The dollar is preparing for battle

The decline in the chances of a Fed rate cut in December from 72% to 48% over the past couple of weeks should have sent the EURUSD into a knockout. However, the futures market anticipates that by the end of the cycle, the federal funds rate will have fallen to 3.25%, down from its current level of 3.75%. Moreover, the question of December remains open. ‘Dove’ Christopher Waller continues to insist on a rate cut amid signs of weakness in the labour market. On the contrary, the Fed ‘hawks’ are inclined to leave everything as it is.

Kansas City Fed President Jeffrey Schmid's concerns about inflation go beyond tariffs. Rising energy and healthcare costs, as well as higher insurance premiums, suggest that inflation will not return to 2% from its current 3% for some time. Cleveland Fed President Beth Hammack notes that inflation has exceeded the Fed's target for more than four years. The scale of the tariff increase means that high prices cannot be considered a temporary phenomenon.

A decisive battle is expected between the FOMC's ‘hawks’ and ‘doves’ in December. October served as a rehearsal. Following the previous meeting, Jerome Powell was forced to dash the market's illusions about a rate cut at the end of the year. Investors fear that the Fed's overly hawkish rhetoric in the minutes will dash hopes for easing next month. These speculations are supporting dollar purchases.

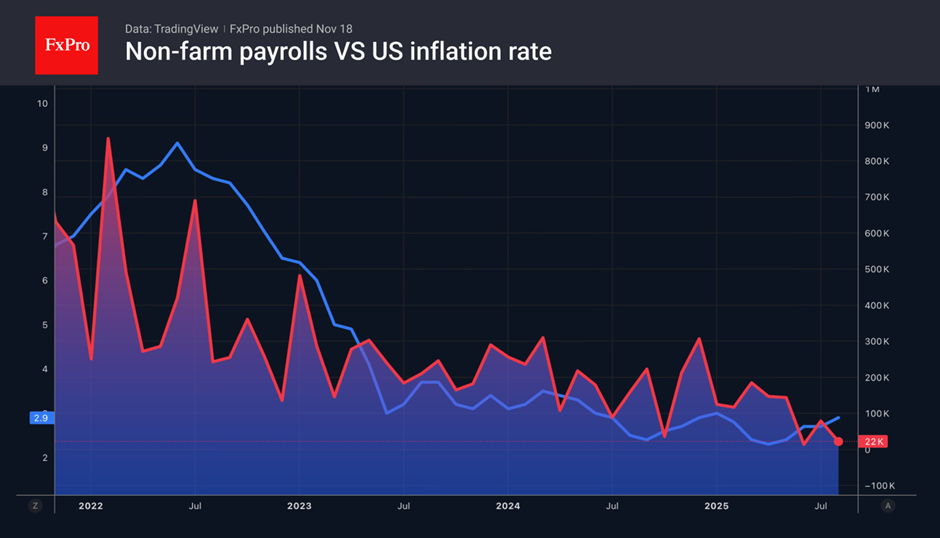

Following the publication of the minutes on 20 November, the US employment figures for September will be released. They will be released with a huge delay, but the trend is important here. If the labour market continues to cool, this will once again make easing in December the main scenario, playing into the hands of EURUSD buyers. Conversely, positive non-farm payrolls will strengthen the dollar.

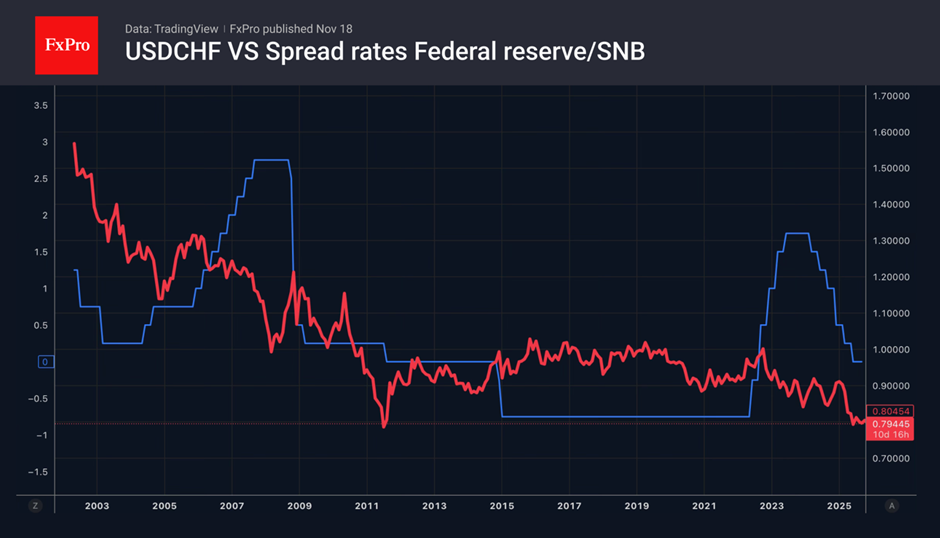

Meanwhile, the White House has finally lowered tariffs on Swiss goods from 39% to 15%. Expectations surrounding this event have made the franc the main favourite on the Forex market. However, according to Commerzbank, the USDCHF peak is unlikely to be too deep. Most of the good news is already priced in. The future of the pair will depend on the interest rate differential between the Fed and the Swiss National Bank.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)