Retreated but not defeated Dollar

Retreated but not defeated Dollar

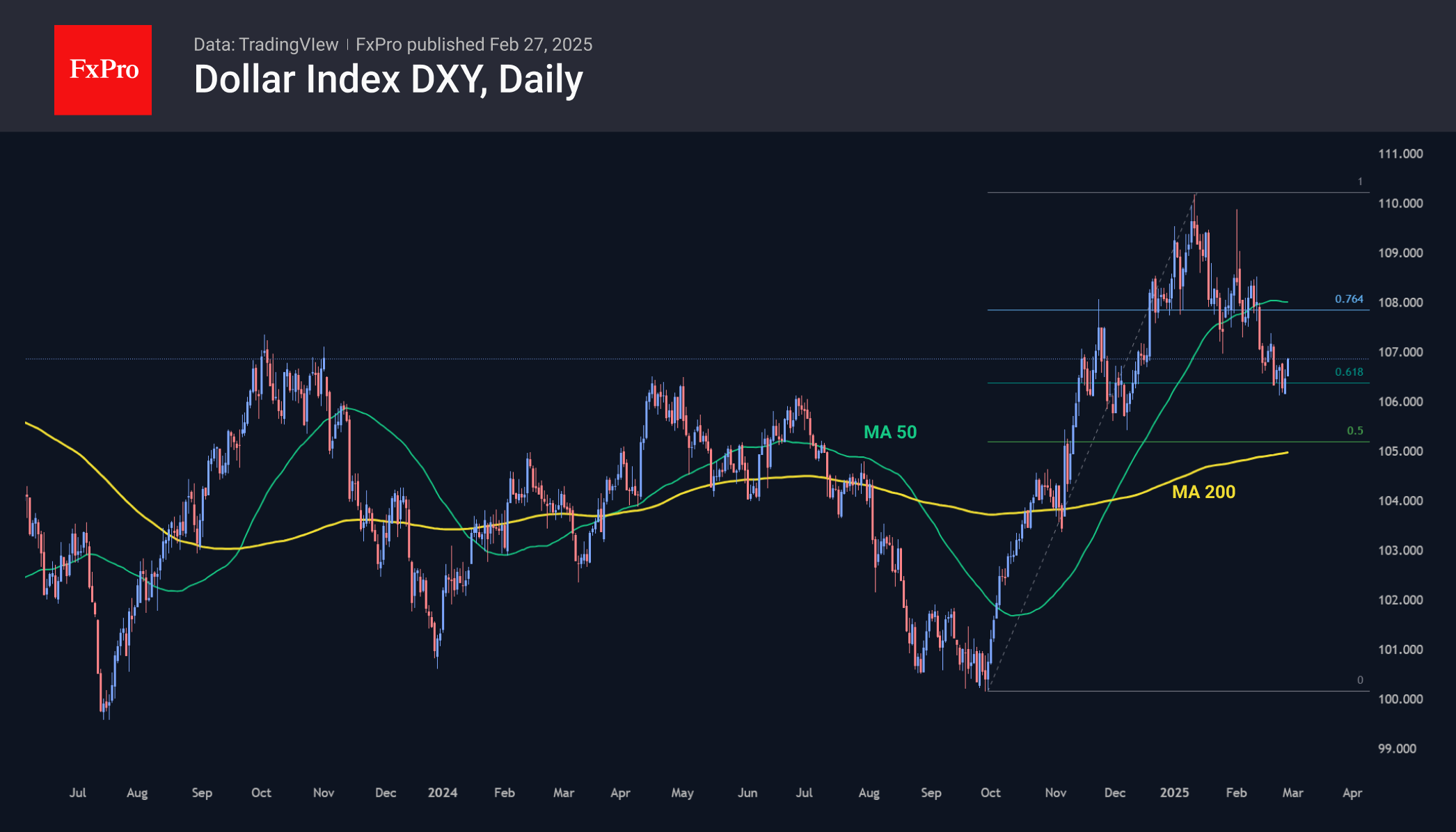

The dollar index fell to 106, retreating from the lows of early December. The momentum against its major rivals was not clear as the Euro stalled, the Pound gained, and the Canadian dollar retreated.

Technically, the DXY retreated to the 61.8% level, a typical Fibonacci retracement. The bears have already recaptured the 76.4% level and sold the index below its 50-day moving average. However, the current test is not an easy one as it is the peak area of the last two years.

The growing caution in the financial markets is playing in favour of the dollar bulls, creating a demand for global profit-taking that will boost the US currency in the short term.

At the same time, a gradual increase in expectations of a softer Fed policy is working against the dollar. Markets are now pricing in a 5% chance of no change in the Fed Funds rate by the end of the year, down from 16% a week ago. The probability of two or more rate cuts has risen to 73% from 48% last week.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)