Dollar slips despite hot US CPI as Trump kick-starts Ukraine talks

Powell feels the heat as CPI unexpectedly rises

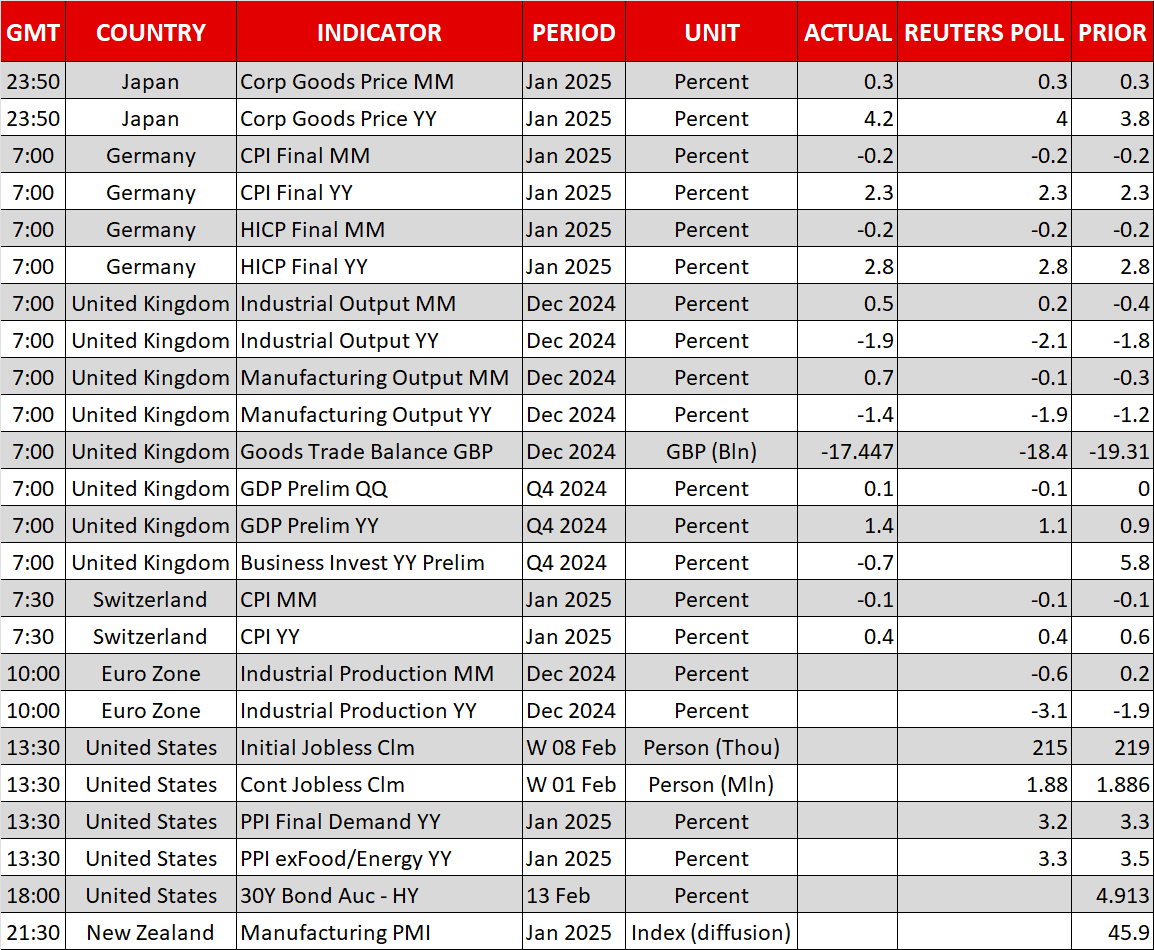

The latest inflation data out of the United States undermined the Fed’s credibility just as Chair Powell addressed lawmakers on Capitol Hill on Wednesday. The consumer price index rose at an annual pace of 3.0% in January, beating forecasts that it would stay unchanged at 2.9%. The month-on-month rate accelerated to 0.5%, the fastest since August 2023, while core CPI picked up to 3.3% y/y.

The data dashed hopes that inflationary pressures are on the wane, particularly as core services CPI jumped by 0.8% over the month, in a major setback for the Fed. Powell was speaking before the House Financial Services Committee when the January figures were published, in his second day of semi-annual testimony.

The Fed chief did not stray much from the script, but the overall tone was one of a more guarded central bank, with Powell acknowledging that there is more work to do on inflation.

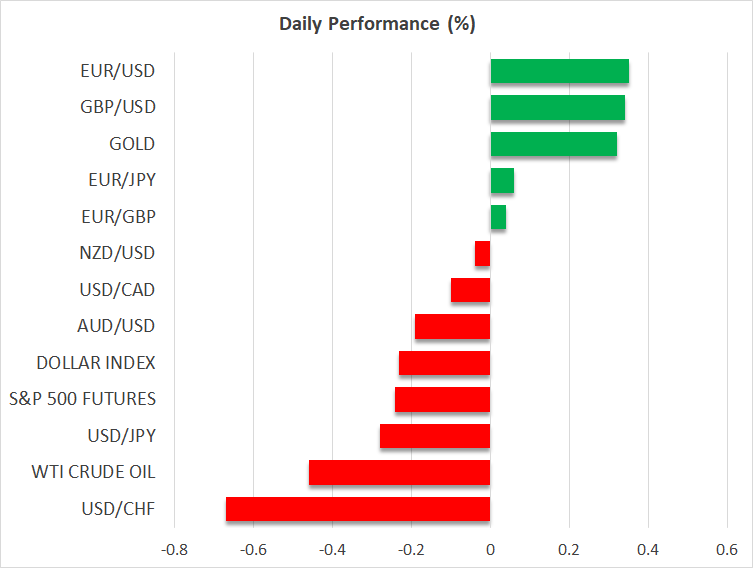

Dollar decouples from yields

The 10-year Treasury yield extended a week-long rebound, hitting a three-week high of 4.66% on the back of Powell’s remarks and the stronger-than-expected CPI report. However, the US dollar has not been keeping pace with yields, with its index against a basket of currencies entering a third straight negative session today.

A brief spike upwards following the CPI numbers did not last long and investors seem hesitant to push the greenback higher. This unusual softness comes despite Fed rate cut bets being scaled back further. Investors are currently pricing in just 30 basis points of reductions for the whole of 2025, with some analysts predicting that the Fed will stay on hold for the rest of the year.

Trump opens Ukraine peace talks

The reason for the dollar’s underperformance is unclear. Perhaps some traders are thinking that Powell will bow to pressure from President Trump and cut rates. Trump again called on the Fed on Wednesday to lower rates, arguing that it would “go hand in hand with upcoming tariffs”.

Reduced safe-haven demand could also be a factor following Trump’s announcement yesterday that he and President Putin of Russia have agreed to start talks on ending the war in Ukraine.

While any effort for peace can only be a good thing, there’s been alarm among European nations and in Ukraine especially, as Trump appears to have set the ball rolling in a phone call with Putin without discussing it with Ukraine’s President Zelenskiy first.

Euro lifted, gold climbs too as more tariffs eyed

The market reaction has been mixed, with the euro edging higher today on the prospect of peace along Europe’s borders, which could potentially lead to lower energy prices for the continent. But the possibility of a de-escalation in the Ukraine conflict isn’t being reflected in gold prices just yet.

The precious metal is climbing towards Tuesday’s all-time high of $2,942.70 today, with investors likely remaining nervous about more tariff decisions from Trump.

There is speculation the US President will sign new executive orders on reciprocal tariffs on Thursday, raising the risk of spoiling the calm in equity markets. Stocks globally have mostly been shrugging off the tariff-related headlines and there was no hysteria on Wall Street from the CPI data, but that could change if traders see that Trump is not letting up on his tariff fight.

Yen and pound also gain

The yen could also be benefiting from some safety flows, as well as from a bigger-than-expected rise in Japanese corporate goods prices in January, increasing the chances of another Bank of Japan rate hike soon.

The dollar was last quoted at just below 154 yen, while the pound is testing the $1.25 handle after being boosted by UK GDP data. The British economy notched up surprise growth of 0.1% q/q in the final three months of 2024 against projections of a small contraction.

Later in the day, the focus will turn to US producer prices.

.jpg)