UK’s inflation surge puts BoE closer to Fed

UK’s inflation surge puts BoE closer to Fed

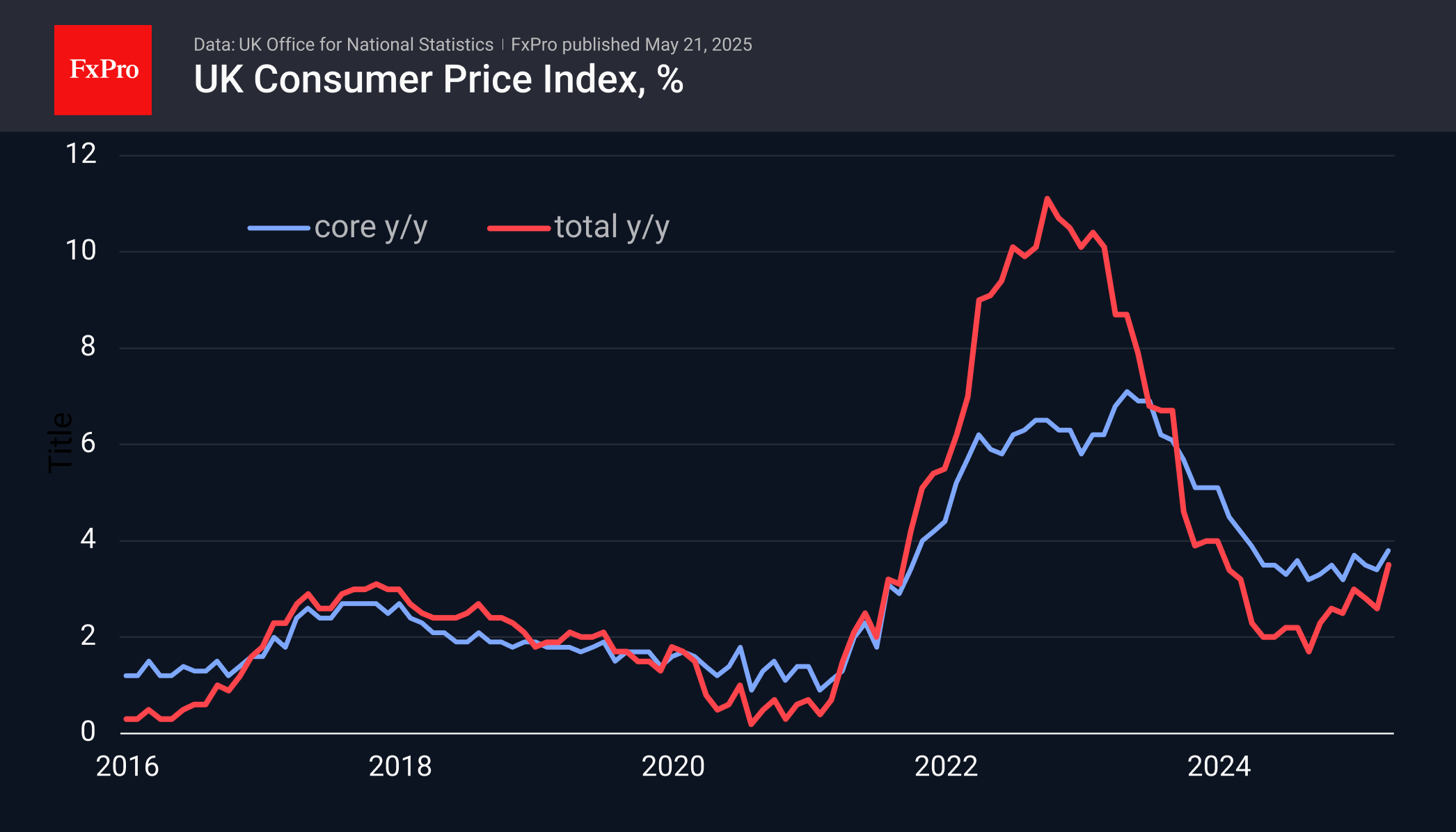

UK inflation accelerated more strongly than forecast, casting doubt on the likelihood of a rate cut by the Bank of England any time soon. The overall consumer price index increased 1.2% in April, the strongest monthly jump since April 2022. The annual rate of growth accelerated from 2.6% to 3.5%, the highest since January 2024. Core inflation accelerated to an annual rate of 3.8%, the highest in 13 months.

What is most worrying about the current situation is the persistently positive trend in inflation. The overall rate hit a low of 1.7% in September 2024, confirming the correctness of the Bank of England's decision to kick off the monetary easing cycle shortly before. Further policy easing will now require more justification from the central bank.

Housing, household services, leisure, and culture are the drivers of inflation in Britain right now. These are difficult categories for monetary policy. Unlike commodity and energy prices, we should not expect markets to cool sharply. In these circumstances, the Bank of England needs to pursue a policy of cooling economic growth.

This is good news for the pound, so nothing is surprising in GBPUSD updating its three-year highs. Nevertheless, it's not easy for the pound to move upwards given the 11% rise from the lows at the start of the year. The latest news is a good signal to get ready for the bulls. However, for the rally to resume, it is still better to wait for hawkish signals from the Bank of England that it is ready to take a pause, like the Fed is now.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)