EBC Markets Briefing | Cooling exports put tech-led A-shares rally to the test

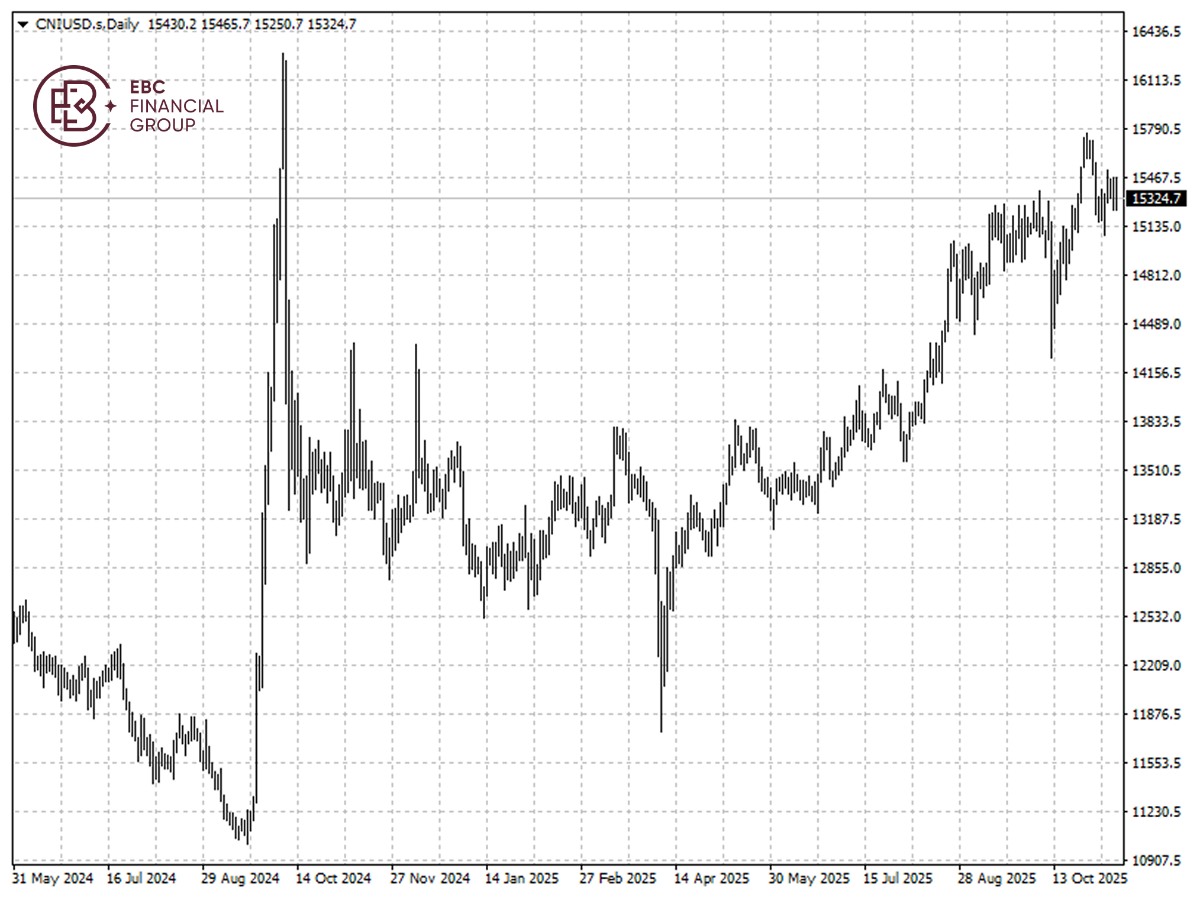

China's stock market ended the first three quarters of 2025 on an upward trajectory across major indices. Thaw in trade tensions and seemingly uninvestable real estate prompted retail investors to up the ante.

Asia-focused private equity managers are turning more bullish on the world's second-largest economy, betting on Beijing's drive for technological self-sufficiency and rapid adoption to deliver the next phase of growth.

Hillhouse Investment said "China will likely be the first to deliver much more on the AI application layers" due to rapid product iterations, lower costs, open-source models, and a massive consumer base.

Primavera Capital noted that China's electricity generation capacity is more than three times that of the US, in addition to the fresh capital flowing into power infrastructure, creating "tremendous promise in AI revolution."

Market breadth will likely remain weak. The fading effect of government consumption subsidies and the protracted housing downturn will continue to suppress growth for next year, Evercore ISI strategist said.

China's exports unexpectedly slumped in October as overseas orders tapered off following months of front-loading to beat US tariffs – a far cry from forecast for 3.0% growth in a Reuters poll.

Similarly, the latest PMI readings showed factory activity growth in October slowing due to a sharper drop in new export orders. Softening in the main driver of Q3 economic growth looks dispiriting.

"Unified Big Market"

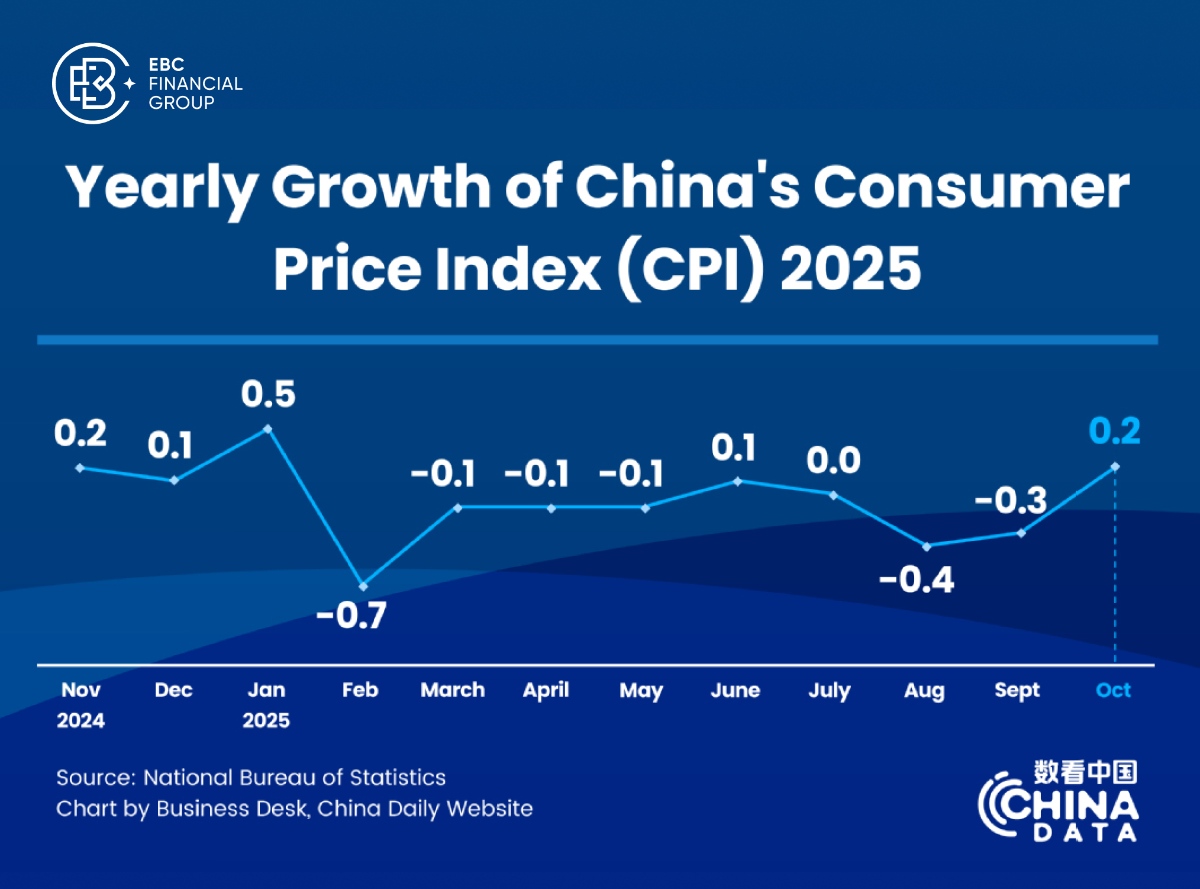

China's consumer prices unexpectedly increased in October, as holidays during the month boosted travel, food and transport demand — a pick-up many economists saw likely as fleeting.

Deflationary pressures mounted in recent months, recording declines in prices for August and September. That is reminiscent of Japan's "Lost Decades" that features shrinking population and low desire.

Government has signalled a shift towards supporting consumption over the next five years as limited investment room and slowing exports have exposed vulnerabilities, though measures may take time to kick in.

"The suggestion explicitly pledged to raise the consumption share in GDP. The philosophy of consumption policy also seems to have shifted from almost supply-centric to supply-and-demand balanced," Citi analysts said.

Currently, household consumption accounts for about 40% of the country's GDP, far below nearly 70% in the US. It appears reasonable to aim for a consumption rate of 50% within the next decade.

Sopping festival 618 ended with record sales, though daily spending dropped amid an extended sales period aimed at boosting sentiment. Double 11 underway will offer more clues on retail sales.

Factory-gate prices fell 2.1% on a yearly basis, completing three years in negative territory. The efforts to rein in price wars have showed signs of effects though, with industrial profit soaring in September.

Make Asia Great Again

Despite Wall Street's major averages rebounding to hit multiple record highs, one trend looks sure to follow investors into the new year: a widespread reluctance to go all-in on American assets.

A rebalancing of investment allocation is underway, as global investors are reassessing their portfolios, which represents an opportunity for more capital to flow back to Asia, said EQT.

US investors are increasingly buying Japanese stocks focused on tech and AI at the fastest pace since Abenomics, lured by the country's outsized returns compared with US stocks, according to Goldman Sachs.

Overseas investors have purchased more than 17.8 trillion won worth of Korean equities since July, Korea Economic Daily noted in a report. The country saw the fastest economic growth in a year-and-a-half for Q3.

Net purchases by southbound funds via China's Stock Connect programme reached more than HK$1.3 trillion so far this year, setting a new record since the mechanism's rollout.

The Hang Seng Index is weighted towards the tech sector and more correlated to foreign markets. Nvidia CEO Jensen Huang said China "will win AI race with US" last week - a remark welcomed by H shares.

China's internet platforms are quietly reviving consumer lending, taking Beijing's push to make household borrowing cheaper as a signal that regulators may be easing a years-long crackdown on the sector, industry sources said.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.