Crypto market postpones rally

Crypto market postpones rally

Market Picture

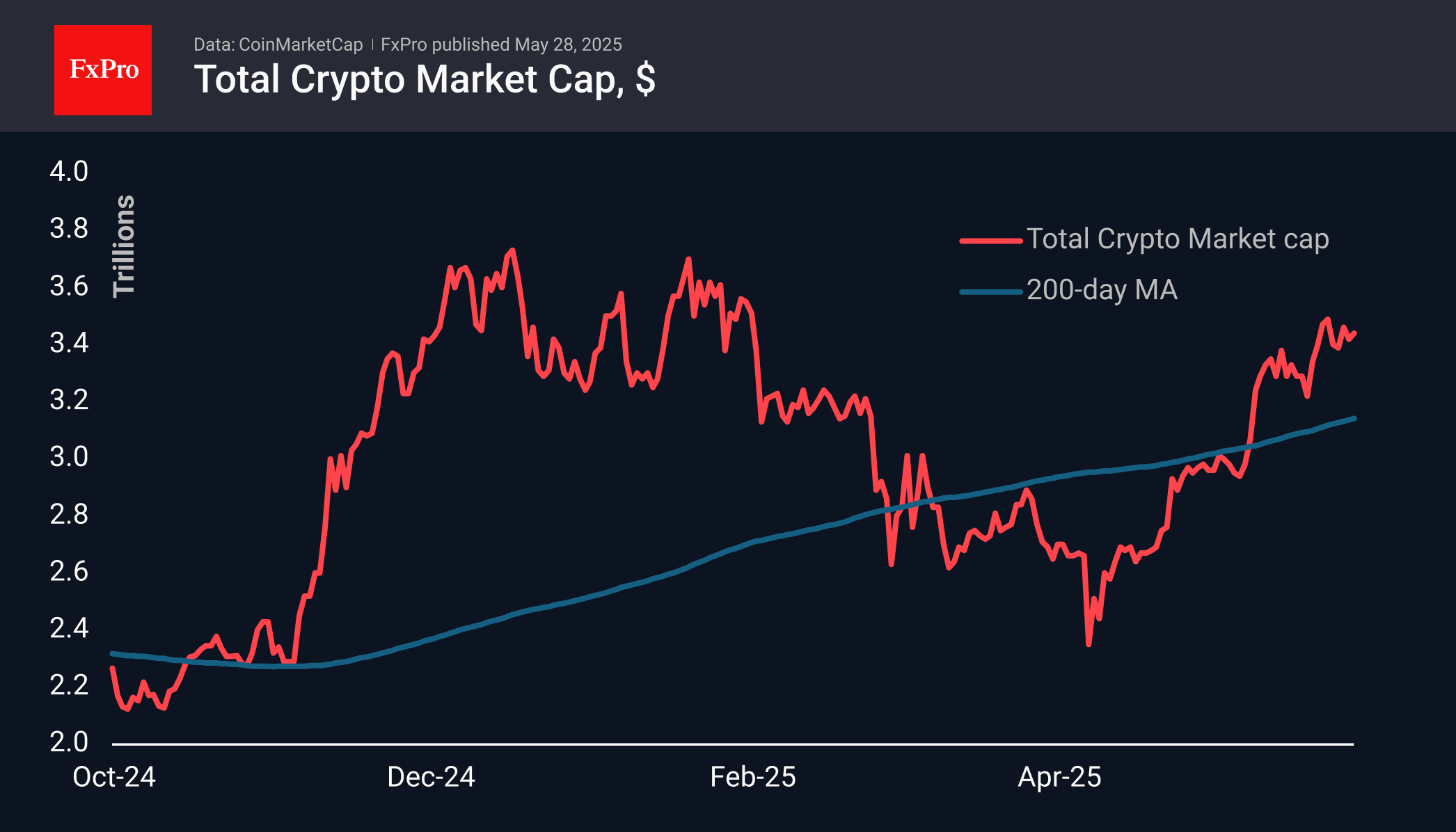

Market capitalisation has risen 0.5% in the last 24 hours to $3.44 trillion, but that's below Tuesday's intraday peaks of $3.49 trillion and last Friday's highs of $3.54 trillion. This is an interesting development given the risk appetite in the stock markets over the last couple of days. Perhaps the behaviour of cryptocurrencies indicates that optimism isn't so all-encompassing.

Bitcoin has been trading in a 5% range between $106.6k and $111.7k since 22 May, and is currently in the middle. The current high area fits into a Fibonacci extension pattern at 161.8% of the first upside momentum from early April to the first days of May. Overcoming 112k would then be a prologue to 134k (261.8%).

Ethereum and Solana have been battling resistance in the form of their 200-day moving averages for more than two weeks now. We seem to be dealing with an indecisive market choosing between a further mighty rally and fading after a rebound. Bitcoin's rally has the potential to inspire big alts to break out, but for now, we are not there yet.

News Background

Bitcoin options maturing in June-July have been dominated by activity in calls with strikes of $115,000 and $120,000, Kaiko notes. The highest turnover was in contracts with expiry at $110,000, suggesting consolidation at established levels in the coming weeks.

Trump Media, a company linked to US President Donald Trump's family, will raise $2.5bn through the sale of stocks and bonds to build a bitcoin reserve. The company has signed private placement agreements with about 50 institutional investors to raise the funds.

Circle, which issues the USDC stablecoin, has updated documents for an IPO on the NYSE. The goal is to raise about $600m with the firm’s valuation of $5.4bn.

Cardano founder Charles Hoskinson announced a willingness to integrate Ripple's stablecoin RLUSD into its blockchain without charging fees, as a gesture of support for the XRP community.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)