Gold Shines as Trade Tensions Escalate | 13th October 2025

Gold’s Record Rally

Global markets kicked off the week on a cautious tone as rising US-China trade tensions and renewed Federal Reserve rate cut bets drove investors toward safe-haven assets. Gold surged to fresh record highs, reflecting investor anxiety over slowing global growth and political uncertainty. Meanwhile, the US Dollar traded mixed, with commodity-linked currencies like the Canadian Dollar gaining modest support from a rebound in oil prices.

Oil prices climbed near $59.50 after recent declines, helped by moderating remarks from former President Trump on China, which temporarily eased fears of escalating trade frictions. In the FX space, the Euro and Loonie held steady, while the Chinese Yuan strengthened slightly after the PBOC set a firmer daily reference rate, signaling Beijing’s efforts to maintain market stability.

Gold Forecast (XAU/USD)

Current Price and Context

Gold pushed to a fresh all-time high above $3,900, extending the safe-haven rally as US–China trade tensions re-escalate and markets price higher odds of Fed rate cuts. Momentum is strong, but some traders are booking profits after the historic breakout, so intraday swings are likely.

Key Drivers

Geopolitical Risks: Renewed US–China friction and broader geopolitical uncertainty are driving safe-haven flows into gold.

US Economic Data: Softer or delayed US data would reinforce rate-cut expectations and provide continued upside for bullion.

FOMC Outcome: Markets pricing Fed easing later this year lowers real yields and remains supportive of gold.

Trade Policy: Escalating trade rhetoric increases demand for non-yielding assets as a hedge.

Monetary Policy: Dovish central-bank expectations globally keep the structural backdrop favourable for precious metals.

Technical Outlook

Trend: Strong bullish trend after the breakout to new highs.

Resistance: Near-term resistance sits around $3,950, then the round $4,000 psychological level.

Support: Initial support at $3,850, followed by $3,800.

Forecast: Expect continued upward bias while price holds above $3,850; intermittent pullbacks are likely but dips should attract buyers.

Sentiment and Catalysts

Market Sentiment: Bullish — traders are treating pullbacks as buying opportunities amid safe-haven demand.

Catalysts: US–China headlines, Fed speakers/minutes, and US inflation/retail data will determine whether gold extends or consolidates.

WTI Crude Oil Forecast (WTI/USD)

Current Price and Context

WTI rebounded toward $59.50 after calming rhetoric on trade and mixed inventory reads, but prices remain below recent peaks as the market assesses demand resilience. The bounce looks driven by reduced geopolitical premium and short covering rather than a clear demand recovery.

Key Drivers

Geopolitical Risks: Moderating US–China rhetoric and easing Middle East tensions have removed some risk premium from oil.

US Economic Data: Softer US demand indicators would continue to cap upside for crude.

FOMC Outcome: Any Fed easing that weakens the USD could support oil, but the immediate driver is demand data.

Trade Policy: Less aggressive trade posturing helps demand prospects, while renewed restrictions would hurt oil.

Monetary Policy: Broader easing expectations are supportive structurally but not a substitute for improving physical demand.

Technical Outlook

Trend: Short-term neutral to mildly bullish after the bounce.

Resistance: $61.80–$62.50, then $64.00.

Support: $58.80–$59.00, then $57.20.

Forecast: Expect consolidation in the $58–$62 band; a sustained break above ~$62.50 would signal a stronger recovery, while a drop below ~$58 would resume the downtrend.

Sentiment and Catalysts

Market Sentiment: Cautiously constructive — buyers present but risk sensitive.

Catalysts: API/EIA inventory releases, OPEC+ commentary, and demand signals from China and the U.S. will be decisive.

USD/CAD Forecast

Current Price and Context

USD/CAD is trading just above 1.4000, near six-month highs, as recovering oil prices give partial relief to CAD but the US Dollar remains firm on safe-haven flows and subdued USD demand. The pair is balancing commodity dynamics with broader USD momentum.

Key Drivers

Geopolitical Risks: Shifts in risk sentiment tied to trade tensions and global growth prospects directly affect CAD via commodity risk premia.

US Economic Data: US prints that support the dollar will push USD/CAD higher; weaker US data could cap gains.

FOMC Outcome: Fed guidance that keeps the dollar supported will maintain USD/CAD upside pressure.

Trade Policy: North American trade stability helps limit structural shocks but won’t offset oil-driven moves.

Monetary Policy: BoC’s cautious stance relative to USD dynamics keeps the loonie on the back foot when oil is weak.

Technical Outlook

Trend: Bullish bias above 1.3950/1.4000.

Resistance: 1.4035–1.4065, then 1.4100.

Support: 1.3950, then 1.3890–1.3850.

Forecast: Range-bound to modestly higher near term toward 1.4050 if oil fails to regain momentum; a stabilisation in oil could reduce USD/CAD upside.

Sentiment and Catalysts

Market Sentiment: USD-favouring, though commodity moves are increasingly watched.

Catalysts: Oil price direction, BoC commentary, and US inflation or risk-related headlines.

USD/CNY Forecast (PBOC Fix)

Current Price and Context

The PBOC set the USD/CNY reference at 7.1007, a slightly firmer fix versus the previous 7.1048, suggesting measured yuan support from Beijing amid external headwinds. The managed fix and modest CNY strength reflect efforts to steady the currency while monitoring capital flows and trade impacts.

Key Drivers

Geopolitical Risks: US-China tensions may pressure capital flows, prompting PBOC guidance to smooth volatility.

US Economic Data: Stronger US data would exert upward pressure on USD/CNY through yield differentials.

FOMC Outcome: Fed policy signals remain a key influence on USD strength and yuan moves.

Trade Policy: China’s trade performance and export data will be watched for CNY implications.

Monetary Policy: PBOC FX operations and liquidity management will be the primary tools to manage any abrupt moves.

Technical Outlook

Trend: Neutral, with a bias to stability given active PBOC management.

Resistance: 7.1200, then 7.1400.

Support: 7.0900, then 7.0700.

Forecast: Expect a managed trading range near the fix; strong USD pressure would test resistance while PBOC intervention could limit extremes.

Sentiment and Catalysts

Market Sentiment: Cautiously neutral; markets expect orderly guidance from the PBOC.

Catalysts: Further PBOC fixing behavior, Chinese trade/PMI releases, and major USD moves stemming from US data or Fed signals.

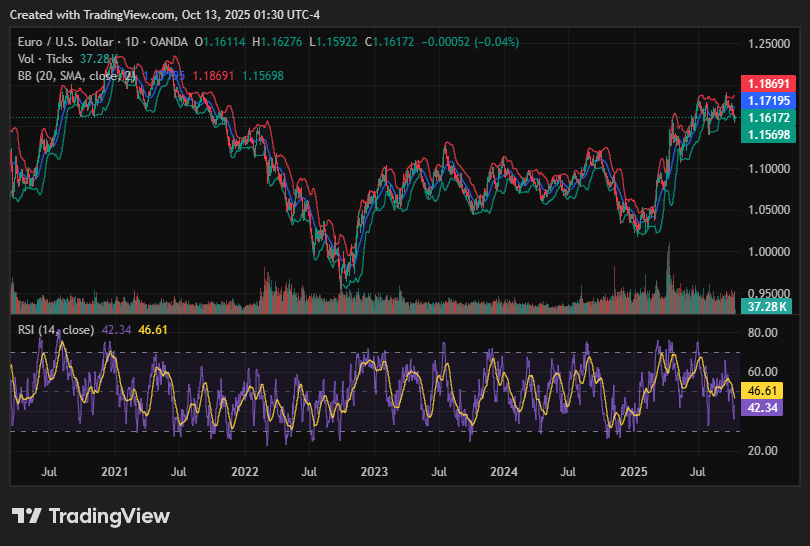

EUR/USD Forecast

Current Price and Context

EUR/USD is holding just above 1.1600, treading water as US–China tensions and US political uncertainty support safe-haven flows that favour the dollar, while Eurozone data and ECB commentary keep the euro’s downside limited. The pair is rangebound with downside risk if USD strength persists.

Key Drivers

Geopolitical Risks: Elevated trade tensions and global uncertainty bolster dollar demand, weighing on EUR/USD.

US Economic Data: Strong US indicators would further support USD and pressure the euro.

FOMC Outcome: Any Fed signal that keeps the dollar bid will tilt EUR/USD lower.

Trade Policy: Europe’s trade and energy considerations remain important but secondary to USD dynamics today.

Monetary Policy: ECB caution versus Fed positioning creates a backdrop where EUR gains require stronger Eurozone data.

Technical Outlook

Trend: Neutral to mildly bearish below 1.1650.

Resistance: 1.1650–1.1680, then 1.1725.

Support: 1.1570, then 1.1520.

Forecast: Expect range trading with downside vulnerability; a sustained break below 1.1570 would open scope toward 1.1520.

Sentiment and Catalysts

Market Sentiment: Cautiously negative for EUR relative to USD.

Catalysts: US political/trade headlines, US inflation/retail data, and ECB speeches will be pivotal.

Wrap-up

Markets remain finely balanced as traders weigh the impact of ongoing US-China trade rhetoric, potential Federal Reserve policy adjustments, and the looming US government shutdown risk. With gold prices hitting all-time highs and oil showing tentative recovery, investors are likely to stay defensive in the near term.This week’s focus will shift toward US retail sales data, Fed officials’ speeches, and any new trade policy headlines that could reshape risk sentiment across global markets.

Ready to trade global markets with confidence? Join Moneta Markets today and unlock 1000+ instruments, ultra-fast execution, ECN spreads from 0.0 pips, and more! Start now with Moneta Markets!