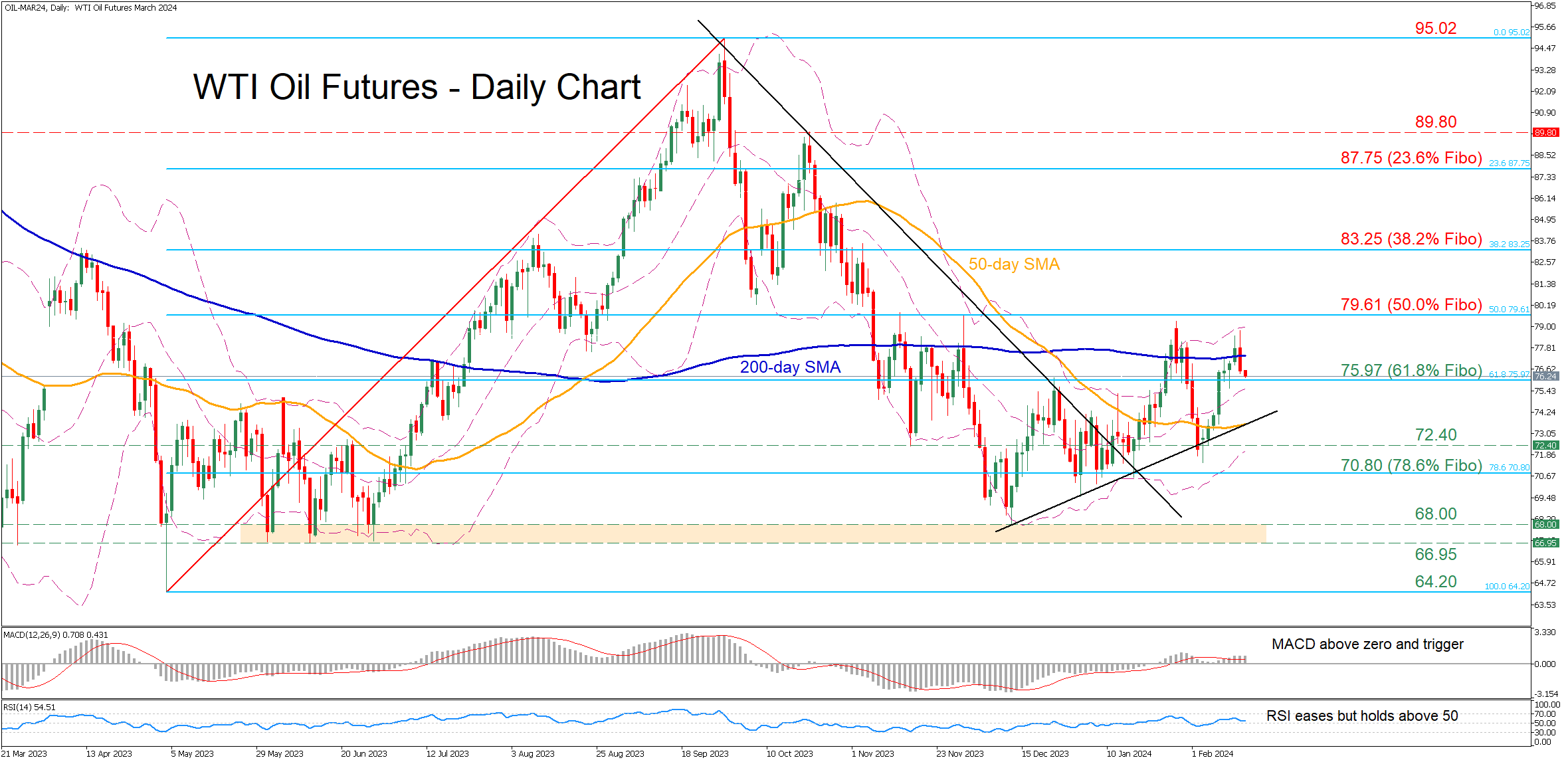

WTI oil futures get rejected at 200-day SMA

WTI oil futures (March delivery) had been staging a comeback after their decline below the 50-day simple moving average (SMA) came to an end in early February. However, the bulls failed to conquer the 200-day SMA, which led to the price reversing back lower on Wednesday.

Should bearish pressures persist, oil futures could challenge 75.97, which is the 61.8% Fibonacci retracement of the 64.20-95.02 upleg. Lower, the November bottom of 72.40 could act as the next line of defence. A violation of that zone could set the stage for the 78.6% Fibo of 70.80 ahead of the 66.95-68.00 support range defined by June lows and the recent six-month bottom.

On the flipside, if buyers re-emerge and propel oil above the 200-day SMA, immediate resistance could be found at the 50.0% Fibo of 79.61. Further upside attempts could then stall around the 38.2% Fibo of 83.25. Surpassing that zone, the price could ascend to face the 23.6% Fibo of 87.75.

In brief, WTI oil futures lost some ground after getting rejected a tad below their January high, generating a bearish double-top pattern. For the bulls to regain confidence, the price needs to close above the 200-day SMA.

.jpg)