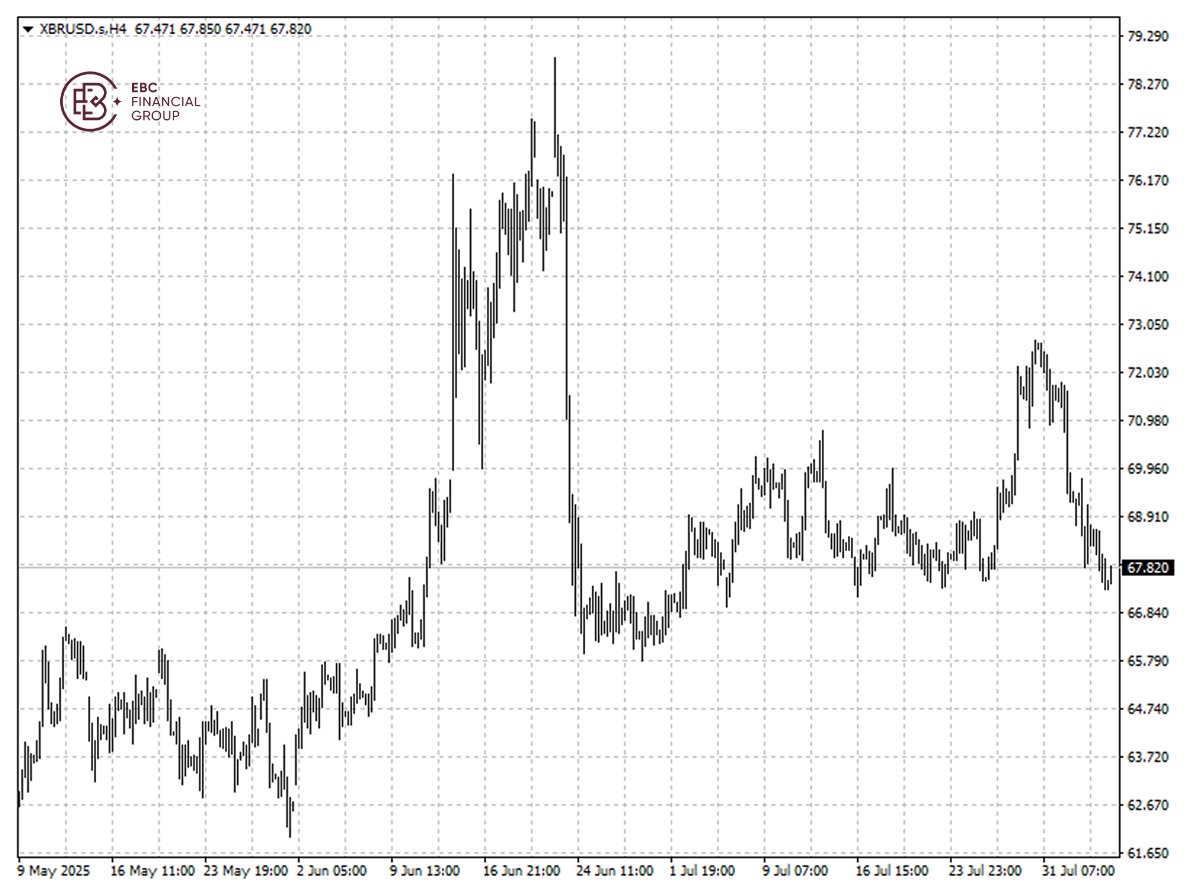

EBC Markets Briefing | Crude rebounds on Russia supply concerns

Oil prices climbed on Wednesday, rebounding from a five-week low in the previous day, on concerns of supply disruptions after Trump's threats of tariffs on India over its Russian crude purchases.

OPEC+ agreed on Sunday to raise oil production by 547,000 bpd for September, the latest in a series of accelerated output hikes to regain market share, easing concerns over potential supply disruptions linked to Russia.

The move marks a reversal of OPEC+'s largest tranche of output cuts plus a separate increase in output for the UAE amounting to about 2.5 million bpd, or about 2.4% of world demand.

Russia has ramped up drone and missile attacks towards Ukraine since despite calls for a ceasefire. Potential secondary tariffs on Russia could hit the global economy.

An analysis shows that the EU is also amongst the biggest buyers of Russian energy. The sanction could affect the new trade terms which will see a 15% tariff applied on most EU exports to the US.

China's crude oil imports dropped the lowest level since September 2022 in July, pointing to weak demand from the manufacturing powerhouse State-run refineries were likely the main contributor of the reduction.

Crude prices remain comfortably above strong support of $67.4, and the path of least resistance is to rally towards $68.3.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.