.47%. The recent economic data releases surprised on the upside, indicating robust US economic growth. While positive overall, this data also fueled concerns about inflation and the possibility of a delayed Fed rate cut. Moreover, the release of the Federal Open Market Committee (FOMC) meeting minutes on Wednesday further dampened investor sentiment. The minutes hinted at the potential for additional rate hikes by the Fed, a prospect viewed as unfavourable for the stock market.

Dow Jones is currently trading with strong bearish momentum which hammered the Dow by more than 5% this week. The RSI has broken into the oversold zone while the MACD is diverging after breaking below the zero line, suggesting the bearish momentum is gaining.

Resistance level: 39190.00, 39850.00

Support level: 38550.00, 37740.00

NZD/USD, H4

The NZD/USD pair retreated slightly, influenced by the appreciating US Dollar. However, hawkish statements from the Reserve Bank of New Zealand (RBNZ) provided some support. Assistant Governor Karen Silk indicated the central bank's readiness to raise interest rates if necessary to control inflation. Although the RBNZ recently kept the Official Cash Rate at 5.50%, it surprised markets by considering a hike and maintaining a restrictive policy stance due to high domestic inflation. Investors should continue to monitor New Zealand's economic performance for further insights.

NZD/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 0.6145, 0.6210

Support level: 0.6080, 0.6015

CL OIL, H4

Crude oil prices remain under significant downward pressure, on track for their lowest levels since February. This decline is primarily driven by a shift in expectations regarding Federal Reserve monetary policy. The recent release of strong US economic data has convinced markets that a Fed rate cut this year is less likely, with the possibility of further rate hikes even being discussed. This has dampened demand for oil, a commodity often viewed as an inflation hedge that benefits from a dovish Fed stance. However, some hope remains for oil bulls. The upcoming OPEC+ meeting in June is closely watched, as production cuts or quotas agreed upon by the cartel could provide a much-needed boost to prices.

Oil prices continue to trade with strong bearish momentum. A break below its current support level suggests a solid bearish signal for oil. The RSI remains flowing near the oversold zone, while the MACD is diverging below the zero line, suggesting that the bearish momentum remains strong.

Resistance level: 77.90, 79.85

Support level: 76.00, 73.45