Fed’s Waller fuels the dollar, yen intervention warnings intensify

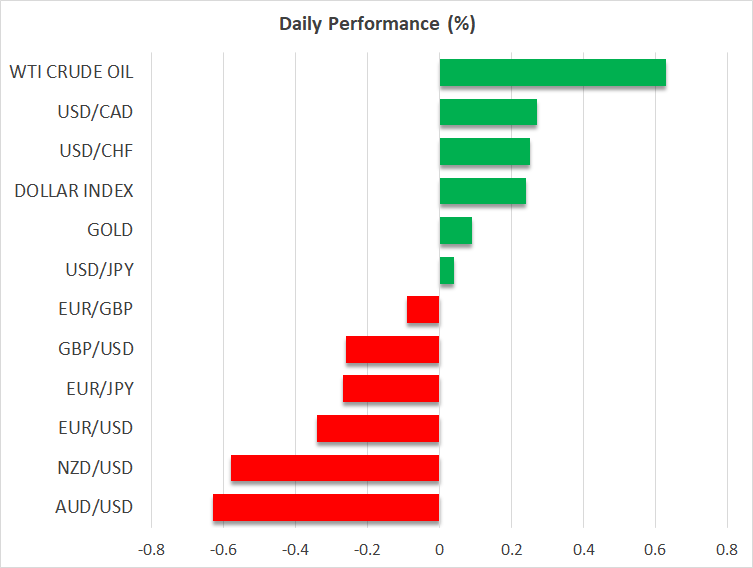

Dollar gains as Waller signals patience

The US dollar finished Wednesday slightly higher against all but one of its major peers and continues to trade on the front foot on Thursday as well. The only currency versus which it lost ground yesterday was the Japanese yen.

The greenback started the day on a relatively quiet note but comments by Fed Governor Christopher Waller after Wall Street’s closing bell added some fuel to the currency’s engines. Waller said that the recent disappointment in inflation numbers confirms the case for the Fed to wait for a while before pressing the rate cut button.

Waller’s remarks seem contradictive to Powell’s view at the press conference following last week’s decision, where he said that recent high inflation readings had not changed the narrative of slowly easing price pressures, and thereby are not a reason to alter the Committee’s plans.

Given that Waller was the first among Fed policymakers to talk about rate cuts, investors took his words seriously and lifted their implied path somewhat. According to Fed fund futures, the probability of a June cut slid to around 68%, while the total number of basis points worth of rate reductions by the end of the year came down to 75, matching once again the Fed’s own projections.

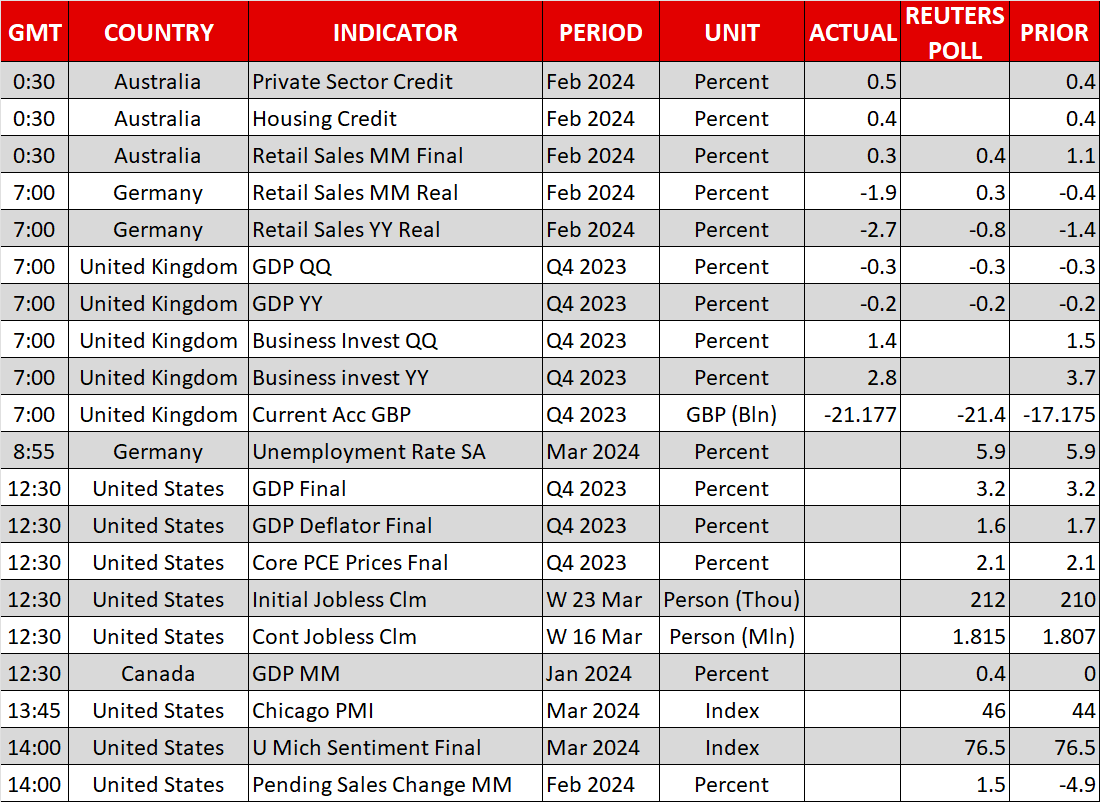

The next big test for Fed expectations and the US dollar may be tomorrow’s core PCE index, which is the Fed’s favorite gauge. Although Powell has already mentioned that the stickiness in recent inflation data is not a reason for the Fed to hold its fire, Waller’s opinion adds extra importance to tomorrow’s data.

Another round of data pointing to stickier-than-previously-expected inflation could further weigh on the probability of a June rate cut and thereby further support the dollar.

Japanese authorities ready to intervene

The yen was the only major currency against which the dollar lost ground yesterday, with the once safe haven gaining after Japan’s three main monetary authorities – the Bank of Japan, the Finance Ministry and Japan’s Finance Services Agency – held a meeting late in Tokyo trading hours to discuss the slide in the yen and suggested that they were ready to intervene in the market to stop speculative moves.

Dollar/yen was trading in a consolidative manner slightly below 152.00 ahead of the meeting with the announcement pushing the price down to 151.00. Although the pair rebounded slightly later, it remained unaffected today by the BoJ’s summary of opinions, which confirmed that at last week’s gathering, policymakers highlighted the need to proceed slowly and gradually in phasing out ultra-loose monetary policy.

That said, although yen sellers may be reluctant to push dollar/yen beyond 152.00, this could still happen if the dollar receives fuel by tomorrow’s PCE data. Such a break could ring the intervention alarm bells louder.

Wall Street trades in the green, gold shines

On Wall Street, all three of its main indices closed in the green, with the Dow Jones gaining the most and the S&P 500 securing a new closing record. The Nasdaq gained the least, perhaps dragged down by Nvidia, which closed in the red for a second straight session.

More data suggesting that inflation in the US is proving stickier than expected could weigh on Wall Street, but any PCE-related retreat is unlikely to lead to a long-lasting decline. Even if delayed, the next move on US interest rates is likely to be lower, which is positive for firms that are valued by discounting free cash flows for the quarters and years ahead, while recent activity has shown that investors are willing to price more future growth opportunities related to artificial intelligence.

Gold also traded higher yesterday, despite the recovery in the US dollar. Perhaps this is because central banks continue with increased buying activity in an attempt to diversify their currency reserves. This suggests that even if the precious metal is dragged down by a higher-than-expected core PCE rate tomorrow, the slide may prove to be limited and short-lived.

.jpg)