EBC Markets Briefing | Loonie languishes around 2-year low

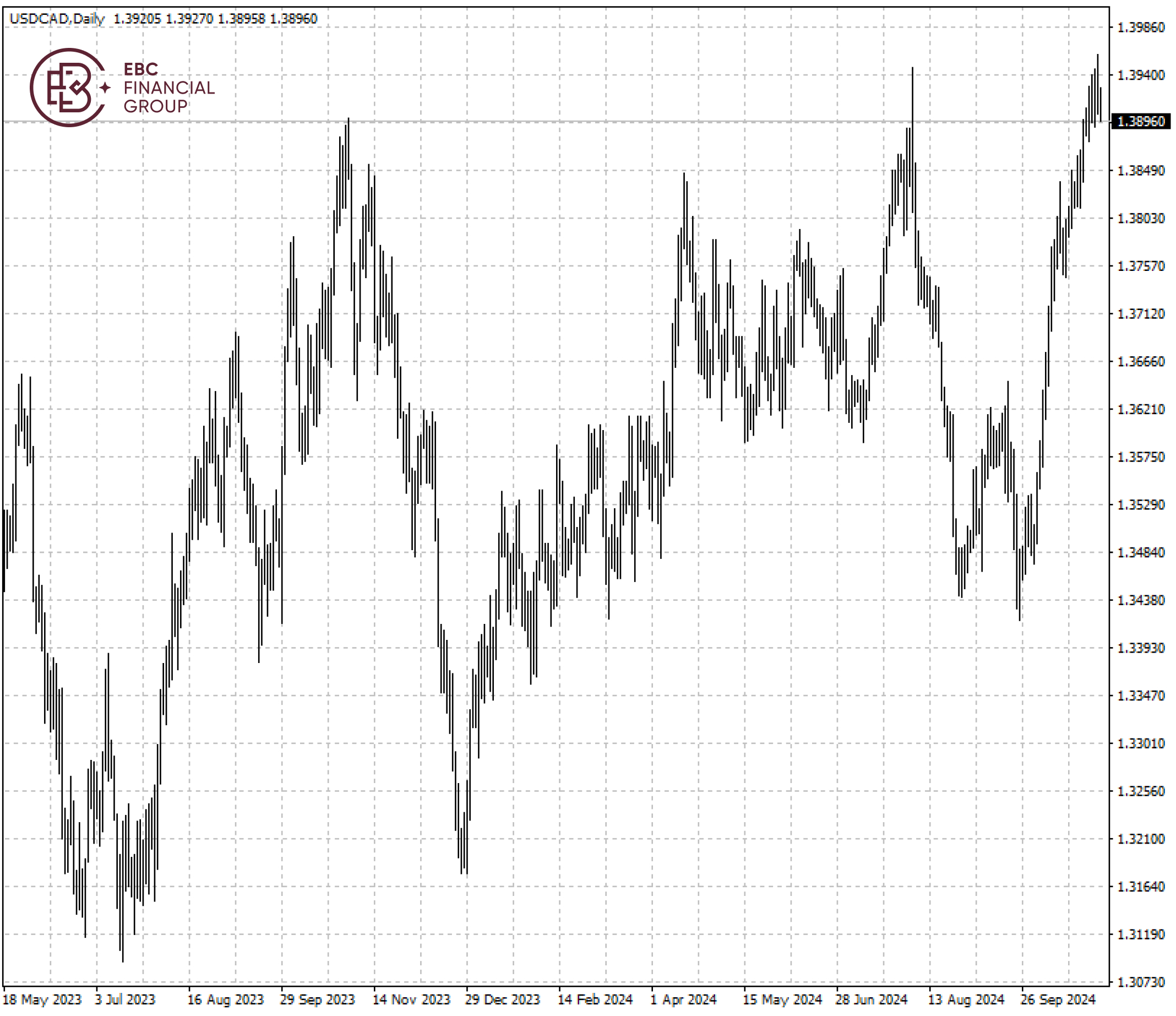

The Canadian dollar rallied from a two-year low on Monday ahead of the US presidential election. Domestic data on Friday showed factory activity growing at a faster pace.

The currency is expected to strengthen in the coming year as lower borrowing costs boost the domestic economy but the result of Tuesday's election could unsettle the outlook, a Reuters poll found.

Canada sends about 75% of its exports to its neighbour and hence vulnerability to Trump’s tariff plan. The former president targeted its steel and aluminium industry and initiated USMCA while in office.

The S&P Global Canada PMI rose to its highest level in 20 months at 51.1 in October as production and employment picked up in anticipation of rising orders. The positive sign suggest disinflation may ease.

Consumer price growth slowed more than expected to 1.6% in September, the lowest since February 2021. Last month the BOC cut its lending rate by 50 bps – the fourth reduction this year.

Economists said the central bank's annual economic growth forecast is overly optimistic, and another jumbo-sized rate cut in December will likely be required to revive recovery against the weak oil market.

The loonie steadied at the support around 1.3950 per dollar again with trader reluctant to make large bets on the direction. It could hardly cross 1.3840 per dollar until upcoming election ends.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.