Bitcoin and Ethereum in the eye of the storm?

Market picture

The crypto market avoided sharp moves on Tuesday, showing low volatility over the 24 hours and remaining near $2.3 trillion. The Crypto Fear and Greed Index added 2 points to 67 (greed) by Wednesday.

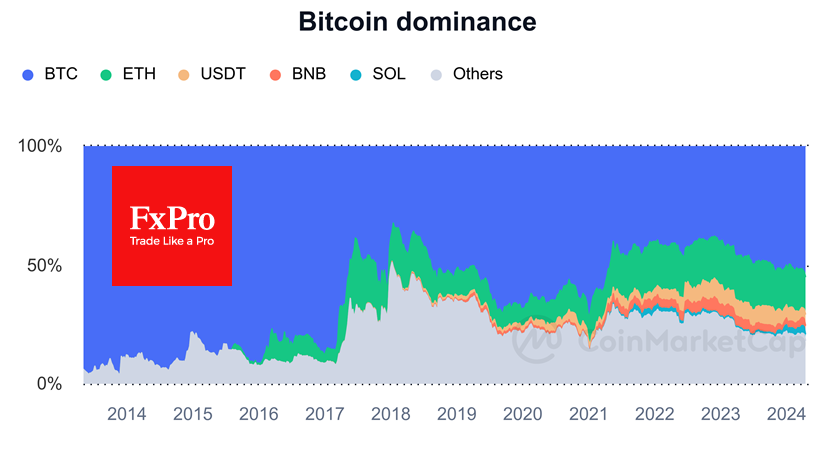

Bitcoin's share of the entire crypto market capitalisation exceeded 54%, maintaining its upward trend since December 2022. This is the clear impact of the Bitcoin-ETF, but we also note the diminishing enthusiasm for altcoins.

The technical picture for Bitcoin is rather worrying, as we saw no rebound after the price drop on Friday and Saturday. On the contrary, the market seems to be getting used to current prices in anticipation of a halving.

Similarly, Ethereum sold off powerfully at the end of last week from the 50-day MA. Now, the second largest cryptocurrency holds near the psychologically significant $3000 level.

The pattern of cryptocurrency behaviour this week indicates that we are more likely to be in the eye of the storm, i.e. a temporary lull between violent gusts of wind. If this prediction is correct, Bitcoin could fall towards $52-55K, and Ethereum - to $2500.

News background

The crypto market is "halfway to bitcoin euphoria," according to CryptoQuant. New bitcoin miners, who have held their assets for less than 155 days, hold up to 9% of the circulating BTC volume and continue to build up inventories in anticipation of rising prices. The imbalance between BTC supply and demand will increase over the next six months, potentially driving prices higher.

Hong Kong-listed cryptocurrency ETFs will be "lucky" if they manage to raise $500 million in aggregate, Bloomberg said. The agency called Matrixport's projected $25bn "insane".

According to CoinGecko, there are more than 2.52 million crypto assets in existence today, which is 5.7 times the number at the end of 2021. The pace of new coins accelerated in 2024 when 0.54 million tokens have already been created, which means an average of 5,300 pieces launched per day.

Blockchain team The Open Network (TON) has announced the launch of the Memelandia hub for meme coin developers. The project is part of The Open League's programme, which was created to support new meme coins and raise awareness of them.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)