Cooler Bitcoin

Market picture

Market Dynamics: The cryptocurrency market stabilised, losing just 0.1% of capitalisation and dropping to $2.37 trillion over the last 24 hours. After the halving, the bulls intensified their efforts to boost prices, but by the end of the week, the bears took the initiative.

Bitcoin under pressure: Bitcoin has been losing value (0.7%) since early Friday, reaching $64.2K, despite rising 1.2% the day before. The currency continues to correct, remaining at the bottom of the range set in March. The RSI is signalling a possible further decline in price.

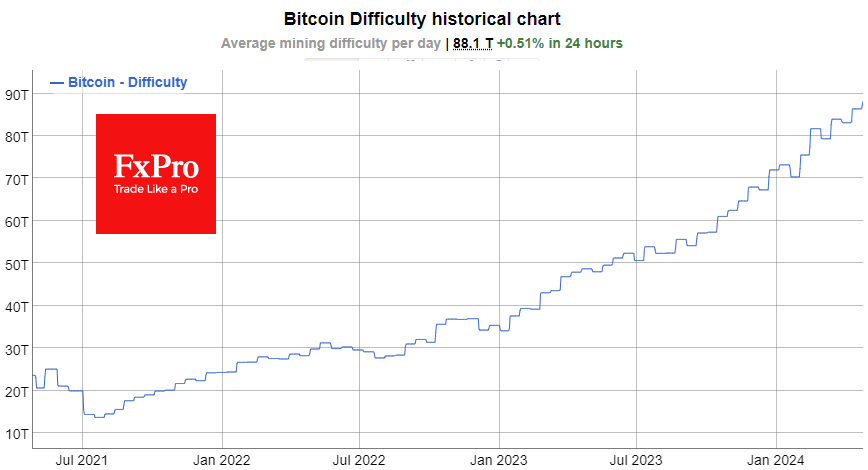

Mining gets harder: Bitcoin's mining complexity increased by 1.99%, reaching a record of 88.1 T, with an average hashrate of 726.3 EH/s.

News background

Morgan Stanley and BTC-ETF: The bank is considering including spot bitcoin-ETFs in its list of recommendations for its brokers.

Wallet growth: The number of bitcoin wallets over $1,000 has doubled since last year to 10.6 million.

Morgan Creek forecasts: The company's CEO predicts baby boomers will invest more than $300bn in cryptocurrencies in the coming year.

Ethereum ETF: According to Reuters, management companies expect the U.S. SEC to reject applications for spot Ethereum-ETFs after "disappointing" discussions. The SEC has only held a handful of meetings on Ethereum funds.

Stablecoin Act: Standard & Poor's notes that a payment-stablecoin bill introduced in Congress has the potential to undermine Tether's dominance. USDT is issued by a non-US company and would be banned from circulation in the US.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)