Bitcoin cools down ahead of Fed

Market picture

Bitcoin selling intensifies as it touches the $28K level. The leading cryptocurrency has lost 2.2% over the past 24 hours, but this is a minor pullback after a more than 40% gain since 10 March. This pause will allow Bitcoin to "cool down" and create opportunities for another leg up. Nevertheless, the risks of a deeper correction remain elevated, with the first significant line of defence likely to be the $26K (76.4% of the last rally) and the second at $25K (61.8% of the rally).

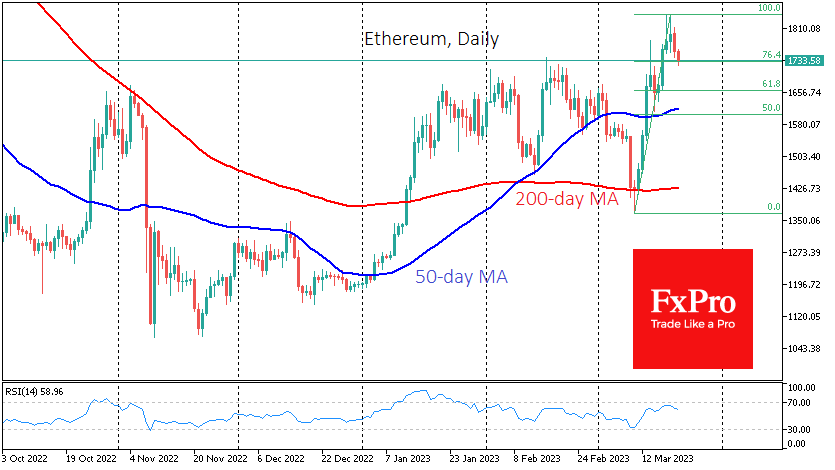

Interestingly, Ethereum has had a less impressive flight and remains heavier, pulling back to $1730 (76.4% of the original rally). Above $1700 is also the area of previous local highs for the second-largest cryptocurrency.

We should be prepared for increased market profit-taking before the Fed's decision. The central bank must choose between fighting inflation (negative for crypto) and supporting the banking system (positive for markets).

According to CoinShares, investments in crypto funds fell by $95 million last week, marking the sixth consecutive week of outflows. Bitcoin investments decreased by $113 million and Ethereum by $13 million. Investment in funds that allow shorting of bitcoin increased by $35 million.

News background

"Bitcoin is volatile but has never needed a bailout like banks. It has no CEO. No one can print coins out of thin air," said Changpeng Zhao, head of Binance.

Bitcoin has entered the bull market phase, according to CryptoQuant founder Ki Yun-Ju, who cited optimistic signals from on-chain indicators.

The US Federal Deposit Insurance Corporation (FDIC) has sold Signature Bank without its cryptocurrency division. As of 20 March, the 40 former Signature branches will be operated by Flagstar Bank.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)