US inflation: a step back before the run-up?

US inflation: a step back before the run-up?

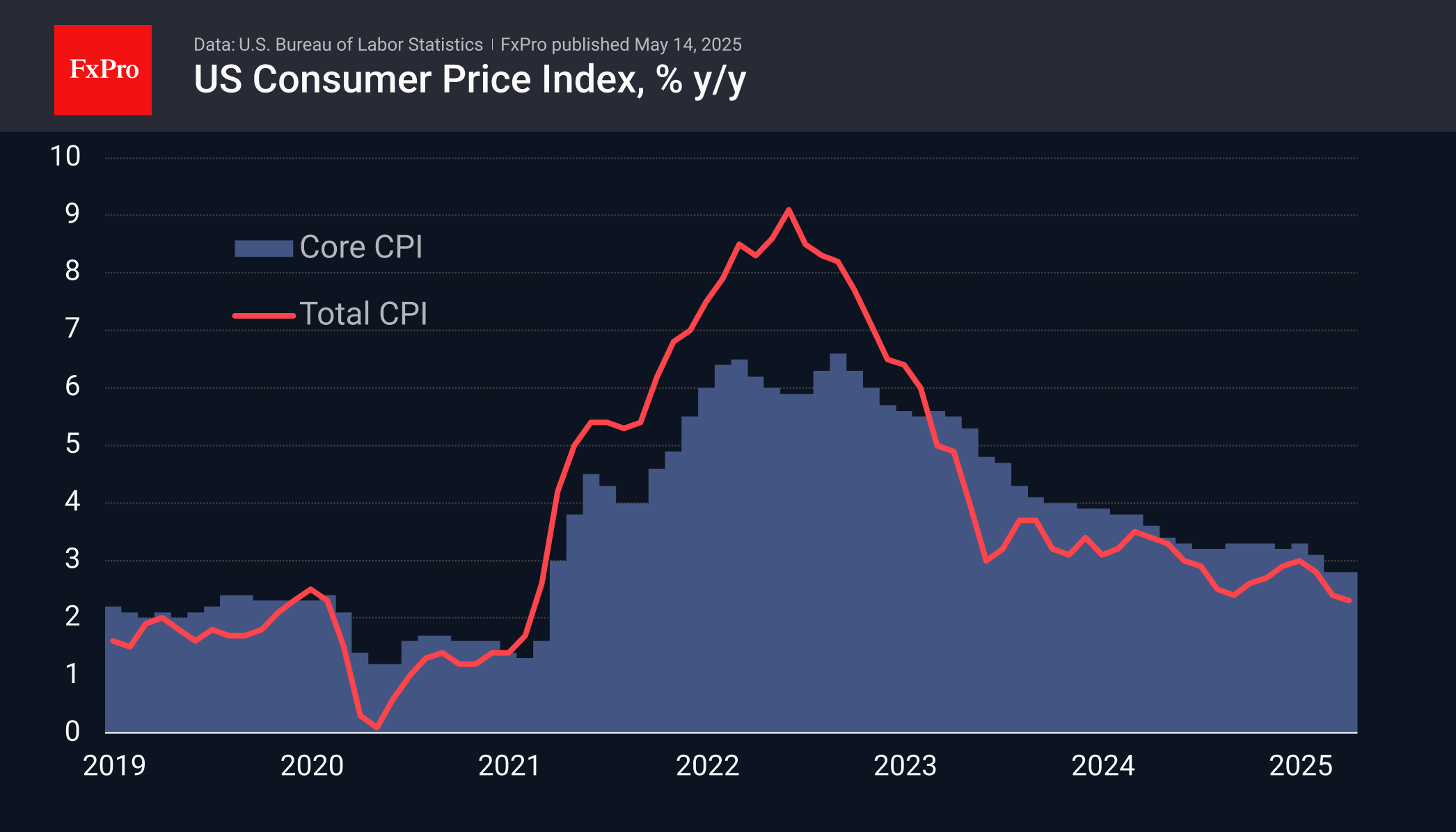

US consumer inflation slowed to 2.3% y/y, just below the forecast 2.4% and the same level as a year earlier. Core inflation maintained its annualised pace of 2.8% but also rose slightly weaker than expected.

This softer data triggered a new wave of dollar decline after a week of strong growth. The reason for this dynamic is the softening of expectations for the key rate, which has increased the chances of a cut. Investors have become less fearful of the immediate effects of rates. At the same time, many economists point out that the upward impact on prices will only increase in the coming months. Even if tariffs return to pre-April levels, the tail effects will stretch over the next couple of quarters.

The first actual signs of price effects from tariffs should be looked for in import prices (published on Friday), but producer prices already released on Thursday may carry the first traces of tariffs.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)