New Growth Impulse for Stocks

Indices

A trio of key US indices hit all-time highs on the rally following the announcement of the presidential election results. The Nasdaq100 hit new highs for the first time in 84 trading sessions, while the S&P500 and Dow Jones have not done so in less than three weeks.

Historically, volatility tapers off after the election, with the November-January period providing the biggest gains for indices. Whether that will be the case this time around is a big question, as markets have already moved far ahead in valuations, and there are few details on how the White House policy in Washington will change.

Stocks

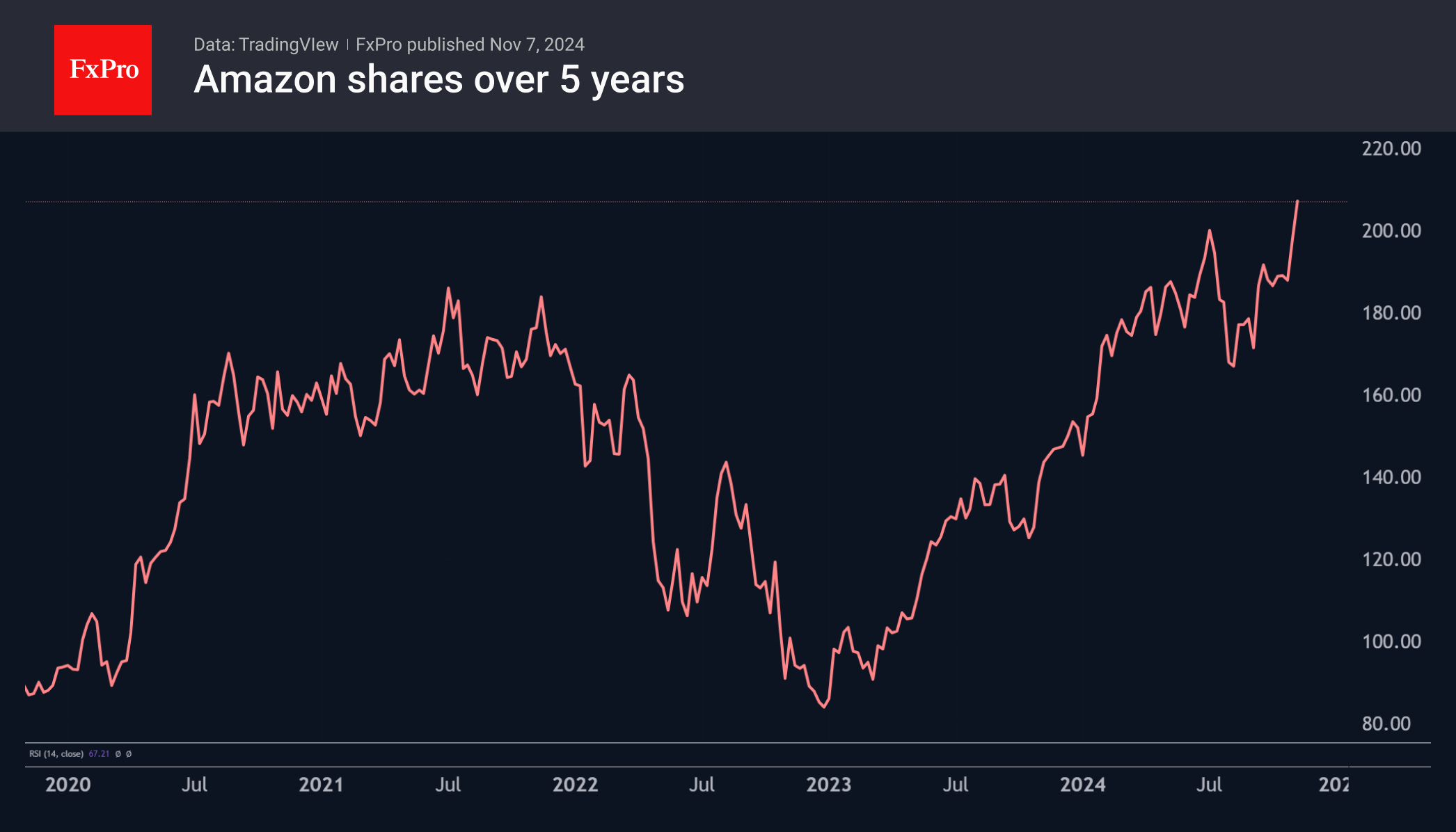

The transition of power from the Democratic to Republican parties in the US has triggered a shake-up of portfolios, suggesting new leaders. In addition to expectations of acceleration in Tesla shares, investors also paid attention to Amazon, which went from a confident pro-Democratic stance to a neutral one shortly before the election.

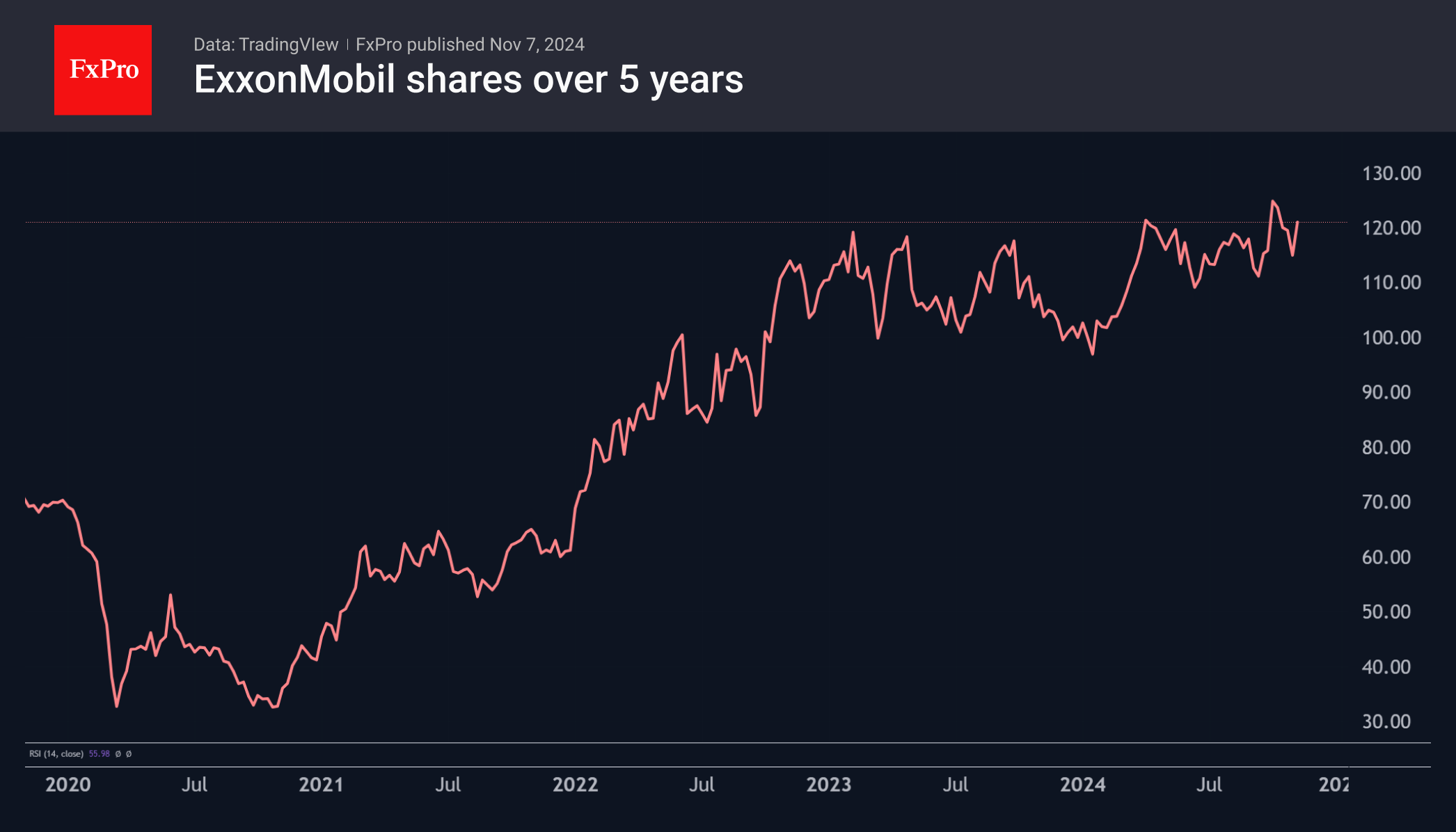

Separately, it is worth mentioning the oil industry, with which the Republican Party is closely associated. ExxonMobil shares have added 6%, and Chevron shares have added 7% since the beginning of the month—about three times more than the price of oil has risen over the same time.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)