EBC Markets Briefing | Yen grapples with Ishiba's resignation

The dollar wobbled on Monday after dismal US labour data, while the yen fell as investors girded for uncertainty in Japan following the resignation of PM Ishiba.

The spotlight will be on who takes over, with concerns that an advocate of looser fiscal and monetary policy, such as LDP veteran Sanae Takaichi, who has criticised the BOJ's interest rate hikes, could take the helm next.

The Japanese economy grew at a faster pace than initially estimated in Q2 revised data showed, confirming a fifth straight quarter of growth. Consumption and capital expenditure were both revised higher.

Still Japanese companies have to face a 15% flat tariff on exports to the US. Government officials have warned that the tariffs will weigh on growth in the coming quarters, and could hurt capital investment.

US job growth cooled notably last month while the unemployment rate rose to the highest since 2021, reinforcing views the labour market may be on the cusp of a more significant deterioration.

Traders have increased bets that the Fed will cut interest rates at its September meeting, which Chair Powell signalled in a speech last month during the central bank's annual Jackson Hole symposium.

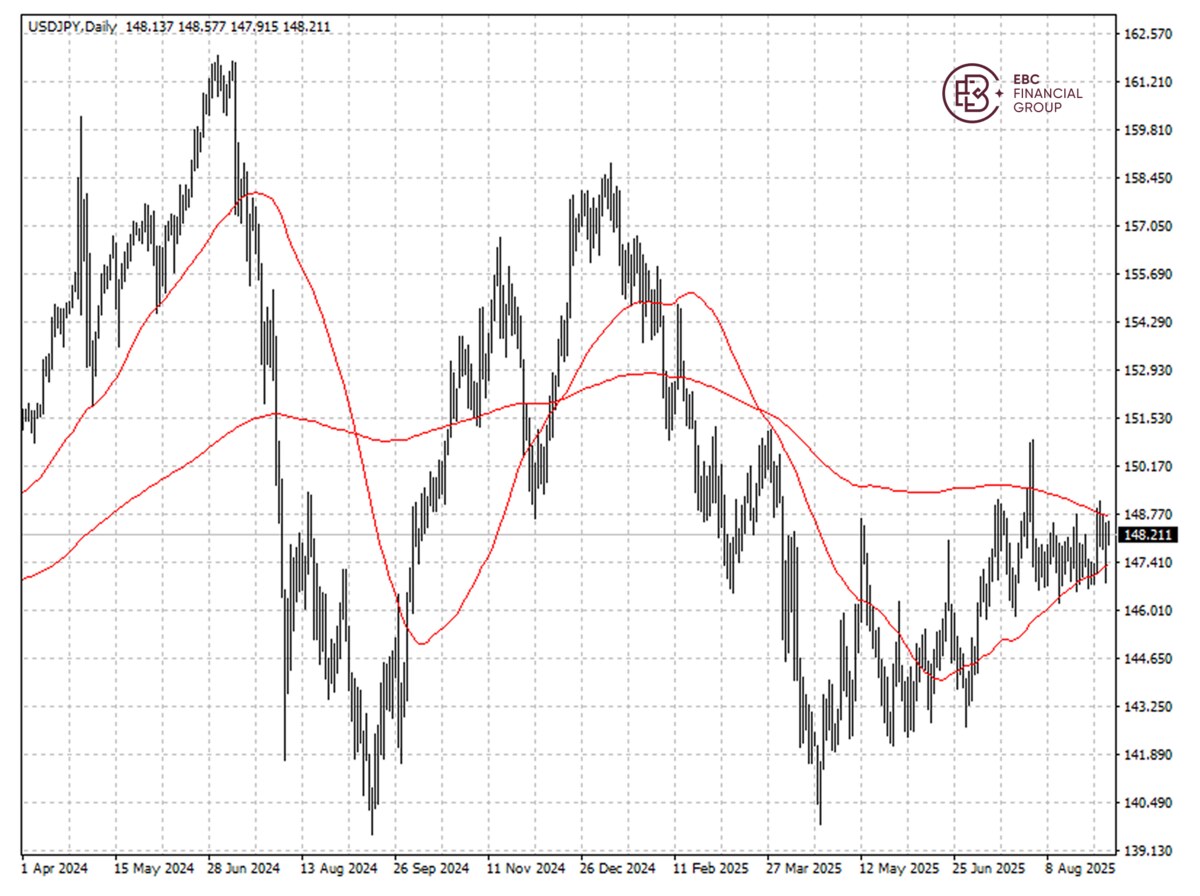

The yen has oscillated between 50 SMA and 200 SMA with few signs of breakout. As such, it is proper to sell the rally at the point.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.