EBC Markets Briefing | Antipodean currencies tumble after Fed rate cut

The US dollar rebounded from a 3-1/2-year low on Thursday after the Fed lowered interest rates by 25 bps as expected. Meanwhile, the Australian dollar fell following the latest data release.

Australian employment unexpectedly fell in August as full-time positions slipped after a sharp rise in the previous month, while the jobless rate held steady in a sign of cooling labour market.

The RBA would likely skip a move in interest rates this month, with a cut in November about 75% priced. Some of the Big Four down under are considering mass redundancy programmes.

The New Zealand dollar also tumbled after data showed the country's economy shrank far more than expected in Q2. Slowing export volumes largely offset middling growth in private spending.

Westpac changed its call for the RBNZ's meeting next month to a half-point cut from a quarter-point reduction. The central bank has largely kept the door open for more monetary loosening.

So far in 2025, precious and industrial metals have led the charge, while energy markets, though volatile, have avoided outright collapse. That helps push the relate currencies higher.

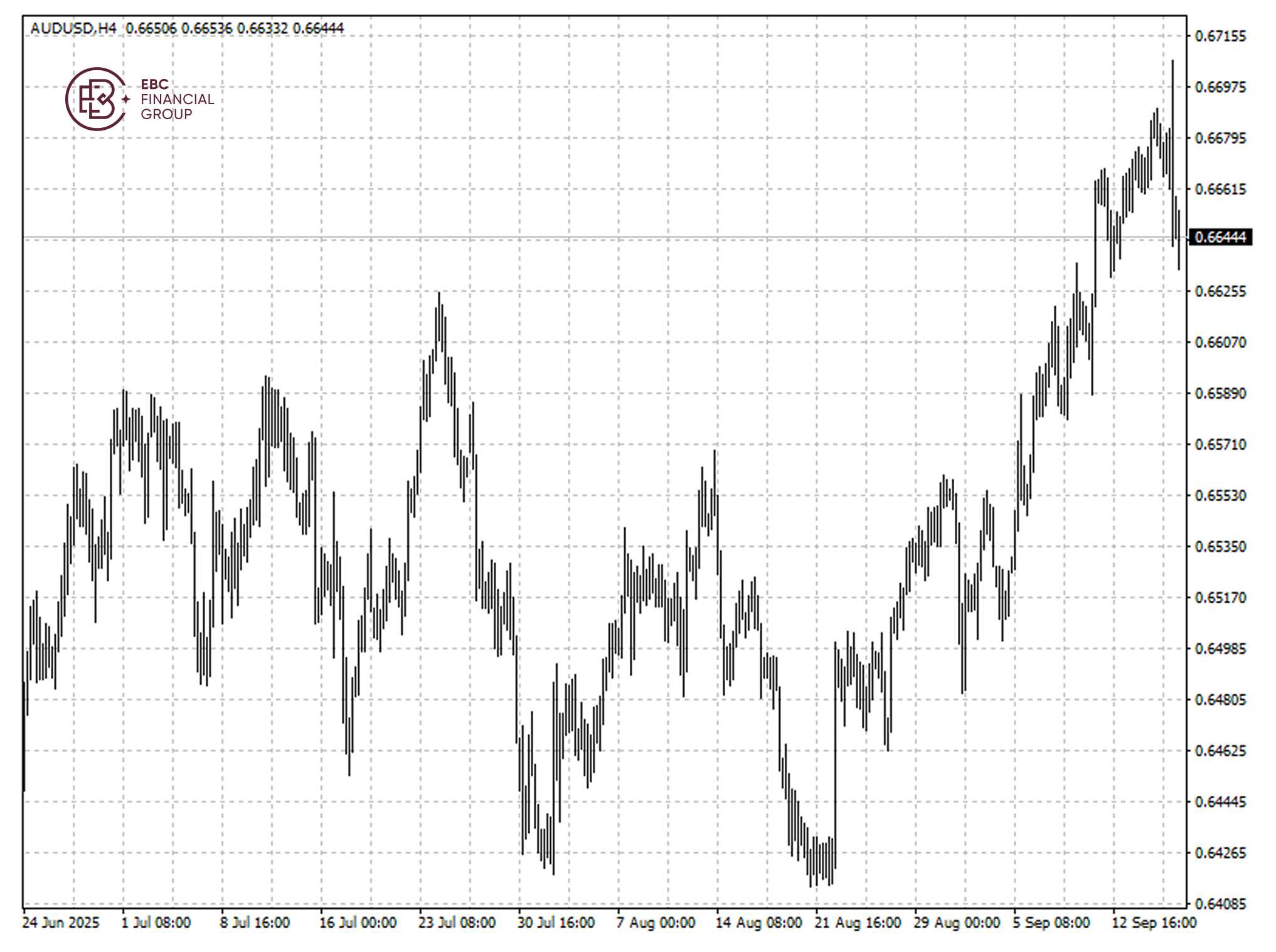

The Australian dollar slid towards the neckline of 0.6630 after a head and shoulders pattern was formed. The next support of 0.6620 will be exposed if the downside momentum stays.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.