Dollar has rolled back to local lows

Dollar has rolled back to local lows

The US dollar has retreated to the lower levels it has visited multiple times since the end of January. The decline at the end of last week was driven by reports that US 'retaliatory' tariffs have been postponed until April, allowing time for negotiations and potential easing of terms. This development proved more significant for the dollar than the Federal Reserve's further hawkish stance and the unexpected rise in inflation.

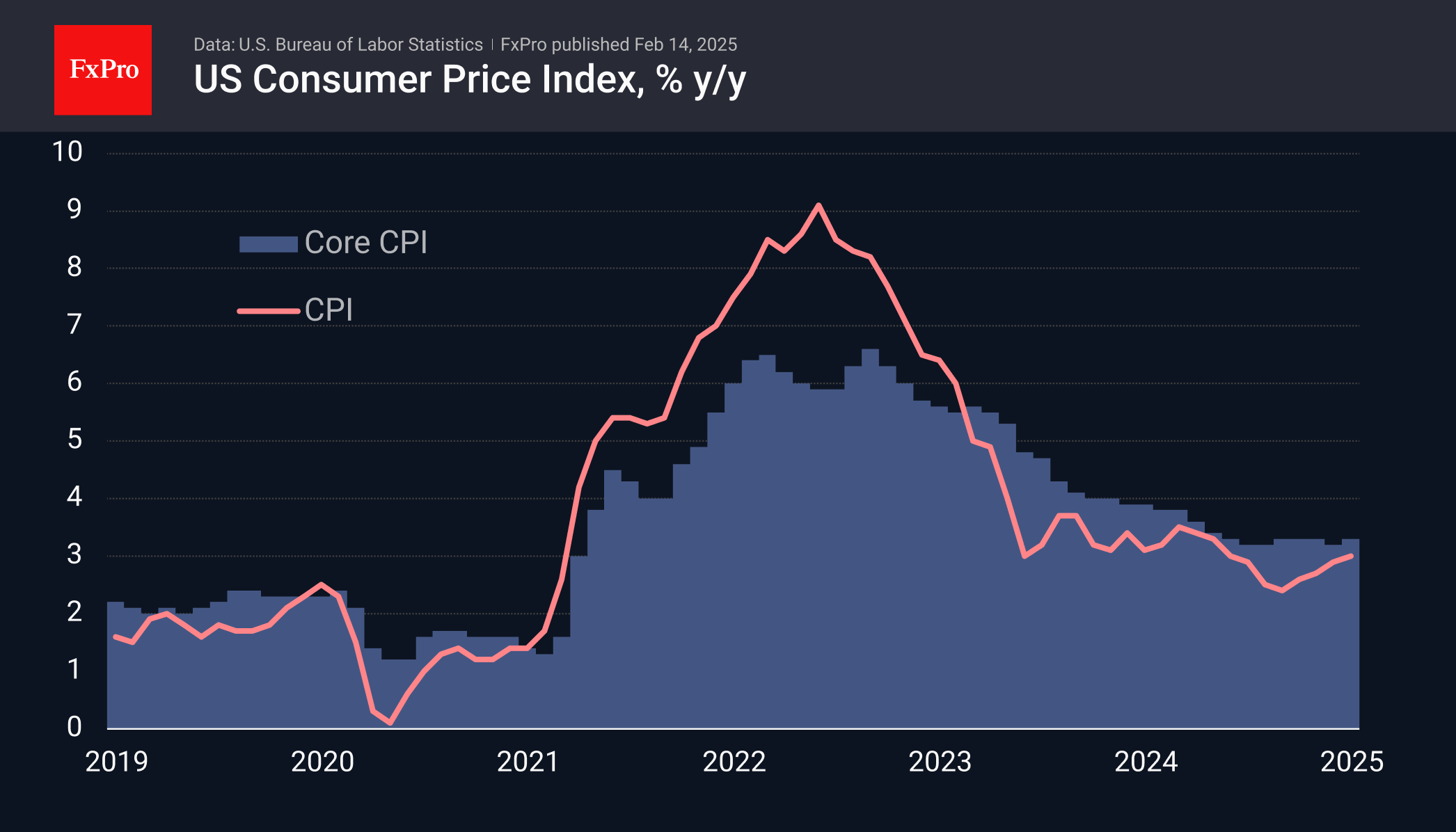

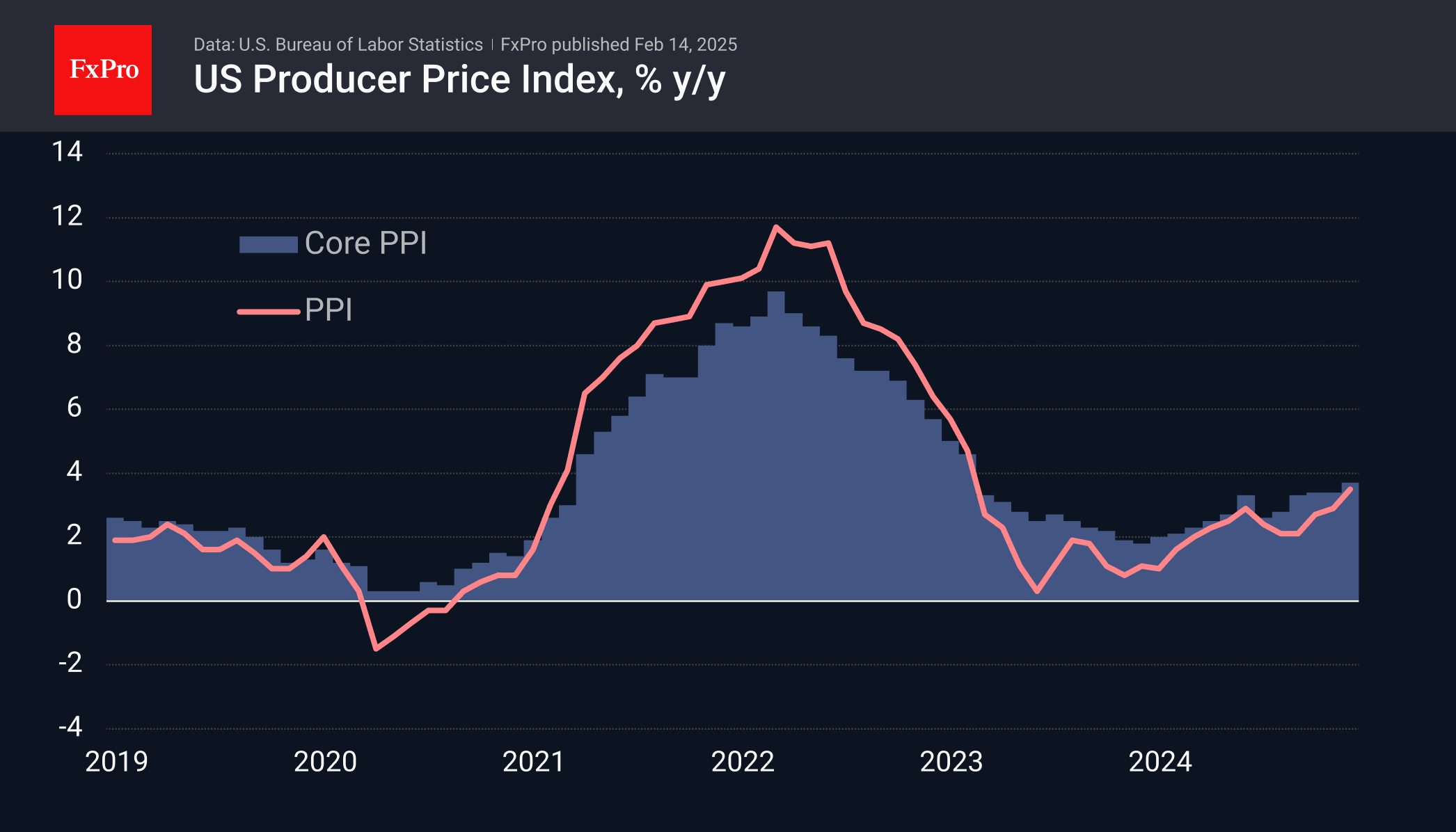

Data released mid-week indicated that consumer inflation accelerated to 3.0% year-over-year, marking a six-month high and a notable increase from September's low of 2.4%. Core inflation remained stable at 3.3% over the past eight months. Additionally, the producer price index, a leading indicator of inflation, rose to 3.5% year-over-year, the highest rate since early 2023.

An inflation rate above the target compels the Federal Reserve to adopt a restrictive approach, maintaining the key interest rate above inflation to suppress it. This strategy may present a bullish scenario as other major central banks signal their intent to ease policy.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)