EURUSD Analysis: Bulls Regain Control with Sights Set on 1.1900

Ultima Markets brings a detailed examination of the EURUSD pair for December 23, 2025.

Technical Analysis of EURUSD

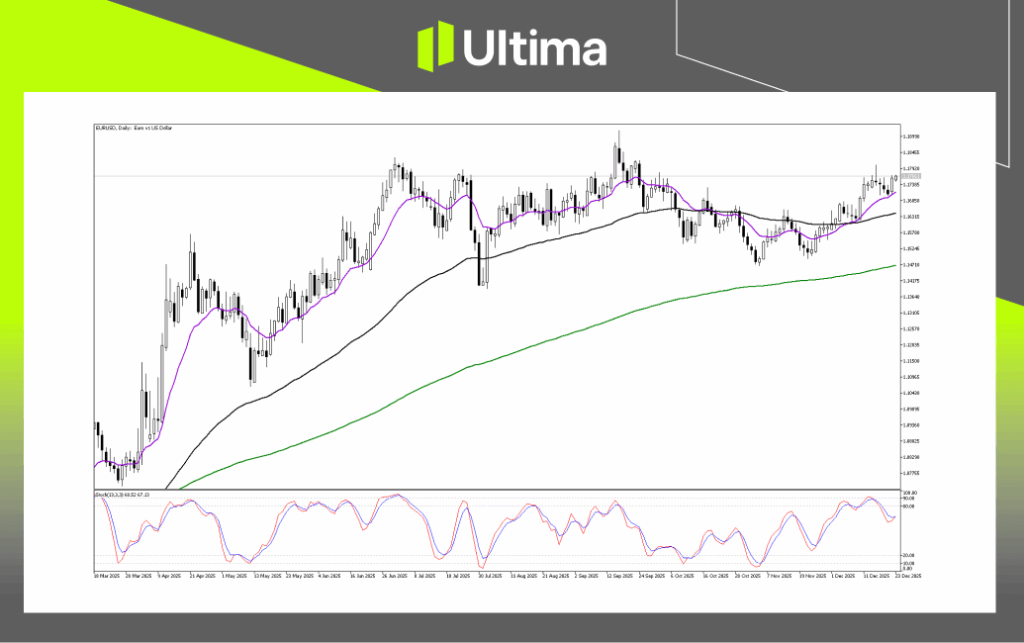

EURUSD Daily Chart Overview

The most straightforward path for price action at present seems bullish. Watch closely for a decisive push beyond. 1.1860. Conversely, position stop-losses on long trades near 1.1730, as a breach below this would invalidate the near-term bullish bias. The Stochastic oscillator hovers near 68.5 and continues rising, pointing to strong bullish drive. While approaching overbought levels (below 80), it remains manageable, suggesting the ongoing advance might extend to 1.1899 resistance before any potential stall or retracement.

Key Levels

This pair confronts multiple hurdles ahead. Near-term resistance clusters at 1.1855 - 1.1860, echoing the early December local high now under test. A broader barrier spans 1.1899 - 1.1900, the multi-month peak from late September that acts as a key technical and psychological threshold. A firm close above 1.1900 could propel toward the round-figure 1.2000 mark.

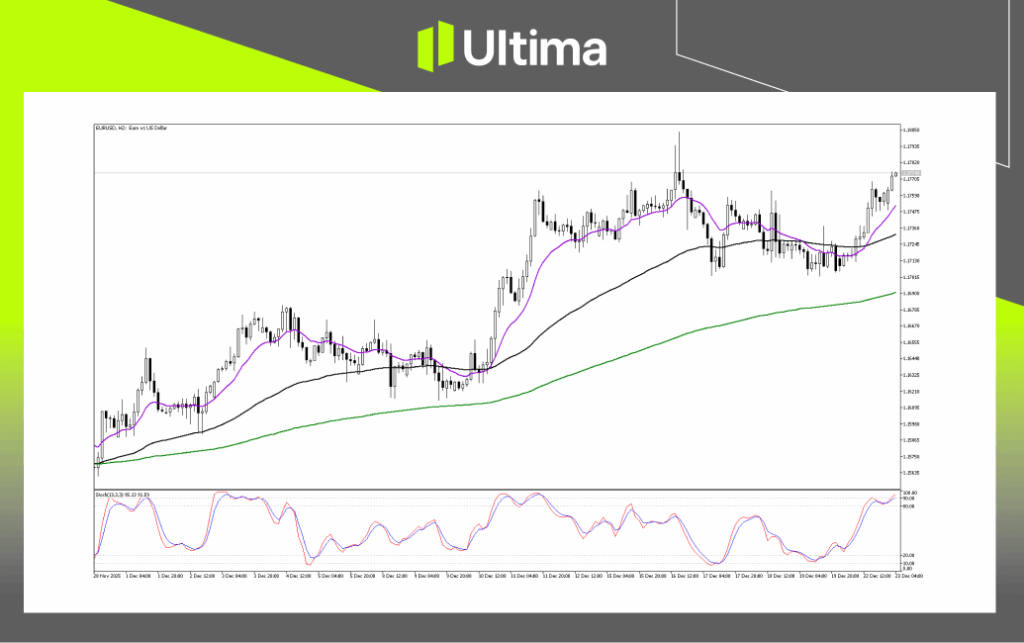

EURUSD 2-Hour Chart Review

Bullish forces maintain clear dominance. However, opening longs at the current 1.1774 level carries higher risk amid overbought signals. Better tactics include awaiting a close above 1.1805 or seeking dip buys near 1.1750.

Breakout Possibilities

For bullish continuation, a 2-hour candle settling above 1.1805 signals escape from recent chop, drawing buyers toward daily resistance at 1.1855 and 1.1900. In a corrective phase, extreme Stochastic overbought conditions favour short-term consolidation. Target pullbacks to 1.1747, home to the 50-period moving average; support there plus Stochastic rebounding from below 80 offers prime trend-following entries.

EURUSD Pivot Points

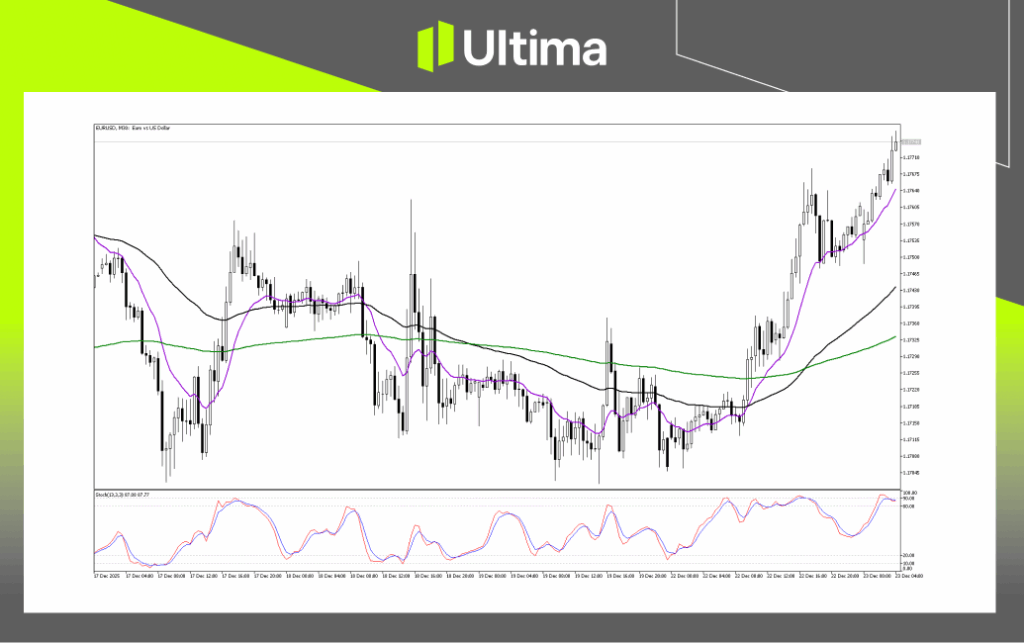

The 30-minute view reveals a parabolic uptrend. Despite the evident bullish tilt, the wide separation from moving averages shows overextension. Expect either brief sideways action before probing 1.1800 or a shallow dip to 1.1760 sparking fresh bids.

Trend Continuation Setup

Watch for 30-minute break over 1.1775 for trend persistence, aiming initially at 1.1800. Aggressive entries buy the breakout, but with Stochastic overbought, prudent traders use buy stops above the high and stops at 1.1760.

Pullback Strategy

For mean reversion, failure at 1.1775 alongside Stochastic dropping below 80 triggers the play, targeting 1.1755 - 1.1760. Conservative traders prefer bounces from the 50-period moving average for superior risk-reward over chasing highs.

Trading Forex with Ultima Markets

Mastering forex demands vigilance and informed decision-making choices that are evidence-based. Ultima Markets commits to equipping traders with expert analysis for informed paths. For personalised guidance tailored to your financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and gain access to a comprehensive trading ecosystem equipped with resources such as tools and knowledge to thrive in the financial markets. Stay in the loop for ongoing expert insights from Ultima Markets.

--

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licenced financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.