Low inflation in China supports the yuan

Low inflation in China supports the yuan

Deflation persists, creating opportunities to stimulate the economy. Without these measures, conditions are created for the yuan to strengthen.

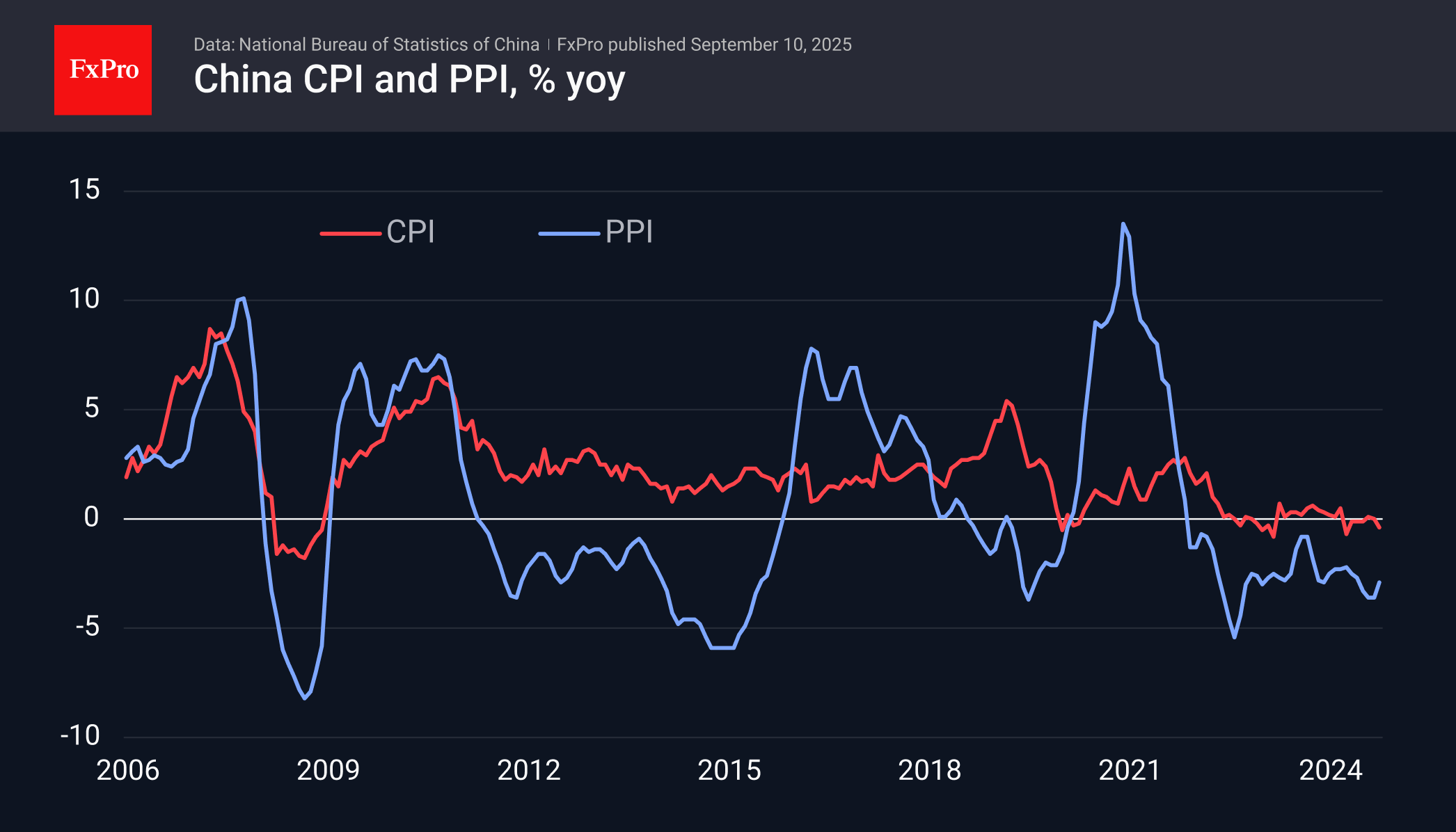

In August, the consumer price index returned to negative territory, dropping 0.4% year over year. Over the past two years, the average inflation rate has been zero, making it appropriate to discuss deflation in China.

The producer price index was 2.9% lower than a year earlier. While this represents a slowdown in the rate of decline, it is still a negative trend that has been evident in this indicator for the last 35 months, or nearly three years. Producer prices are an important factor that puts pressure on final selling prices, allowing China to retain its title as an exporter of deflation.

Developed countries would consider such inflation rates a reason to ease monetary policy, lower rates, or stimulate final demand in some other way. However, the People's Bank of China is pursuing a different strategy. It has kept rates unchanged since May to avoid creating bubbles in the housing sector.

The government and central bank do not seem to consider low inflation a problem that supports the national currency. Since the beginning of August, the USDCNH exchange rate has been drifting downward, losing 1.3%. Although growth rates are not high, they have brought the exchange rate back to its lows since Trump's presidential election victory. The USDCNH exchange rate has been supported near the current levels of 7.11 over the past two years, although it slipped down in September and October of last year.

Technically, current levels may attract buyers, but traders should monitor the situation closely to determine whether a real reversal of the dollar's long-term trend is occurring.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)