Japanese yen halts gains as US trade negotiations return to the spotlight

By RoboForex Analytical Department

USD/JPY had an opportunity to correct after two consecutive days of decline, with Tuesday’s trading centred around 143.78.

Dollar strengthens on trade optimism and Fed anticipation

The US dollar regained ground as markets reacted to renewed expectations surrounding US-China trade negotiations. Investor caution also grew ahead of the Federal Reserve’s meeting, which begins today.

President Donald Trump cautiously suggested that the 145% tariffs on Chinese imports might be reduced. However, true to form, he offered only a vague hint, further adding to the already uncertain outlook for US-China relations.

Markets are also paying attention to the US-Japan bilateral talks regarding trade engagement. Tokyo aims to finalise an agreement before the June deadline, and any delays could complicate the process further.

Meanwhile, last week’s Bank of Japan meeting saw no change in the key interest rate, which remains at 0.5% per annum. However, the BoJ lowered its GDP and inflation forecasts, reinforcing the view that it does not intend to raise rates soon.

Japan observes a bank holiday on Tuesday, so no major domestic news is expected.

Technical analysis of USD/JPY

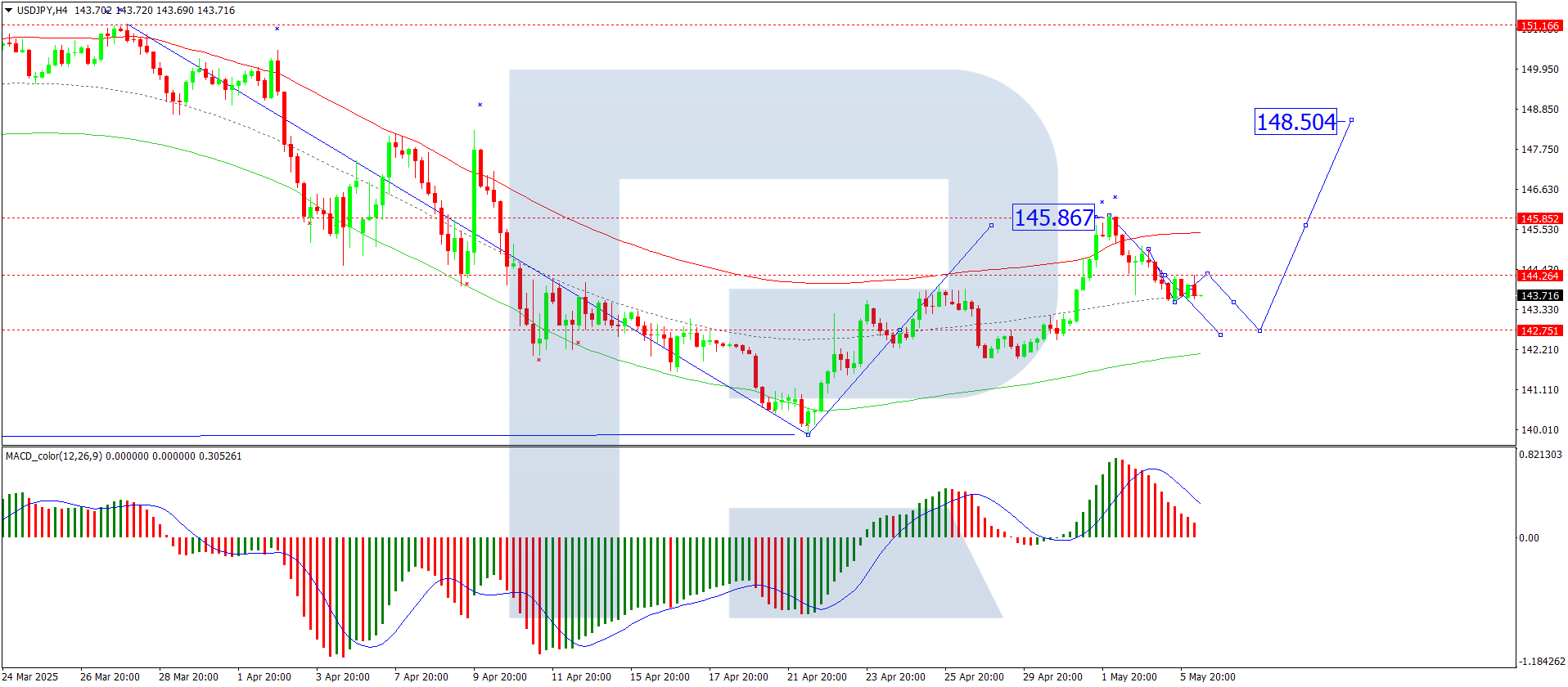

On the H4 chart, USD/JPY completed a growth wave towards 145.86, followed by the start of a corrective phase. The first downward impulse reached 143.72, followed by a correction to 145.05. The market is now forming a consolidation range around 144.30. A downward breakout from this range could send the pair to 142.75. The MACD indicator supports this scenario, as its signal line has exited the histogram area and points firmly downwards, suggesting continued bearish pressure.

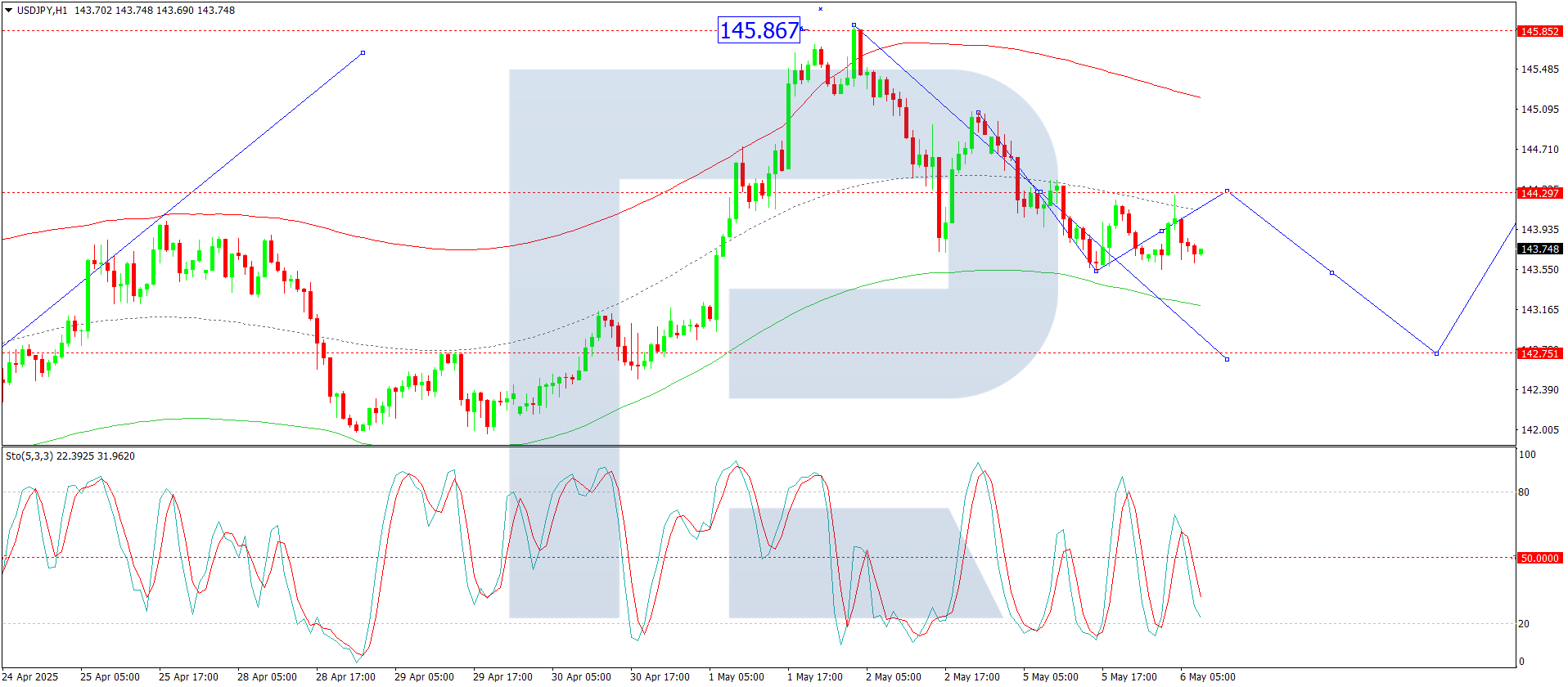

On the H1 chart, the pair is building a corrective structure targeting 142.75. The local correction target of 143.53 has already been achieved. Today, there is a strong likelihood of a fifth downward wave in this correction, with 142.75 as the next target. Once this level is reached, a new upward wave towards 145.86 may begin. The Stochastic oscillator confirms this view, with its signal line below 50 and heading sharply towards 20, indicating strong short-term downside momentum.

Conclusion

USD/JPY is currently in a corrective phase as markets digest renewed trade hopes and prepare for the Fed’s decision. Technical indicators support further downside towards 142.75, with a possible reversal to 145.86 thereafter. Trade talks with both China and Japan, along with the Fed’s stance, will remain the key drivers of short-term volatility for the pair.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.