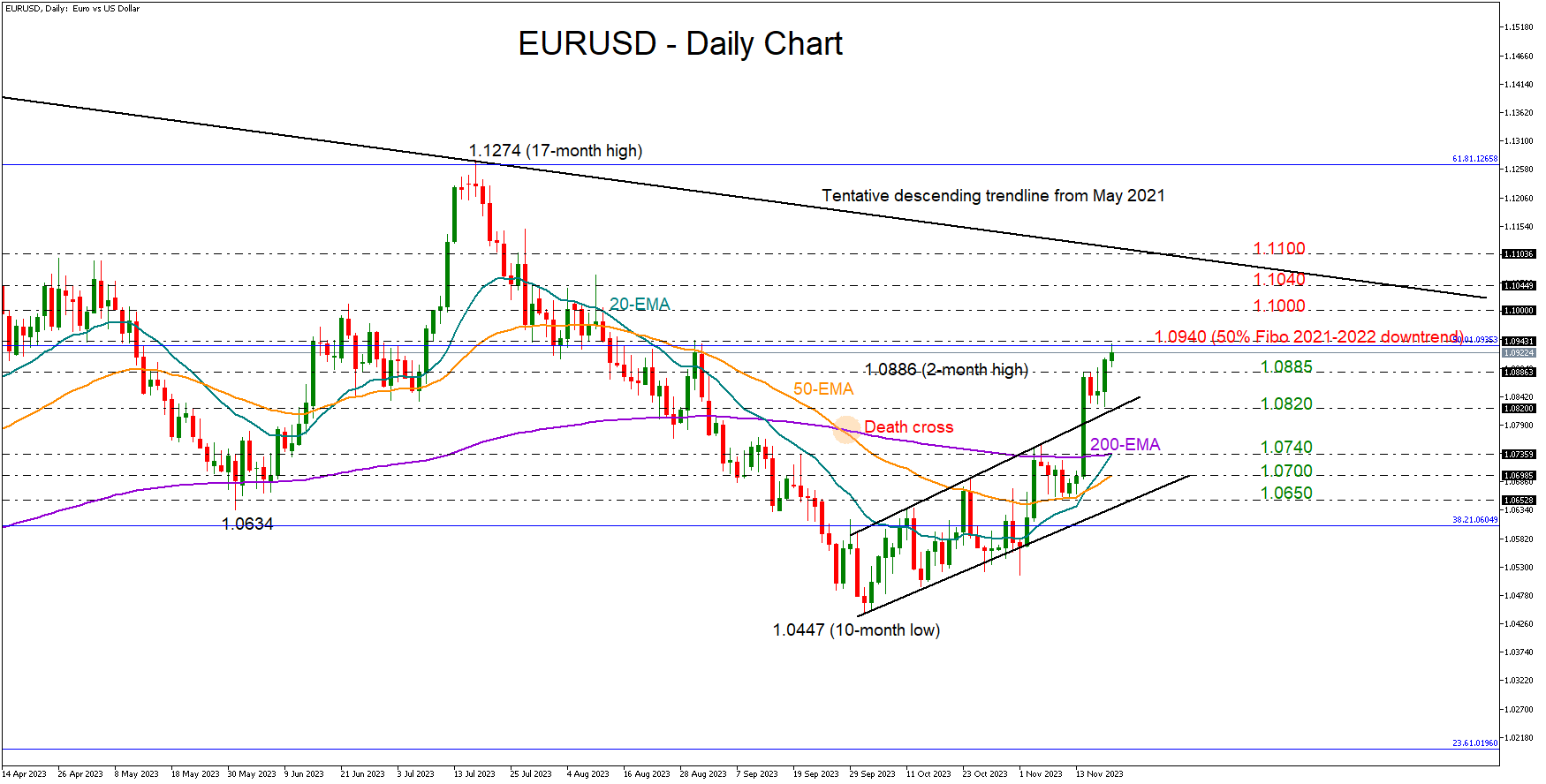

EURUSD is halfway to July’s top; tests 1.0940 level

EURUSD stepped into the 1.0900 zone after an exponential rally last week, marking a new 2½-month high of 1.0934 during Monday’s early European trading hours.

The pair has passed the halfway mark to July's peak from the October low and some profit-taking would not be a big surprise as the RSI and the stochastic oscillator are hinting at overbought conditions while the price is testing its August’s resistance levels.

Encouragingly though, the 20-day exponential moving average (EMA) has crossed above the 50-day EMA and is preparing for another intersection with the 200-day EMA, indicating the possibility of the positive trend continuing. Meanwhile, it would be also interesting to see if the 50- and 200-day EMAs will manage to reverse the death cross registered at the end of September.

The 1.0940 caution area, which overlaps with the 50% Fibonacci retracement of the 2021-2022 downtrend, is under examination. Breaking the wall could propel the bulls into an uptrend towards the 1.1000 psychological level. The former resistance at 1.1040 and the 1.1100 number could attract attention, especially the latter, as the tentative descending trendline from May 2021 happens to be there too.

Alternatively, a backward flip beneath 1.0885 might seek support around the upper band of the broken bullish channel at 1.0820. Should sellers dominate there, the decline could worsen towards the 20- and 200-day EMAs at 1.0740. The 50-day EMA might also be on guard near 1.0700. If the latter proves fragile, the next stop could be at the channel’s lower band seen at 1.0650.

All in all, EURUSD retains a positive monthly picture, with the bulls looking for a close above 1.0940 to run higher ahead of Eurozone’s flash business PMI figures due on Thursday. Given the overbought signals though, additional gains could come with some delay.