EBC Markets Briefing | Oil muted as demand looks dim

Oil prices were little changed on Friday after settling lower in the previous session, the day after the Fed cut interest rates for the first time this year, due to worries about fuel demand in the US.

Joblessness claims data released this week indicated the US labour market has softened, with both demand for and supply of workers falling. But at 54.6 in August, composite PMI indicated solid growth.

US commercial crude oil inventories fell by 9.3 million barrels in the week ending 12 September, according to data from the EIA, defying market expectations of a 1.4 million-barrel increase.

Russia's Finance Ministry announced a new measure to shield the state budget from oil price fluctuations and Western sanctions, easing some supply concerns.

Surprisingly Japan pushed back against a US call to ramp up pressure on Putin to end the war in Ukraine by imposing higher tariffs on China and India for importing Russian oil.

China is set to continue its crude stockpiling throughout next year, but even the buying spree would not be sufficient to support oil prices into the $60s per barrel as a major glut looms over the market in the coming months.

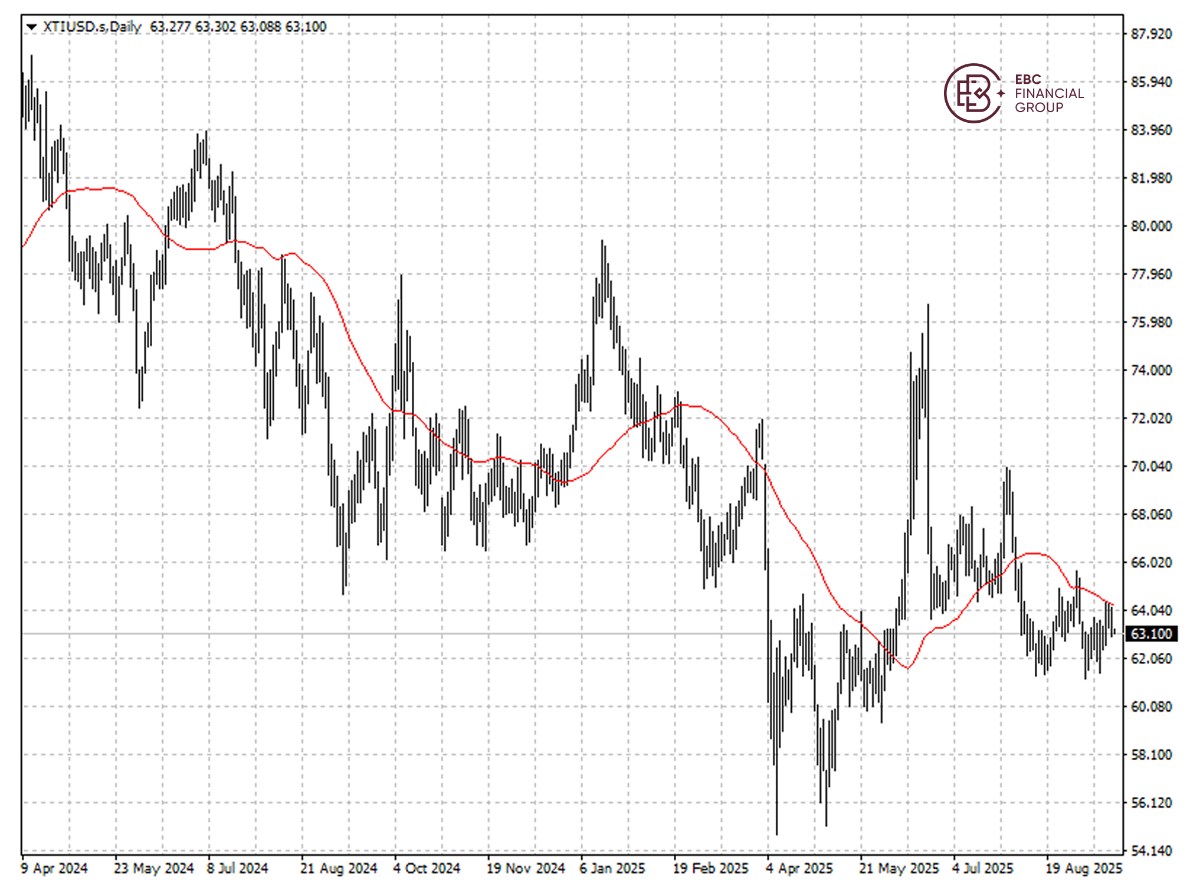

WTI crude shows bearish flag, which means a push blow $63 is around the corner. It may need to breach the resistance at 50 SMA to negate the bearish bias.

The Australian dollar slid towards the neckline of 0.6630 after a head and shoulders pattern was formed. The next support of 0.6620 will be exposed if the downside momentum stays.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.