What to expect from US inflation

The currency market has moved little over the past week, waiting for significant drivers. The Easter lull is likely to end today, as inflation data and the Fed's March meeting minutes are expected to be released.

US inflation reports have moved markets more than NFP in recent months and have often been a bellwether for the Dollar in the coming weeks as they have influenced interest rate expectations.

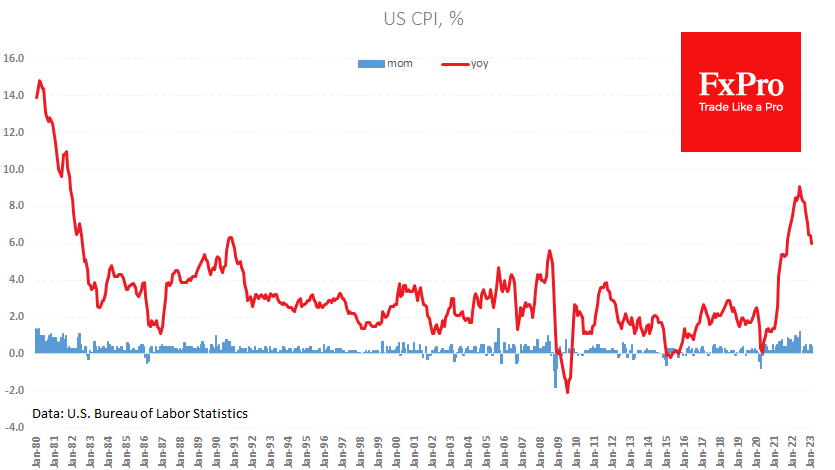

On average, market analysts are forecasting a 0.2% rise in prices for March and a slowdown in annual inflation to 5.1% from 6.0% the previous month and a peak of 9.1% in June last year.

However, economists expect core inflation to rise from 5.5% to 5.6% YoY, reversing the downward trend that has been in place since September.

In our view, a deeper slowdown in headline inflation, as we saw in China earlier this week, cannot be ruled out. Moreover, we should not be surprised if the rate of increase in prices, excluding energy and food, also falls short of expectations. A recovery in supply chains and a slowdown in wage growth are working against inflation.

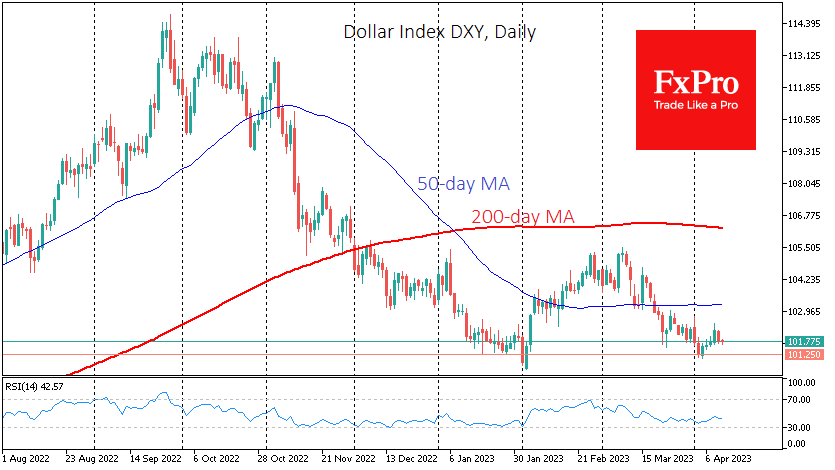

A weaker-than-expected reading or other reliable signs of waning inflation could unleash a wave of pressure on the Dollar, reducing the chances of another Fed rate hike. Weaker inflation data is also good for demand for equities and commodities, as markets will reinforce expectations that inflation has peaked. The Dollar would then stand a good chance of rallying off this year's lows.

On the other hand, if prices rise significantly more than expected, this will push the Dollar higher. Technically, the DXY could form a double bottom with lows in early February and April. Equities and commodities could go down.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)