EBC Markets Briefing | Silver keeps pace with gold in the fog of war

Gold hovered around an all-time peak on Wednesday on safe-haven demand spurred by uncertainties around US election and rising geopolitical tensions. Expectations of further monetary easing also helped.

South Korea warned Tuesday it could consider supplying weapons to Ukraine in response to North Korea allegedly dispatching troops to Russia. NATO's secretary general said that would mark a “significant escalation.”

A growing chorus of analysts have predicted that the price of gold will continue to rise to $3,000, with some expecting the commodity to cross $2,800 in the next three months.

Citi analysts said, despite a drop in Chinese retail demand over the last three months, gold prices have still performed "extremely well," which reflects the willingness of buyers to pay higher prices.

Meanwhile, they revised its 6 to 12-month forecast for silver upward to $40 per ounce. The white metal hit its highest level in more than a decade earlier this week thanks to China’s stimulus hopes.

While silver's role in consumer electronics and renewable energy is well-known, recent analysis suggests that military usage of silver may be substantially greater than any other industry category.

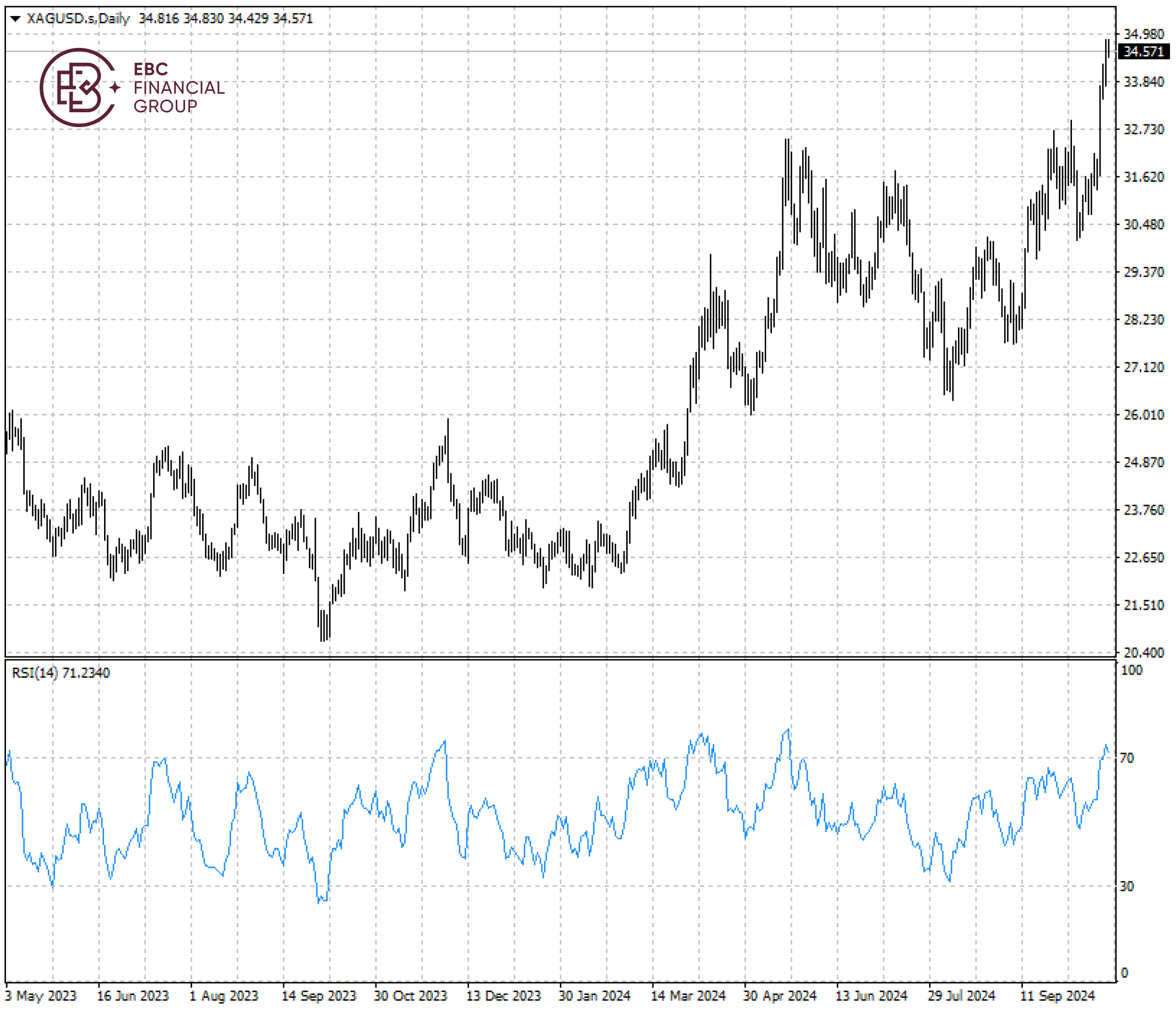

Silver is a little overbought, so we see a moderate drop as likely. If it manages to breach the resistance at $35, the high of $37.48 in Feb 2012 could be attainable.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.