Stocks and dollar hit by profit taking as 2024 wraps up

Stock market rally turns into year-end selloff

After a record-breaking year for Wall Street, there was no Santa rally to cap off 2024, with the US election boost stalling in early December. Given the scale of the past year’s rally, which was mostly driven by the Magnificent 7 and AI-related stocks, some end-of-year profit taking is not only overdue but reasonable when considering all the uncertainties that await in 2025.

The euphoria about Fed rate cuts and Trump’s pro-business policies that dominated the market theme in November soon turned into caution. The Fed may have slashed interest rates by a full percentage point in 2024 but the overriding message of its final policy decision of the year was that it will likely go on pause in early 2025, with traders eyeing May as the earliest possible meeting for a 25-basis-point rate cut.

Investors have also soured on Trump in recent weeks amid the big question mark about how far he will take his tariff war with America’s major trading partners. Moreover, with markets becoming reacquainted with Trump’s chaotic style of leadership since his re-election, any further gains in equities are unlikely until there is more clarity about what the incoming administration’s tax and tariff policies will look like.

A strong year for equities

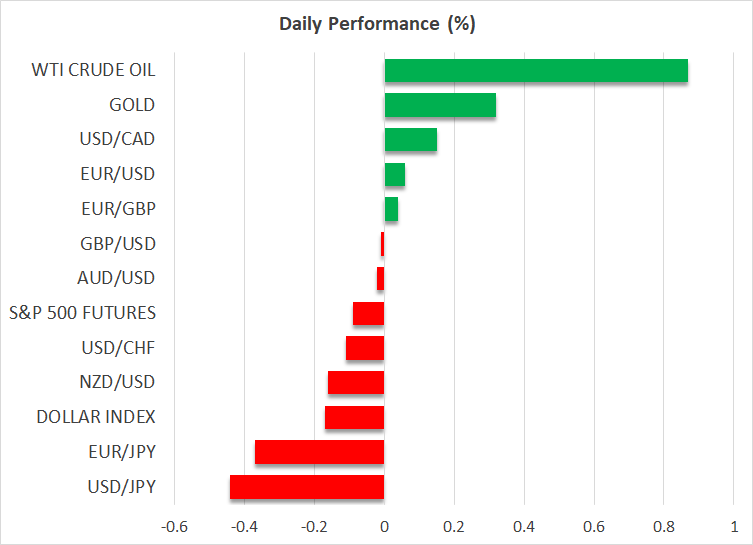

How earnings expectations evolve in the coming months will also be crucial for Wall Street, particularly for tech and AI stocks. The Nasdaq 100 is the only one of the major US indices that has held onto some of its monthly gains, while the S&P 500 and Dow Jones are on track to finish December in the red.

Still, the Nasdaq and S&P 500 are headed for gains of around 25% for the year and even European indices, clouded by economic gloom and political uncertainty, can boast solid increases, with France’s CAC 40 being the exception.

In Asia, Japan’s Nikkei 225 is the star performer, helped largely by the yen’s slide, while Chinese indices got a shot in the arm by Beijing’s stimulus policies.

A light calendar amid New Year’s celebrations

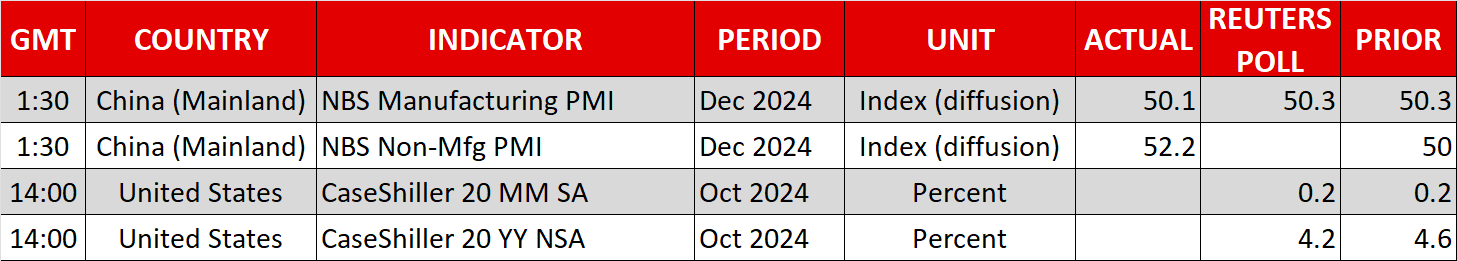

PMI data out of China did little, however, in lifting sentiment on the last trading day of the year. Despite the non-manufacturing PMI offering some relief as the services sector grew at its fastest pace since March, the manufacturing PMI printed below expectations just above 50. Nevertheless, the signs of stronger domestic demand buoyed oil prices today.

Manufacturing activity will be in focus later in the week as well when the ISM’s equivalent gauge is released on Friday in the United States. Ahead of that, the weekly jobless claims on Thursday is the only other top-tier data as markets are shut globally on Wednesday for New Year’s Day, and trading volumes will be incredibly light today, with only the US stock exchange operating normal hours.

Dollar softer as yields drop sharply

In the FX space, the US dollar is having its first negative week in five, but it’s down only slightly. Treasury yields took a tumble on Monday as investors poured into bonds as they divested some of their stock holdings, though Bitcoin is surprisingly steady this week.

But the pullback in yields is likely to be short-lived as the temporary suspension of the US debt ceiling expires on January 1 and Congress will have to reach a new deal by the middle of the month if it wants to avoid a debt default.

In the meantime, the greenback looks set to finish 2024 on a high, while the yen fares the worst, even as it finds some support this week from intervention fears and rate hike speculation.

.jpg)