Dollar Rebound Despite Job Market Soften

U.S. equity markets managed to eke out modest gains during the last trading session, contrasting with a pullback observed in Asian stock markets. The recovery in the U.S. 10-year Treasury yield from its lowest point since late July contributed to a resurgence in the strength of the dollar. Despite the rebound, persistent speculation surrounding a potential dovish pivot by the Federal Reserve continues to exert downward pressure on the U.S. dollar. This sentiment gained traction following higher-than-expected Initial Jobless Claims, reinforcing the notion that a softening job market in the U.S. may offer relief in terms of inflationary pressures. In the commodities market, a substantial decrease in crude oil inventories failed to provide a lift for oil prices. The optimism was offset by a simultaneous increase in inventories at the key U.S. oil storage hub in Cushing, Oklahoma. Consequently, oil prices experienced a significant decline of over 2.5% in the latest trading session.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (83.5%) VS -25 bps (16.5%)

Market Movements

DOLLAR_INDX, H4

DOLLAR_INDX, H4

The US Dollar index demonstrated a marginal rebound yesterday, recovering from its lowest level in five months. Despite discouraging job data, this turnaround occurred, with Initial Jobless Claims surpassing market expectations. The abrupt resurgence of U.S. Treasury yields played a pivotal role in bolstering the dollar's recovery. However, prevailing market sentiment suggests a belief that the Federal Reserve may adopt a dovish tilt early next year. This anticipation has the potential to exert pressure on the strength of the dollar.

The dollar index had a slight technical rebound but remains trading at its long-term resistance level, suggesting the bearish momentum remains intact. The RSI has rebounded from the oversold zone, while the MACD flowing flat below the zero line suggests the bearish momentum is easing.

Resistance level: 101.30, 102.60

Support level: 100.80, 99.67

XAU/USD, H4

Gold prices experienced a technical retracement, declining by over 0.5% in the recent trading session. This retracement was primarily attributed to the late-session resurgence of the U.S. dollar as 2023 drew to a close. Notably, the dollar exhibited a technical rebound, even in the face of U.S. job data unveiled yesterday, which did not favour the dollar. The data further strengthened the market's belief in a Federal Reserve dovish tilt expected early in the upcoming year.

Gold prices are traded below their uptrend channel, implying a potential trend reversal for gold. The RSI has dropped out of the overbought zone while the MACD has crossed above the zero line, suggesting the bullish momentum has decreased drastically.

Resistance level: 2069.40, 2088.00

Support level: 2052.00, 2028.50

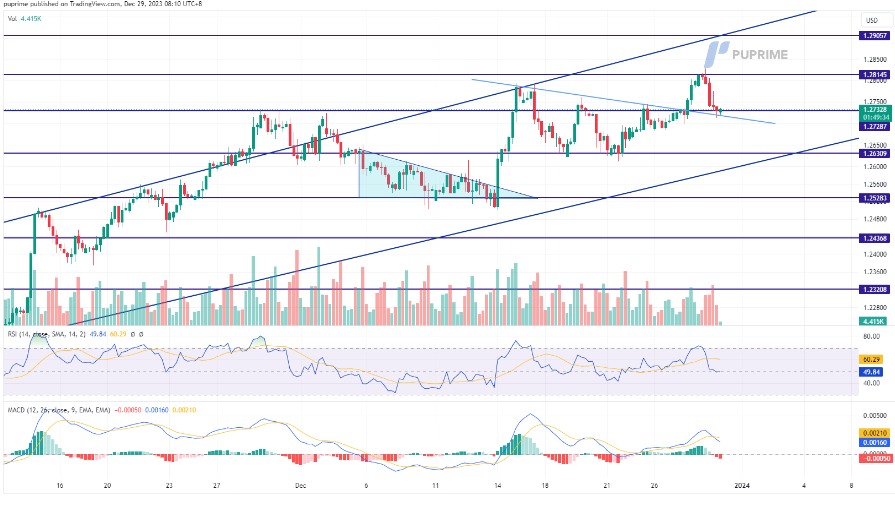

GBP/USD,H4

The GBP/USD pair is on track for its most impressive performance since 2015, notwithstanding a retracement observed in the latest session. The British Pound (Sterling) has demonstrated substantial strength, appreciating nearly 6% against the U.S. dollar throughout 2023. This notable performance can be attributed to a divergence in monetary policy dynamics, particularly towards the end of the year. The Bank of England (BoE) has focused on inflation control, while the Federal Reserve has hinted at the possibility of adopting a dovish tilt in the upcoming year.

The GBP/USD had a technical retracement from its recent high, but the bullish bias remains. The RSI failed to break into the overbought zone while the MACD crossed above the zero line, suggesting a drop in bullish momentum.

Resistance level: 1.2815, 1.2906

Support level: 1.2631, 1.2528

EUR/USD,H4

The EUR/USD pair experienced a retracement of approximately 0.4% in the previous session, driven by a resurgence in the strength of the U.S. dollar. Interestingly, this occurred despite less favourable U.S. job data. The pair struggled to maintain its psychological support level at 1.1100, influenced by the rebound in U.S. Treasury yields from recent lows, thereby stimulating a rebound in the U.S. dollar. Additionally, the Eurozone's Consumer Price Index (CPI) decreased, fueling market anticipation of a potential monetary policy shift from the European Central Bank (ECB). This expectation shift may exert pressure on the euro's strength against the U.S. dollar.

The EUR/USD remains trading in its bullish trajectory despite a technical retracement yesterday. The RSI has declined sharply from the overbought zone while the MACD has crossed and is moving down from above the zero line, suggesting the bullish momentum is easing.

Resistance level: 1.1140, 1.1225

Support level: 1.1041, 1.0954

USD/JPY,H4

The Japanese Yen staged a technical rebound as the U.S. dollar suddenly strengthened, propelled by the recovery of U.S. Treasury yields. Despite the release of higher-than-expected Initial Jobless Claims data yesterday, the dollar managed a comeback from its recent low, albeit with a subdued momentum. Investors are closely monitoring economic indicators, with the Chicago Purchasing Managers' Index (PMI) being released later today. This data may serve as a focal point for investors to reassess the overall strength of the U.S. dollar.

USD/JPY rebounded yesterday, but it still remains below its long-term downtrend resistance level, suggesting the bearish run persists. The RSI has rebounded from the oversold zone while the MACD continues to decline, suggesting the bearish momentum remains intact with the pair.

Resistance level: 141.65, 143.80

Support level: 138.88, 137.70

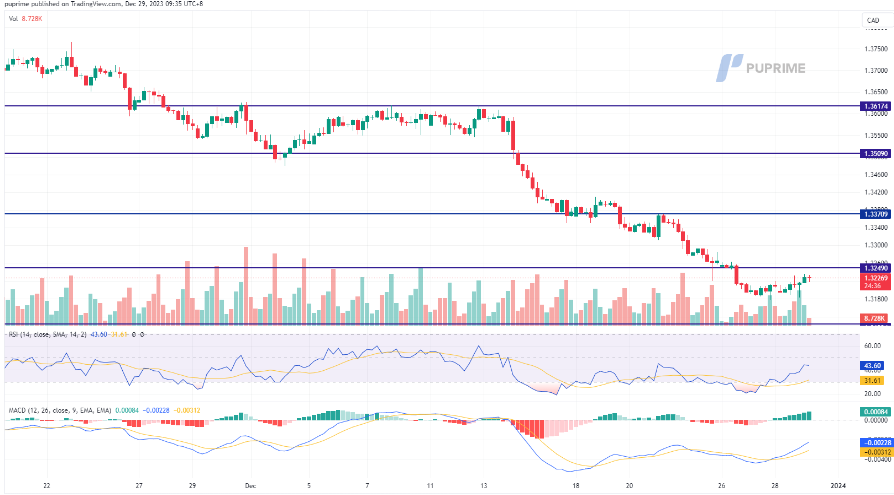

USD/CAD, H4

The Canadian Dollar has demonstrated robust performance against the U.S. dollar, maintaining strength despite a recent easing, with the USD/CAD pair trading sideways following a sharp downturn since mid-December. The U.S. dollar experienced a resurgence as U.S. Treasury yields recovered yesterday, contributing to the temporary stabilisation of the USD/CAD pair. However, the Canadian dollar faced headwinds due to the ongoing decline in oil prices, given its status as a commodity currency closely tied to the energy market.

The USD/CAD pair has eased from its bearish trend and has been traded sideways for the past 2 sessions, awaiting a catalyst to pick a direction. The RSI has rebounded strongly from the oversold zone while the MACD has crossed and is approaching the zero line from below, suggesting a potential trend reversal for the pair.

Resistance level: 1.3250, 1.3370

Support level: 1.3123, 1.2987

CL OIL, H4

Despite the Energy Information Administration (EIA) Crude stockpile data revealing the most substantial decline since August, oil prices persist in trading lower. The bullish aspect of the data is counteracted by the simultaneous increase in stockpiles at key U.S. storage hubs, notably in Cushing, Oklahoma, where inventories have reached their highest levels since August. These developments, coupled with lingering concerns about the outlook for oil demand, continue to exert downward pressure on oil prices.

Oil prices continued to drop and declined by nearly 2.5% yesterday, suggesting the bearish momentum is strong. The RSI is on the brink of breaking into the oversold zone, while the MACD has broken below the zero line, suggesting the bearish momentum is gaining.

Resistance level: 73.80, 77.23

Support level: 68.50, 64.75